Investors began to withdraw from the stocks of technology companies after the hawkish tone in the minutes of the Fed meeting. In the crypto market, the sell-off also accelerated.

Bitcoin declined around $ 4,000 in 24 hours:

Ethereum also plunged by 11%:

Ethereum also plunged by 11%:

Crypto's total market capitalization dropped by 8.4% overnight, reporting to $ 2.17 trillion.

Crypto's total market capitalization dropped by 8.4% overnight, reporting to $ 2.17 trillion.

The minutes mentioned again the forthcoming increase in federal funds rates and a reduction in the size of the Federal Reserve's balance sheet.

As a result, tech stocks declined, gold fell below $ 1,800 an ounce and cryptocurrencies plummeted.

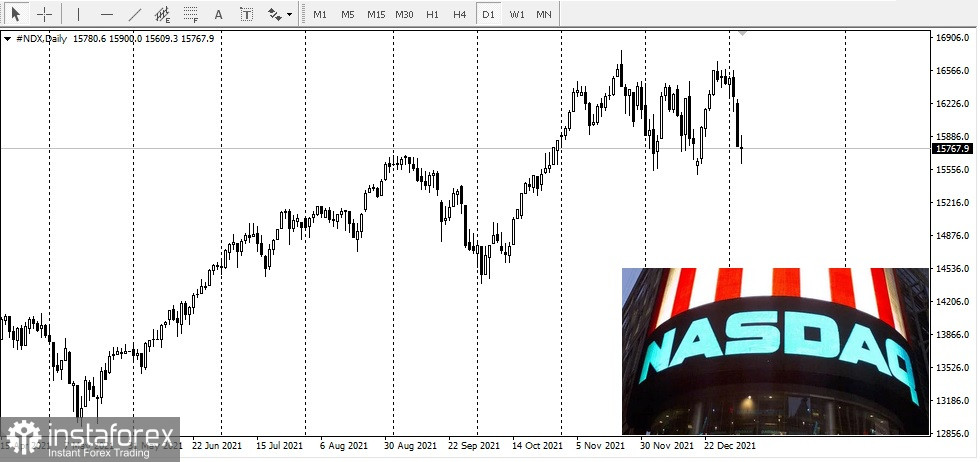

Nasdaq fell more than 3% overnight, which was the biggest one-day drop:

Nasdaq fell more than 3% overnight, which was the biggest one-day drop:

The next major event on the radar of the market is the US nonfarm payrolls (NFP) data today.

FXTM's senior analyst Lukman Otunuga said that the atmosphere has become tense due to the release of the December US employment report. Nevertheless, no matter what figures come out this Friday, the first week of 2022 was very active.

Bitcoin and Ethereum should drive the tightening of the Fed in 2022, according to Mike McGlone, a senior commodity strategist at Bloomberg Intelligence.

He said that the Federal Reserve is facing the highest inflation in four decades and will have to raise interest rates if risky assets continue to rise. Adding that cryptocurrencies are the leaders among risky and speculative assets.

Meanwhile, Ray Dalio believes that allocating bitcoins to 2% of the portfolio is reasonable.

It can be recalled that the founder of Bridgewater Associates admitted last year that he only owned a small amount of BTC and ETH.