Bitcoin's main value in 2021 has been officially recognized as its ability to protect assets from inflationary losses. The trend will probably continue in 2022. This fact is indicated by the ratio of USD to BTC inflation, as well as Ethereum co-founder Vitalik Buterin's statement.

The institutional market changed its attitude to bitcoin due to the acceleration of the US economic stimulus program tapering. It caused a change in priorities of big capital, which began to withdraw funds from BTC and invest them in less risky financial instruments. It was the reason why the S&P 500 Index has renewed its historical high. However, bitcoin is dominating in 2022 due to the cryptocurrency's historic low in inflation.

Bitcoin and US dollar inflation

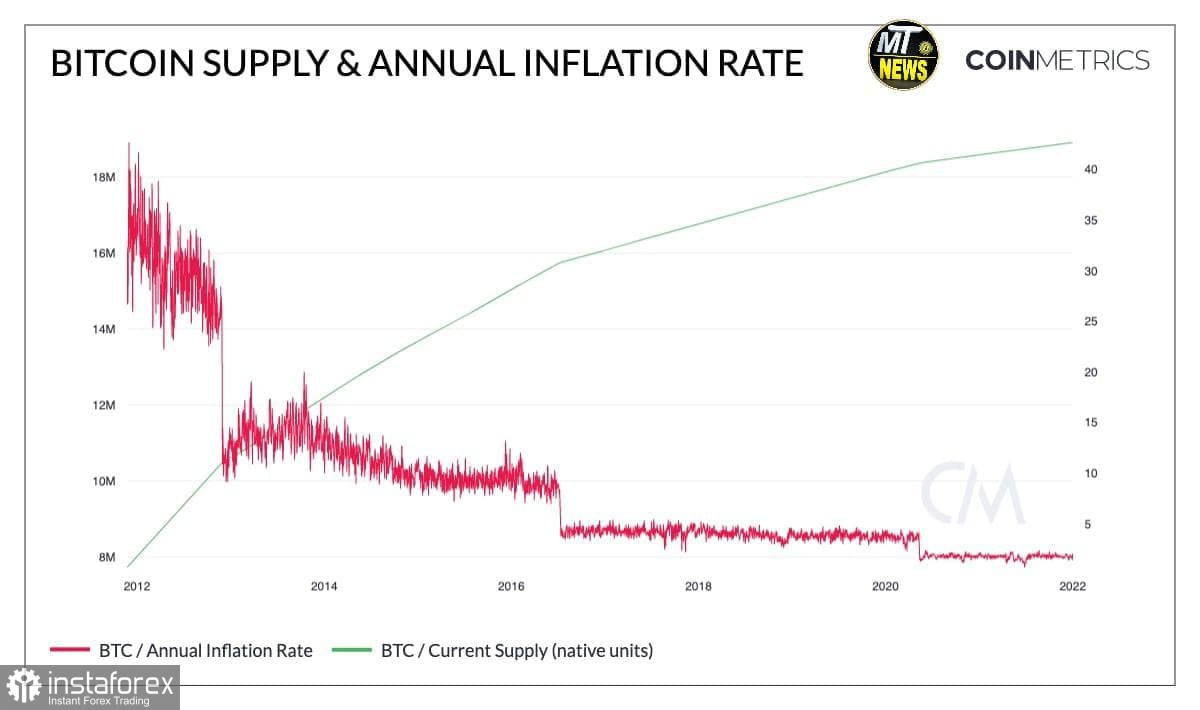

Approximately 90% of all bitcoin issuance is carried out by holders. Moreover, the asset's inflation index has fallen to 1.8%. The US dollar ended 2021, hitting a local high of 6.8%. CoinMetrics research shows that the US dollar inflation rate is 3.7 times higher than that of BTC. This is the first strong argument that this property will allow bitcoin to remain the top 1 cryptocurrency in 2022.

Ethereum is still weak

Bitcoin's closest rival, Ethereum, is approaching Protocol 2.0. The project's co-founder, Vitalik Buterin revealed this fact. This indicates that altcoin is not capable of competing with bitcoin in protecting against inflation. Notably, at the beginning of September algorithms to burn ETH made the cryptocommunity discuss the emergence of a main rival to BTC for risk hedging. It is likely to happen in the future. However, the major altcoin has no chance of poaching bitcoin's institutional audience in the near term.

Consequently, major investors have resumed their period of accumulation and bitcoin's third-largest whale has acquired 5,529 BTC during the last month. CryptoQuant data indicates a massive outflow of coins from the stock exchange. In late December, this process was interrupted during a massive profit taking. Considering these factors, I assume bitcoin is moving in the May 2021 scenario. As of January 5, the asset is halfway through its consolidation and accumulation phase. When balances on stock exchanges reach new lows and major buyers start to take action, BTC will start moving to new highs.

Bitcoin in January

Despite positive aspects, bitcoin's daily chart is not promising. A further trend pattern inverted cup and handle has been formed on the daily chart. Since the trend is upward at the moment, this pattern should be considered bullish. According to this formation of the technical analysis, the potential of price movement reaches a level of $85k. Taking this aspect into account, the situation is getting more bullish. Therefore, a reversal and fixation above $48,000 are likely. However, the formation is irrelevant in case the price breaks the previous local low of $42,000. In this case, the analysis will require revision and the long-term bullish trend will be broken. The main bitcoin's target for January will be a breakout of the mid-term downtrend line at $52,000. In the longer term, I support Goldman Sachs view and expect bitcoin to be around $100,000 by the end of 2022.