While traders of ether and bitcoin are diligently waiting after the New Year for the direction in which the movement will continue to develop and expect better, and there is something to count on, a draft of a new law on digital assets, which also includes cryptocurrencies, was presented in Peru.

The bill, in addition to defining what a crypto asset is and establishing the responsibilities of virtual asset service providers (VASPs), also permits the use of this type of asset and its subsequent accumulation by companies.

Peru launches first attempt to regulate cryptocurrencies

A new bill was submitted to the Congress of Peru under the number No. 1042/2021-CR, which is the country's first attempt to regulate cryptocurrencies. Back on December 10 last year, a pilot project was presented for the first time, which defined several key concepts in the cryptocurrency world, including crypto assets, virtual asset service providers (VASP), blockchain, and cryptography.

The law also proposes to create a public registry for VASP, which users can access at any time to find out whether an exchange or a platform for doing business is registered. In addition, it sets out the conditions that each VASP must follow to work legally in the country.

The project obliges these companies to inform that the Peruvian authorities do not consider cryptocurrencies to be legal tender and that the supervision of these assets by the government is not a guarantee against the risks that work with cryptocurrencies entails.

It is also interesting that cryptocurrencies and tokens can be used to create and register companies, and give these companies a legal basis for storing cryptocurrencies in Peru. Most likely, this is done to attract developers of various software and blockchains.

Last year, quite a lot of countries actively worked towards the regulation of cryptocurrency assets. Only El Salvador is worth something, where bitcoin was recognized as an official means of payment on a par with the national currency. There is also active work on crypto legislation in Brazil, Paraguay, and Venezuela.

However, let me remind you that in Peru, the draft bill does not consider bitcoin a legal tender, as it is done in El Salvador.

1,044 bitcoins in December

Mining also remains a fairly profitable field of activity, at least until bitcoin is trading above $20,000. Core Scientific, a digital asset development company, mined a total of 1,044 bitcoins in December, bringing their total number for the year to 5,769. At the end of the year, Core Scientific had 5,296 BTC. These figures are significantly higher than those of Bitfarms and Marathon Digital. In December, Bitfarms mined 363 bitcoins, and Marathon - 484.5.

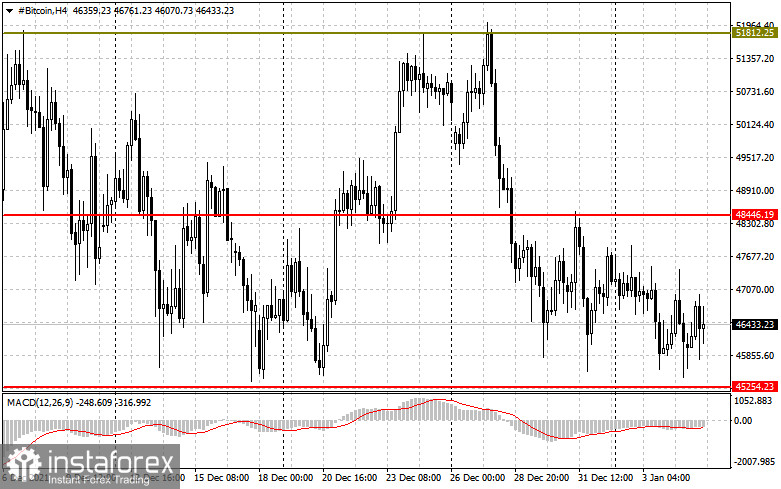

As for the technical picture of bitcoin

The bulls missed the support of $48,460 and now we need to think about how to return it. Without this level, it will be very problematic to build a new major trend, although there is still hope for the support of $ 45,250 – this is a very large level where a fairly large number of players are concentrated. In the case of a breakthrough– it is best to be patient and wait for the update of the levels: $41,600 and $37,380. It will be possible to talk about the continued growth of the first cryptocurrency only after going beyond $ 48,460, which will open a direct road to $ 51,800. Its breakdown will bring bitcoin to: $55,120 and $58,776.

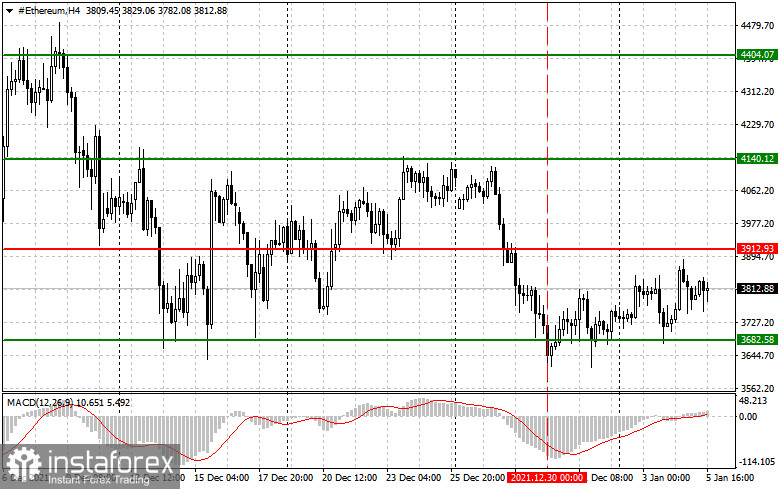

As for the technical picture of the ether

Ether buyers have lost control of $3,912 and have not been able to return it since the end of December last year. Now we need to try very hard to protect the lower level of $3,680. Its breakdown is a very bad call for buyers earlier this year. Therefore, I recommend being patient and opening long positions on the trading instrument only after updating the minimums: 3,448 and 3,046. To resume demand, a breakdown of 3,912 is needed again, which will open a direct road to $4,140. A break in this range will resume the bullish trend, which will lead to highs of $4,404 and $4,647.