In today's article on GBP/USD, we will summarize last week's results and try to determine the future price movement of this trading instrument. First, however, we will discuss the Omicron strain, which has spread strongly across the UK.

Hospitals in London are short of medical staff and beds, due to the high number of COVID-19 omicron strain patients. At the same time, many health workers are forced to go into self-isolation and resign from high workloads. Hospital wards are overcrowded with patients, and newly arrived people are waiting in ambulances for their turn. The situation is extremely difficult and alarming. It seems that Boris Johnson will have to further tighten the quarantine measures, otherwise, the situation will only worsen.

Weekly

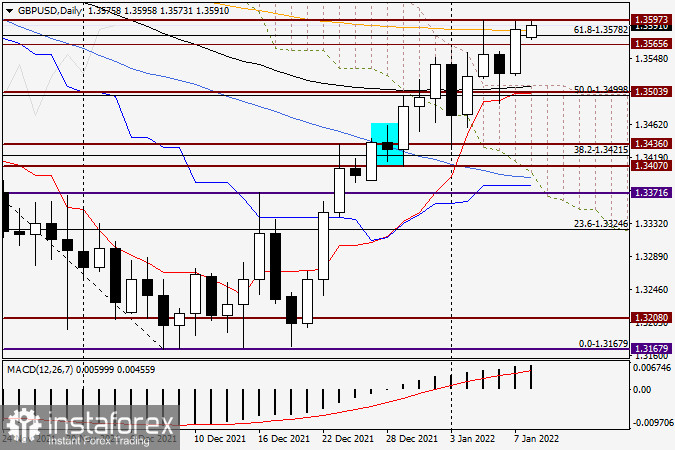

Nevertheless, despite this unfortunate situation with the spread of the Omicron strain in the UK, the pound sterling strengthened against the US dollar in the first week of the new year. However, as can be seen on the weekly chart, the trading on January 3-7 was far from clear for GBP/USD. First, the pair showed a downward trend and fell to 1.3429, where it found strong support and turned in the opposite direction. There is no doubt that the black 89 exponential moving average, as well as the previously broken resistance at 1.3436, helped stop the fall of the British currency. As a result of the change in the price trend, GBP/USD closed the week with gains and traded above another previously broken support at 1.3565 as well as the blue Kijun line of the Ichimoku indicator. After the last candlestick formation and another confirmation that the market has no desire to decline, a further rise in the price is now more likely. The target for this timeframe is the 50 simple moving average, which is located at 1.3752. However, it is still a long way to the 50 MA, so it is possible that the pair will not reach this level immediately and quickly. The bears' priority for the pound is the renewal of the previous lows, a break-up of the 89 EMA (1.3457), and the support at 1.3429.

Daily