In the first week of the new year, bitcoin fell by another $ 6,000. If you look at the long-term chart, there is nothing surprising in this, since the long-term ascending trend line has been overcome. Thus, the "bullish" trend is broken. We have been expecting such a scenario for a long time, but all the time bitcoin has been held at the expense of new, large and institutional investors. However, despite the fact that many experts still believe that bitcoin will grow no matter what, and the "digital gold" is the future of finance, we remind you that bitcoin lost up to 80-90% of its value every time after the completion of the "bullish" trend. Of course, it is impossible to compare what was with cryptocurrency 5-6 years ago with what is now. A lot has changed in such a long time: a pandemic has emerged, central banks around the world have poured hundreds of billions of dollars into stimulating the economy, the money supply has grown, and the pandemic is not over yet. To some extent, we believe that the growth of "bitcoin" in the last 2 years is accidental. If there had been no pandemic, there probably would have been no growth, since there would have been no huge monetary incentives. Nevertheless, the fact that BTC is growing does not mean that it will grow forever now, but it cannot fall in principle.

The Fed is against Bitcoin.

At the end of last year, we repeatedly drew the attention of traders to the fact that the US Federal Reserve is slowly taking the path of tightening monetary policy. We said that in the last two years bitcoin had wonderful conditions, as there was more and more money in the economy, and the rates were ultra-low, which forced investors to look for riskier and more profitable investment tools with rising inflation (or expectations of rising inflation). Now the situation is changing in the opposite direction. The Fed may completely abandon the stimulus as early as March 2022. This will mean that money from "nowhere" will no longer flow into the economy. Accordingly, cash flows to the cryptocurrency market will decrease. Consequently, demand will not grow. Further, starting in March, the Fed may begin to raise the key rate, which will mean an increase in the profitability of other less risky assets. Sooner or later, the Fed will start unloading its balance sheet. Simply put, to withdraw excess money from the economy by selling treasury and mortgage bonds. Accordingly, investors will have less money on their hands. Inflation will begin to decline sooner or later, as regulators around the world do not allow it to be at the level of 5-7%. And bitcoin has recently been called an "inflation hedging tool". Accordingly, if inflation falls, then many investors will no longer need to buy the first cryptocurrency. All this, from our point of view, will reduce the demand for "bitcoin" in the long term. Moreover, we all see a tendency to tighten regulation of the circulation of cryptocurrencies and other digital assets. Taxes will be raised and controls will be tightened. All this makes bitcoin, with its ultra-volatility and increased risks, far from the most attractive tool.

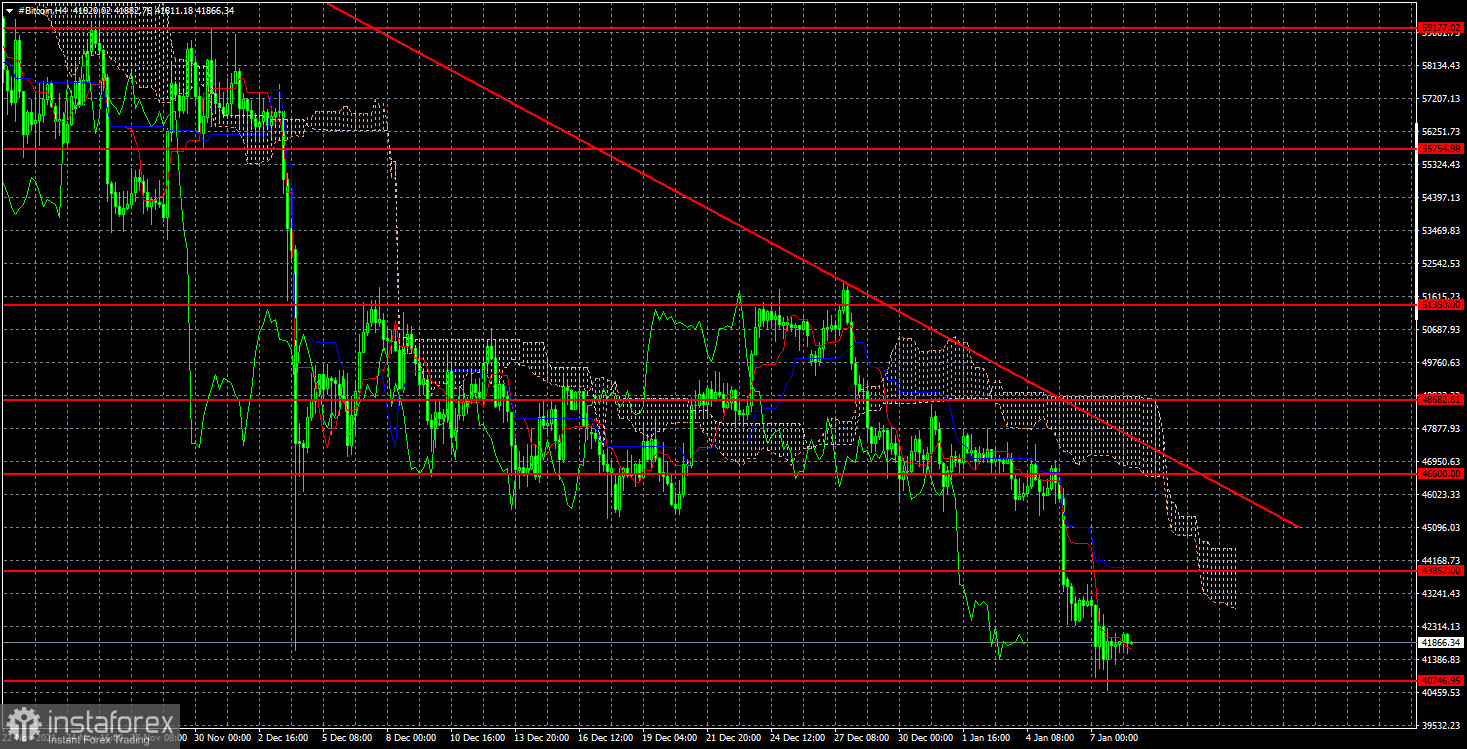

The trend on the 4-hour timeframe is downward again. BTC quotes dropped to the important level of $ 40,746, which is the minimum from September 22 and 29. If the price is fixed below this level, then the path will be open up to the level of $ 31,106, from which a new round of cryptocurrency growth began this summer. We believe that the probability of continued decline is very high. Institutional investors may try to defend the $40,746 level, but will they succeed in a bearish trend?