Analysis of previous deals:

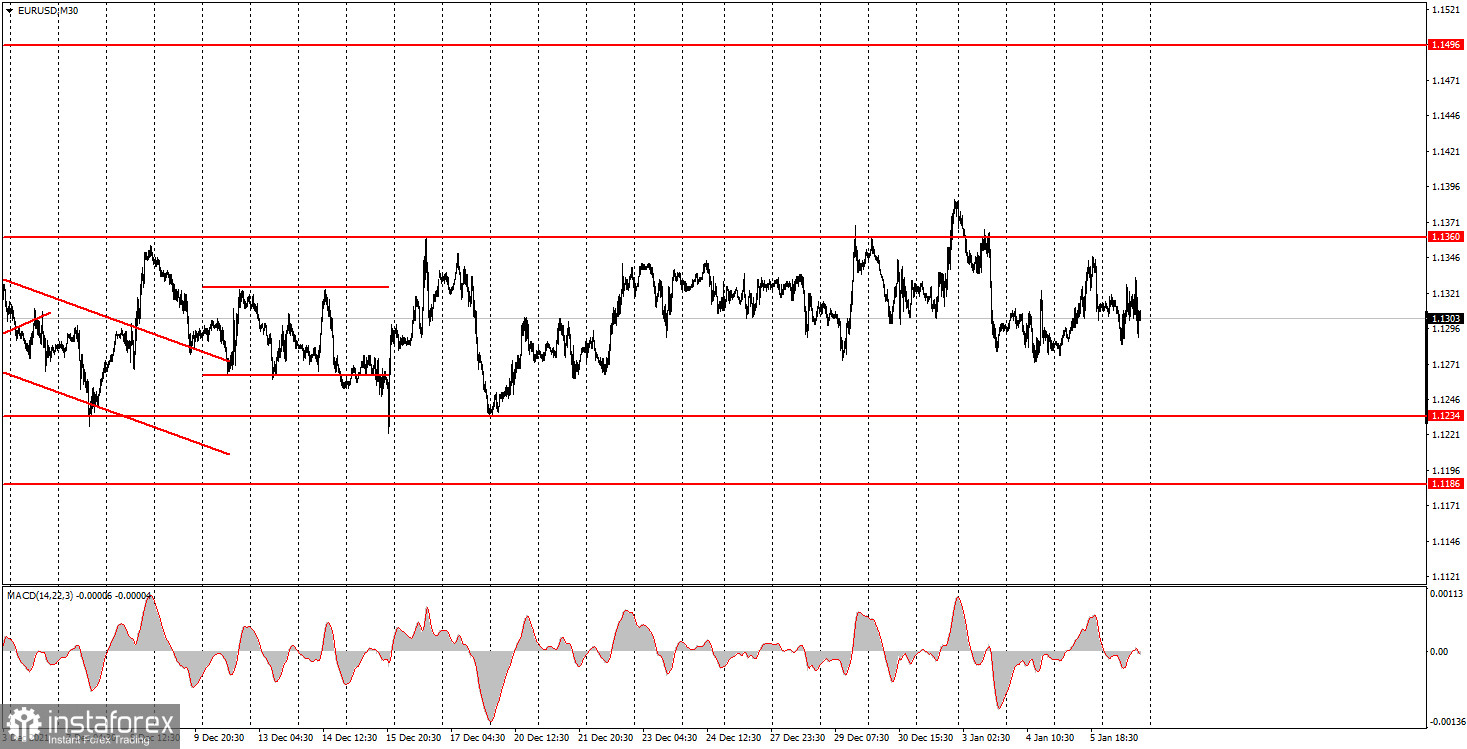

30M chart of the EUR/USD pair

The EUR/USD pair continued to trade as simply as possible on Thursday. We don't zoom out of the 30-minute timeframe so that novice traders do not get confused in the technical picture. Now the chart above clearly shows the horizontal channel and the fact that the pair has not made a single attempt to reach its upper or lower limit. Thus, the fact that the flat remains is the most important thing for any traders now. It is extremely difficult to trade in the flat and this is fraught with the formation of many false signals. It should also be understood that when a pair is in a limited price range for a long time, then small levels (highs and lows of each day) are formed very close to each other and with a large amount. That is, a high density of levels is obtained, due to which they constantly need to be adjusted, deleted and new ones added. As for macroeconomic statistics, today there was only one report worthy of attention – the ISM business activity index in the service sector of America - but the market did not pay attention to it.

5M chart of the EUR/USD pair

On the 5-minute timeframe, it should immediately be noted that the 1.1304 and 1.1324 levels have lost their relevance for today. The price has crossed them too many times. All trading signals of the day were formed around these levels. Therefore, there are signs of a flat for the euro currency, even on the 5-minute TF. Let's analyze the trading signals and understand how the pair should have been traded today, in such chaotic movements. The first two signals - both for short positions - were formed near the level of 1.1304. The pair went down 15 points after the first, which made it possible to set Stop Loss to break even. According to this order, the transaction was closed in the end. We didn't manage to get off with a little blood on the second sell signal, since the price could not go down by even 15 points. The trade closed at a 10 points loss when the pair settled above 1.1304. All subsequent signals near the level of 1.1304 should be ignored, since two trades from this level were not profitable. Thus, it remains to consider only two sell signals near the level of 1.1324. For the first time, the price stopped near the level of 1.1304, where the trade should have been manually closed. Profit 10 points. The second time, everything went according to the same scenario - another 10 points of profit or so. As a result, the day ended with low profit.

How to trade on Friday:

There is still a sideways trend on the 30-minute timeframe. The price continues to remain between the levels of 1.1234 and 1.1360, so there is still no trend now, and it is extremely difficult to trade on the current TF. In case strong and accurate signals near the channel boundaries are formed, it is possible to consider options for entering the market, but cautiously. There are many more levels on the 5-minute timeframe. Tomorrow we recommend trading on the following: 1.1262, 1.1278-1.1285, 1.1332, 1.1347, 1.1360-1.1366. Recall that for any transaction, Take Profit of 30-40 points and Stop Loss should be set to breakeven after passing 15 points in the right direction. The deal can also be closed manually near important levels or after the formation of a reverse signal. As for fundamental events and macroeconomic statistics, tomorrow we recommend novice traders to pay attention to the US reports on the labor market (NonFarm Payrolls) and unemployment. The inflation report from the European Union may also affect the course of trading.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.