The US labor market report for December is ambiguous. The increase in jobs in the said month was only 199 thousand, although both the ISM employment indices and the ADP report assumed a much higher result. On the other hand, the past two months were revised to +141 thousand at once, which reduced the negativity. The unemployment rate also declined to 3.9% altogether, returning to the pre-pandemic level, which made it possible to speak of a complete recovery of the labor market.

Average hourly wages surged by 4.7%, which, combined with high inflation, requires the Fed to reduce measures to support the economy. The minutes of the last FOMC meeting showed that more and more members tend to accelerate the pace of policy normalization.

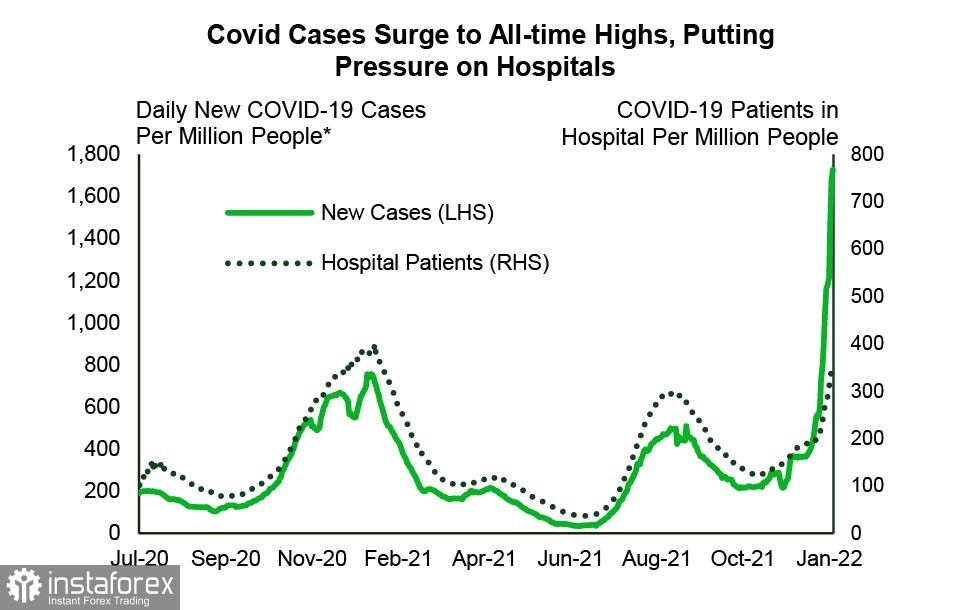

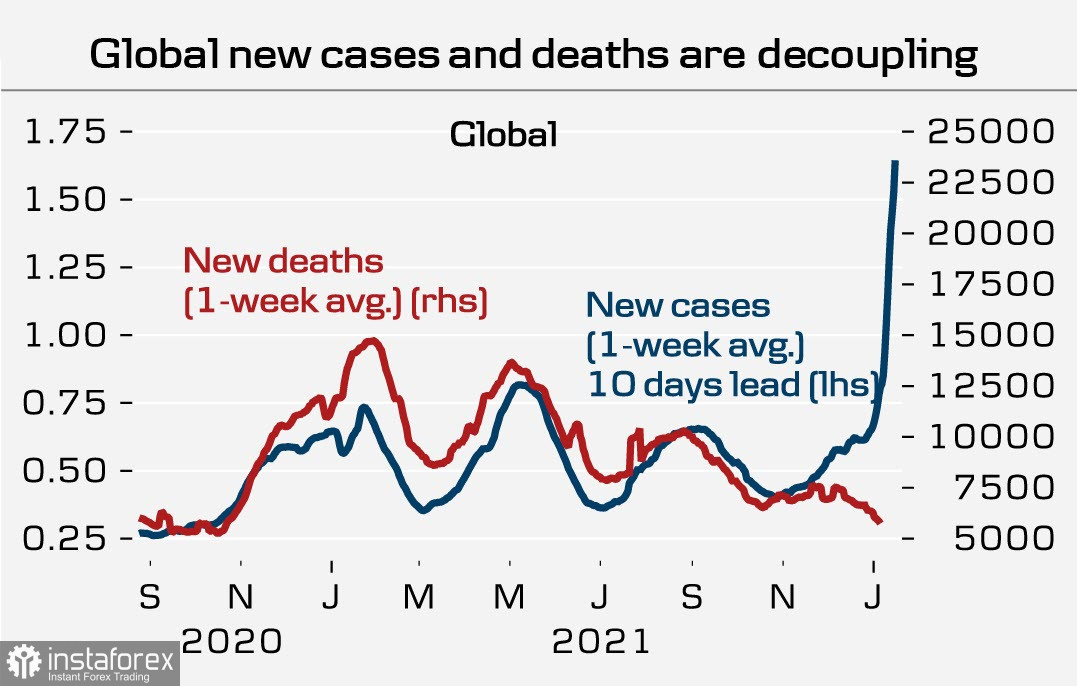

Everything would be fine, but it is not guaranteed that the COVID-19 topic will not intervene again and will not adjust the expectations for the rate. The current growth of cases is significantly ahead of the previous waves. The number of hospitalizations is slowly growing, but the situation is, as they say, subtle.

Omicron's rate of spread in the world is not much different from what is seen in the United States, so all forecasts on risks and on rates can be revised almost overnight if a new strain is recognized as more dangerous than it seems. So far, investors are proceeding from positive scenarios, but who knows?

The CFTC report turned out to be almost neutral for the US dollar (the cumulative long position fell from 19.7 billion to 19.5 billion) but did reveal a few changes in positioning. European currencies (pound, franc, euro) gained, while on the contrary, commodity currencies slightly worsened their positions. This result could be interpreted as the beginning of a cycle of demand for protective assets, if not for gold's absolutely opposite movement. Meanwhile, oil moves to the green zone, as well as high-tech copper, which means an increase in demand for industrial products, and hence for raw materials, while there is a slight negative trend for gold.

Mutually exclusive trends do not allow us to draw a definite conclusion on the mood of speculators, and apparently, a little more time is needed for the markets to develop a more or less unified approach.

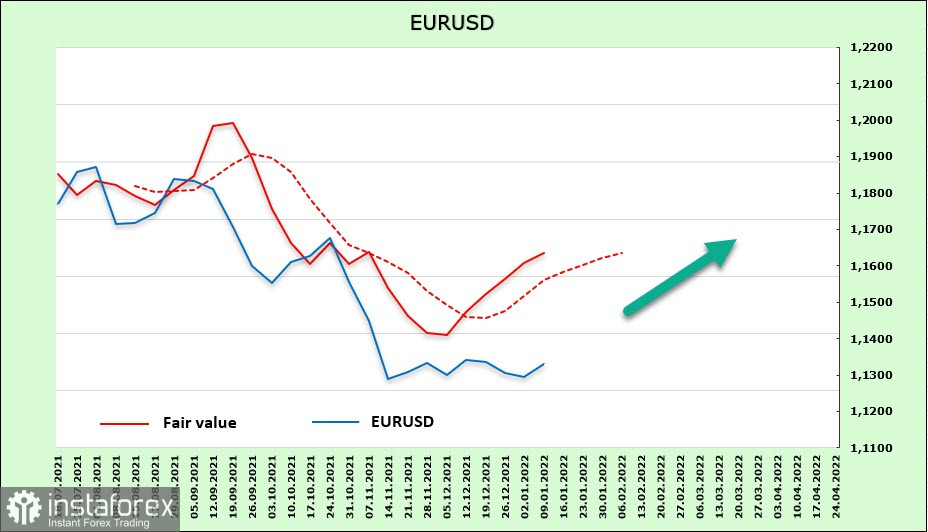

EUR/USD

EU's inflation set a new record, rising to 5.0% in December. Core inflation also increased, but not so critical to seriously count on ECB's quick action. Perhaps, we will hear something definite on Tuesday, when ECB Chairman Lagarde will represent Nagel for the post of head of the Bundesbank.

The euro continues to slowly recover its position. The weekly change of +0.7 billion made it possible to almost close a net short position and reach zero (-0.2 billion). The target price also continues to hold above the long-term average, with a bullish trend for the euro. At the same time, there is no reason to expect that we are seeing not a correction, but a full-fledged bullish reversal. However, the technical picture for the euro remains bearish.

It can be assumed that attempts to make an upward correction will continue. The probability of moving above the resistance of 1.1400/20, where the border of the bearish channel passes, is low. The rotation process at the Fed will begin this week. Powell and Brainard will answer questions during public hearings in the Senate, and the general orientation of their response will allow us to adjust expectations for the US dollar. There is no bullish driver for the euro, so the correction will be shallow. The euro may try to reach the level of 1.10 in the near future.

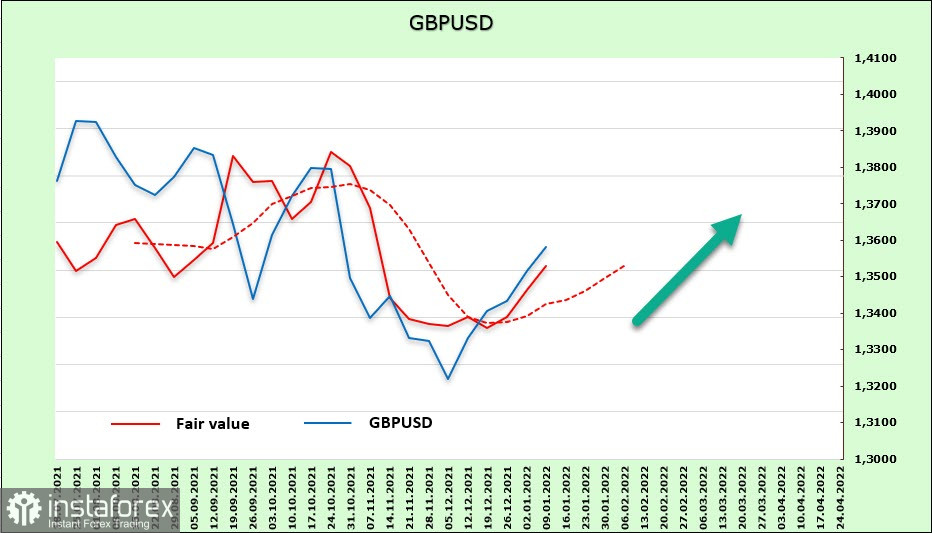

GBP/USD

On Tuesday, NIESR will present its estimate of GDP growth rates for December, inclusive, the main UK data will be released on Friday and may have an impact on the volatility of the pound. In the meantime, the British currency is experiencing a slight bullish influence due to the global demand for risk.

The pound's net short position continues to decline. The weekly change is +0.9 billion, but the bearish advantage has not yet been overcome (-3.3 billion). The dynamics are positive and the target price is growing, so attempts to resume the growth of the pound on the spot can be expected.

The pound approached the upper border of the bearish channel. If it successfully tests it, the next target will be 1.3820/30. A downward pullback, while the overall positivity remains, is unlikely.