In previous reviews on the main currency pair of the Forex market, written this week, the main fundamental event was called data on the US labor market, and this is certainly true. Since the FOMC protocols, by and large, did not surprise investors in any way, now only data on the US labor market will be able to influence the price orientation of the US dollar, including paired with the single European currency. As has been repeatedly noted in previous articles on EUR/USD, the US Federal Reserve System (FRS) continues to signal a tightening of its monetary policy more explicitly than the European Central Bank (ECB). However, the Fed is constantly reminded that further steps will largely depend on the degree of inflationary pressure, as well as on incoming macroeconomic reports. Today is the day when American labor market reports will be released at 13:30 London time.

I dare to assume that this most important event will be able to overshadow the data from the eurozone on the consumer price index and retail sales, although these indicators may revive trading on EUR/USD. Nevertheless, the greatest volatility, which will affect the results of weekly trading, will begin after the publication of labor reports from the United States. Let's recall the forecasts for the three most important indicators. So, as economists predict, unemployment will fall to 4.1% in December, which is lower than the 4.2% shown a month earlier. Regarding the newly created jobs in non-agricultural sectors of the American economy (Nonfarm Payrolls), then, compared with the November value of 210 thousand, the December figure is projected at 400 thousand. As for the average hourly wage, its growth will be 0.4%, let me remind you that the previous indicator was at the level of 0.3%. That's probably all. Now it's time to look at the price charts of the EUR/USD currency pair.

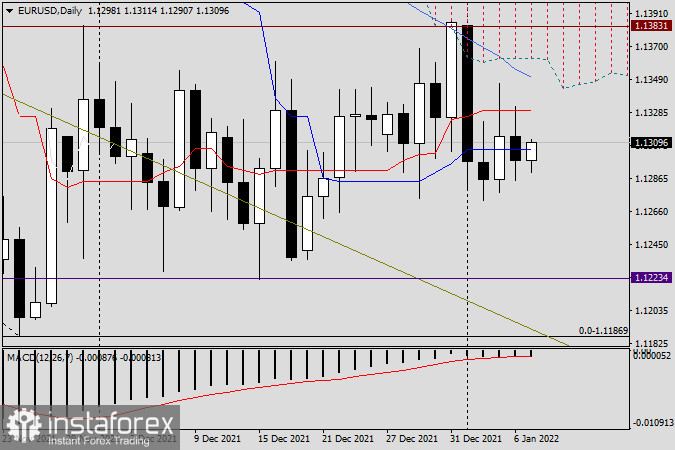

Daily

There were no significant changes on the daily chart. The pair continues to trade near the most important and very strong technical level of 1.1300, which does not want to part with the quote yet. As can be seen in this timeframe, the bulls' attempts to raise the euro rate higher are actively hindered by the red line of the Tenkan Ichimoku indicator, which previously provided the same strong support. Technically, everything looks quite correct and quite reasonable. I believe that today's auctions and the influence of Nonfarm on them will finally change the current picture and send the pair to one of the parties. But in which direction will depend on the actual labor indicators and the reaction of market participants to them. It has happened more than once that labor reports from the United States have played out very ambiguously.

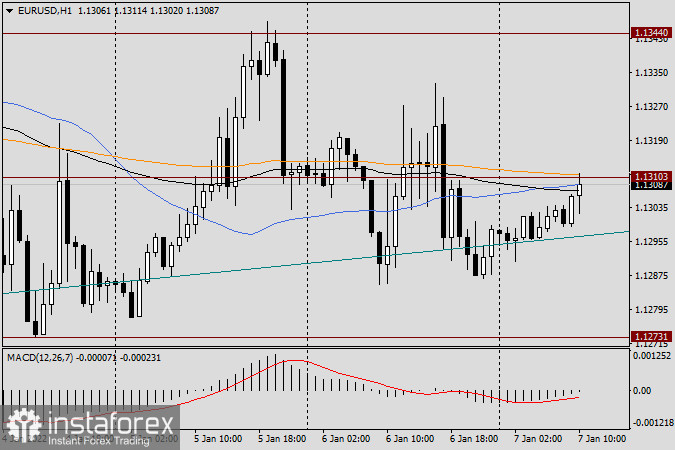

H1

If we turn to trade recommendations, then, as I often note in my articles, the last trading day of the week, and even with such important data, is not the best time to open fresh positions. In addition, as can be seen on the hourly chart, at the end of the article, the pair is trading flat, which happens quite often on the eve of such important events. However, given the practice of recent years, I assume that the market will not be flat right before the release of American labor reports, but will start moving earlier. It is also very likely that the data will not be unambiguously good or bad, but, most likely, will be mixed. If this is the case, then with a high degree of probability, it is possible to assume sharp multidirectional movements that replace each other. Given the high probability of such a course of trading, for those who are going to open deals today, I can suggest considering the opening of sales after a short-term rise to the pink resistance line, which runs near 1.1358, especially since it is near the strong technical level of 1.1360. For potential purchases, it is better to use the same short-term drops to the nearest support area of 1.1275-1.1250. On Monday, we will summarize the results of the week that ended and analyze the actual figures for the US labor market.