Long-term perspective.

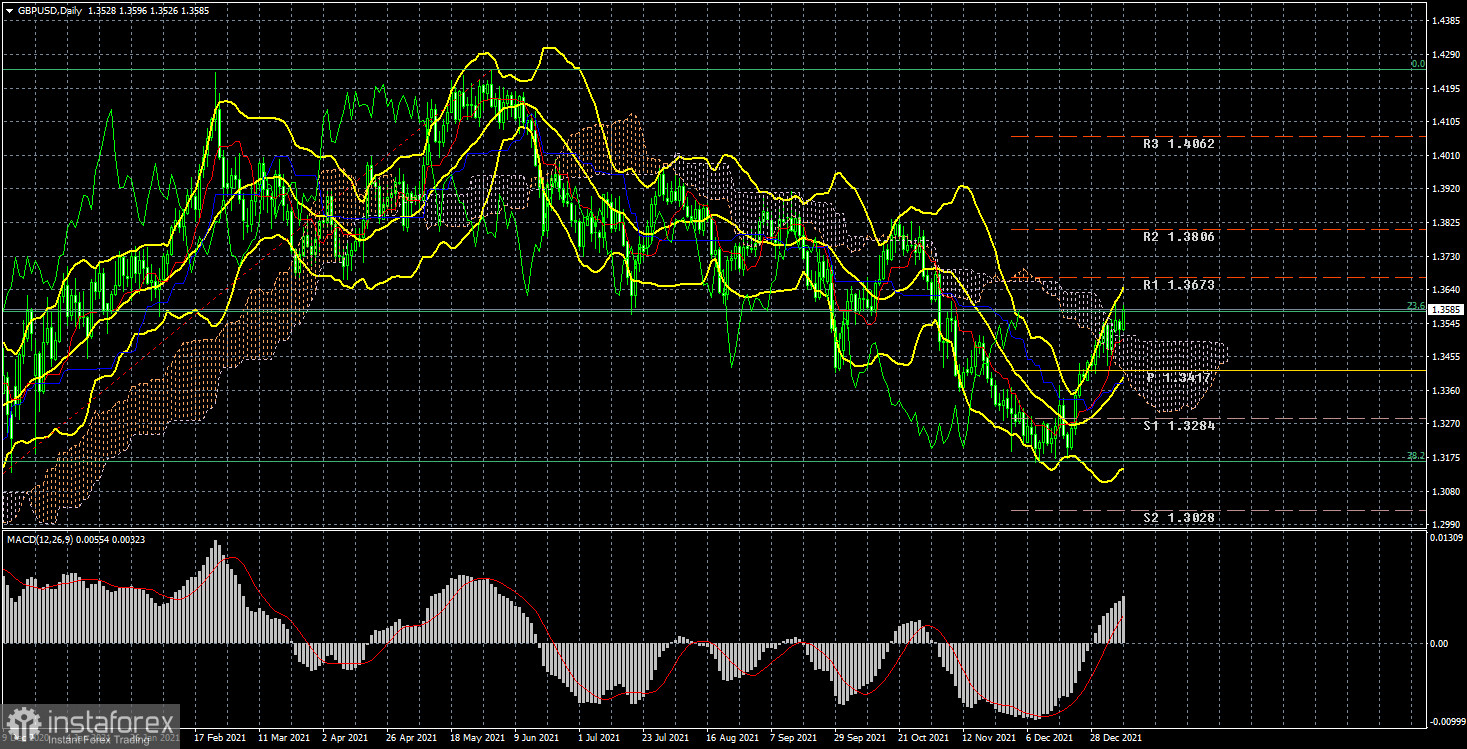

The GBP/USD currency pair has grown by only 50 points during the current week, but the main thing is that it has maintained an upward trend. On a 24-hour timeframe, this growth of the British currency still looks like a correction against the downward trend of 2021, but during the first week of the new year, the pair managed to gain a foothold above the Ichimoku cloud. And this is also very important. If you look at all the bulls' attempts over the past year to overcome the Ichimoku cloud, you can see that they always ended in failures. Thus, now, for the first time in the last 12-13 months, there is a real opportunity to start forming a new uptrend. We have already said earlier that we expect a movement of 400-500 points up since this is exactly the nature of the movement (with deep corrections) that was observed all last year. At the moment, the pair has moved away from the last local minimum by 430 points. We also said earlier that the pound is now more likely to grow against the dollar than the euro. First, during 2020, the pound grew much stronger than the euro. Second, during 2021, the pound fell much weaker than the euro. Third, the Bank of England raised its key rate in December, showing its intentions to embark on the path of tightening monetary policy. And this is a strong fundamental support factor for the British currency. Thus, we believe that now the pound has a real chance of forming a new upward trend.

Analysis of fundamental events.

There were practically no important publications and events in the UK this week. It is possible to note only the indices of business activity in the service and manufacturing sectors, which in general turned out to be stronger than experts predicted. It is important that these reports were for December, that is, the omicron pandemic did not have a devastating impact on business activity. So we can assume that the British economy will show a not too strong slowdown in the fourth quarter. And this is again a factor in supporting demand for the pound. Also this week, business activity indices in the United States were published, which generally deteriorated slightly in December compared to the previous month. On the other hand, the ADP report showed an increase in the number of employees in the private sector by as much as 800 thousand, with a forecast of +400 thousand. However, the market cheerfully ignored this report. The Fed minutes on Wednesday showed that the regulator may start raising rates earlier and do it more often in 2022 than previously expected. Most members of the monetary committee support such a plan for the current year. Also, talk is slowly beginning about unloading the Fed's balance sheet, which has grown to $8.7 trillion during the pandemic. Now the Fed can start selling securities, thus withdrawing excess liquidity from the economy. This should also have a positive impact on inflation and the dollar exchange rate. These factors will have to support the US currency, but, as we said earlier, they can already be taken into account by the market, since all the second half of the year-2021 traders were tuning in to this development. Separately, it should be said about the unemployment rate has already fallen to 3.9% in the United States. The pandemic level is 3.4-3.5%. Thus, we can even conclude that the labor market has almost completely recovered, but at the same time, the Nonfarm index is of greater importance, which for the second month in a row turns out to be weaker than forecasts.

Trading plan for the week of January 10-14:

1) The pound/dollar pair has overcome the Kijun-sen and Senkou Span B lines and is now ready to form a new upward trend. Thus, at this time, it is possible to continue trading on the lower TF for an increase, but we should expect a small pullback down, which should end at least below the critical line. After that, a new round of upward movement should begin with the goals of 1.3673 and 1.3806, and maybe even higher.

2) The bears have let the initiative out of their hands. Now it will be possible to consider selling the pair again no earlier than fixing the pair below the Kijun-sen line. The level of 1.3162, which is a strong Fibonacci level of 38.2%, kept the pair from falling further, so the "technique" does not imply a new strong fall in the pound in the first months of 2022.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).