The AUD/USD pair rebounded in the last hours as the DXY retreated a little. After its massive drop, the price tried to come back to test and retest the near-term resistance levels before dropping deeper.

Fundamentally, the Australian data came in mixed in the early morning, while the US Chicago PMI reported worse-than-expected data. Tomorrow, RBA is expected to increase the Cash Rate from 2.60% to 2.85%. The RBA Rate Statement could really shake the markets.

Later during the day, the US ISM manufacturing PMI could drop from 50.9 to 50.0 points, while the JOLTS Job Openings could drop from 10.05M to 9.75M. The Final Manufacturing PMI, Construction Spending, ISM Manufacturing Prices, and Wards Total Vehicle Sales will be released as well.

On Wednesday, the FOMC is expected to hike the Federal Funds Rate from 3.25% to 4.00%. Also, the NFP, Average Hourly Earnings, and the Unemployment Rate represent high-impact events.

AUD/USD Leg Down!

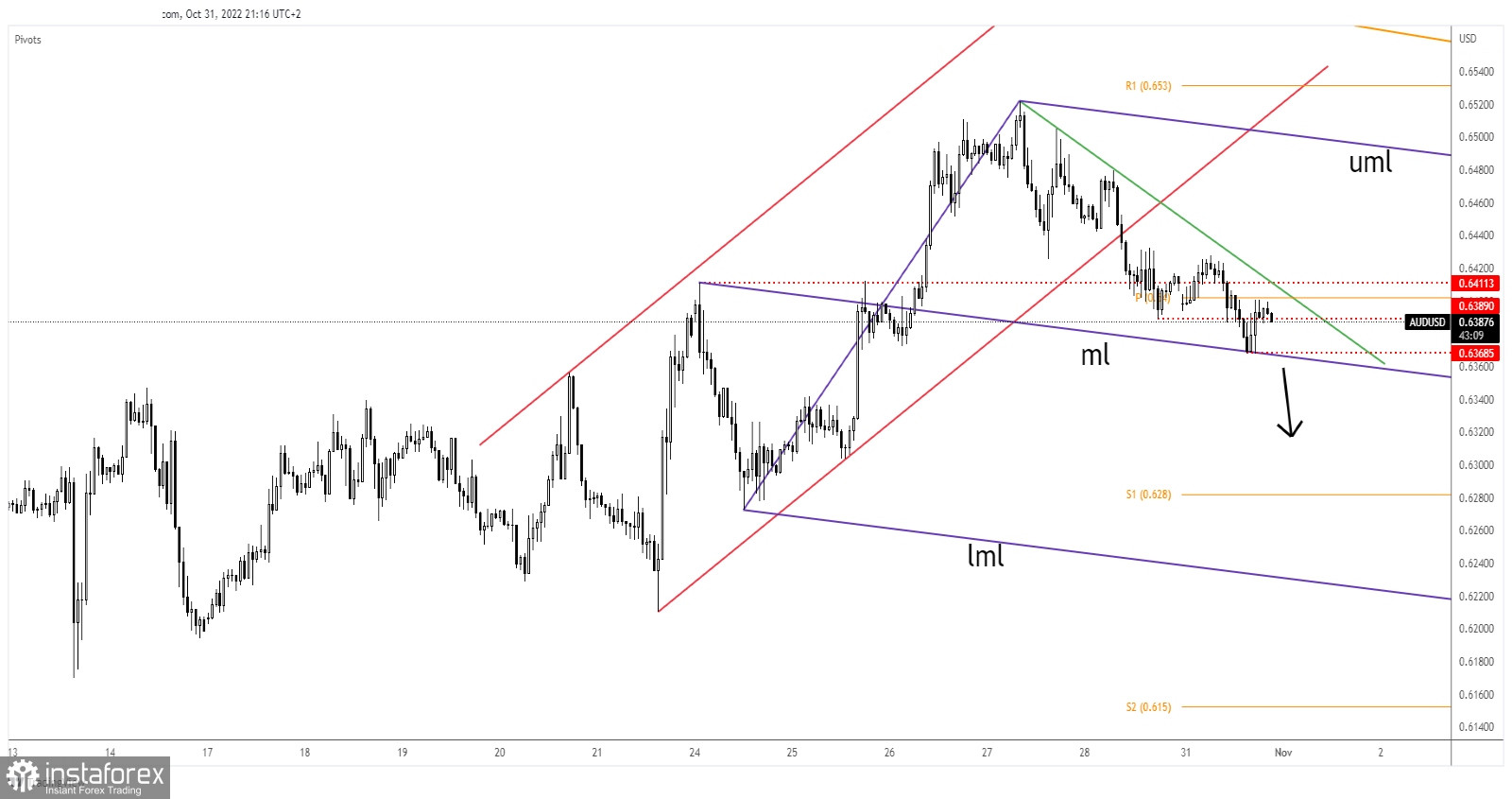

As you can see on the H1 chart, the rate found support on the descending pitchfork's median line (ml) and now it has almost reached and retested the downtrend line. The weekly pivot point of 0.64 represents an upside obstacle as well.

As long as it stays under the downtrend line, the bias remains bearish. Only a valid breakout above it and above 0.6411 invalidates a deeper drop and signals a new leg higher toward the upper median line (uml).

AUD/USD Forecast!

A new lower low activates more declines and brings short opportunities. So, staying below the downtrend line and dropping and closing below 0.6368 opens the door for more declines.