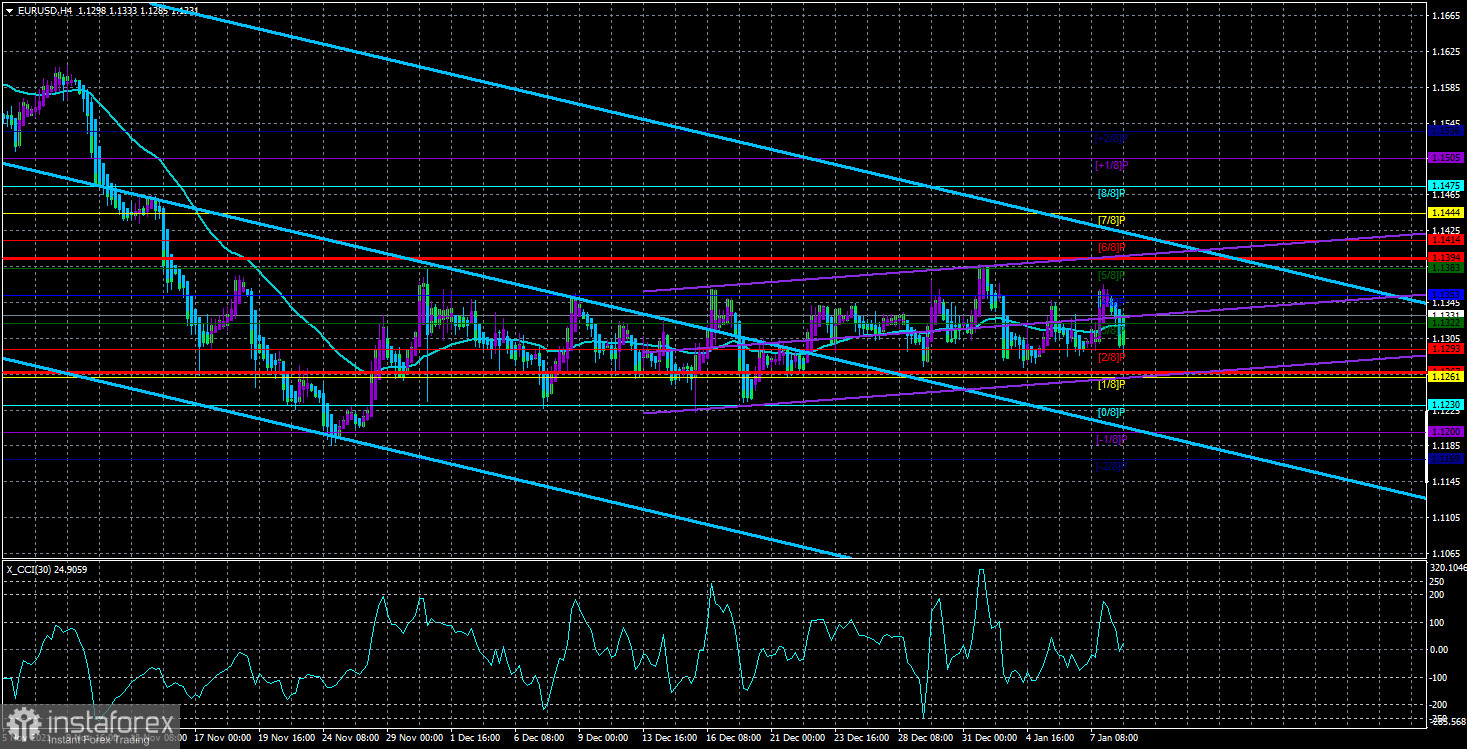

The EUR/USD currency pair on Monday very predictably failed to continue the upward movement that began last Friday. Recall that on Friday, macroeconomic statistics from overseas turned out to be contradictory. Only one report turned out to be weak – Nonfarm Payrolls. But this was enough for the dollar to feel the pressure and ignore the strong reports on wages and unemployment. But, as we can see, the dollar's decline did not continue after Friday. Meanwhile, the pair bounced for the fourth or fifth time from the approximate upper boundary of the side channel, which it has been for a month and a half. "Approximate" - because the minimum upward slope of the movement is still present. The pair has been growing in the last month and a half, but if you look at the picture in general, the fact that there is a flat does not cause any doubt. Thus, another rebound from the level of 1.1353 (1.1360) may provoke a new round of downward movement inside the side channel. However, recently the price has bounced off these levels several times, but it has never been able to reach the lower limit (1.1230). Therefore, the movement is not just lateral now, it is also as confusing as possible, which is probably perfectly visible in the illustration even without our explanations. Thus, the technical picture has not changed at all during Monday.

The currency pair is steadily moving towards the end of the flat.

There is nothing particularly new to say about the fundamental picture now. After the minutes of the December meeting of the Fed and Nonfarm were published, the most important event on the horizon is the December inflation report, which will be published this week. The next important event is the Fed meeting, which is scheduled for January 25-26. It is at this meeting that we will be able to make sure that the regulator will not deviate from the planned path for a faster tightening of monetary policy. Recall that in December it was decided to increase the pace of curtailing the QE program to $ 30 billion per month. Therefore, by the end of January, this amount should remain unchanged. If so, the dollar will get more and more reasons to resume growth against the euro. In addition, Jerome Powell's rhetoric and the decision on the key rate will be important. The Fed is unlikely to decide to raise the rate in January, but there is always the possibility of a surprise. After all, the Bank of England managed to present it at its meeting in December.

However, the Fed meeting is still far away. Much closer on the calendar is Jerome Powell's speech to Congress, which will be dedicated to his re-election as head of the Fed for a second term. On the one hand, this event may be a mere formality, because there is no reason to assume that the Senate will vote against Powell. On the other hand, Powell is likely to present his management plan for the organization for the next few years. And, of course, the fate of the American economy and the fate of the American currency will depend on how much his plan will be "hawkish". It may turn out the same way as with the Fed protocol. Such events rarely cause a market reaction, but sometimes they do happen. The minutes of the December meeting were too "hawkish". If Powell pours "hawkish" theses to the left and right on Tuesday, it may again support the US currency. But, on the other hand, does it make any sense if the euro/dollar pair has been flat for a month and a half? We believe that the flat can end by itself. Yes, about the way Lagarde and Powell expected inflation to slow down. After all, we are dealing with the market and several extremely important events have already failed to bring the pair out of the side channel. So you need to wait for the moment when the demand or supply for any of the currencies will begin to increase or decrease and reach a critical point at which the price will leave the specified range. Most likely, this process has already begun, but it is proceeding very slowly.

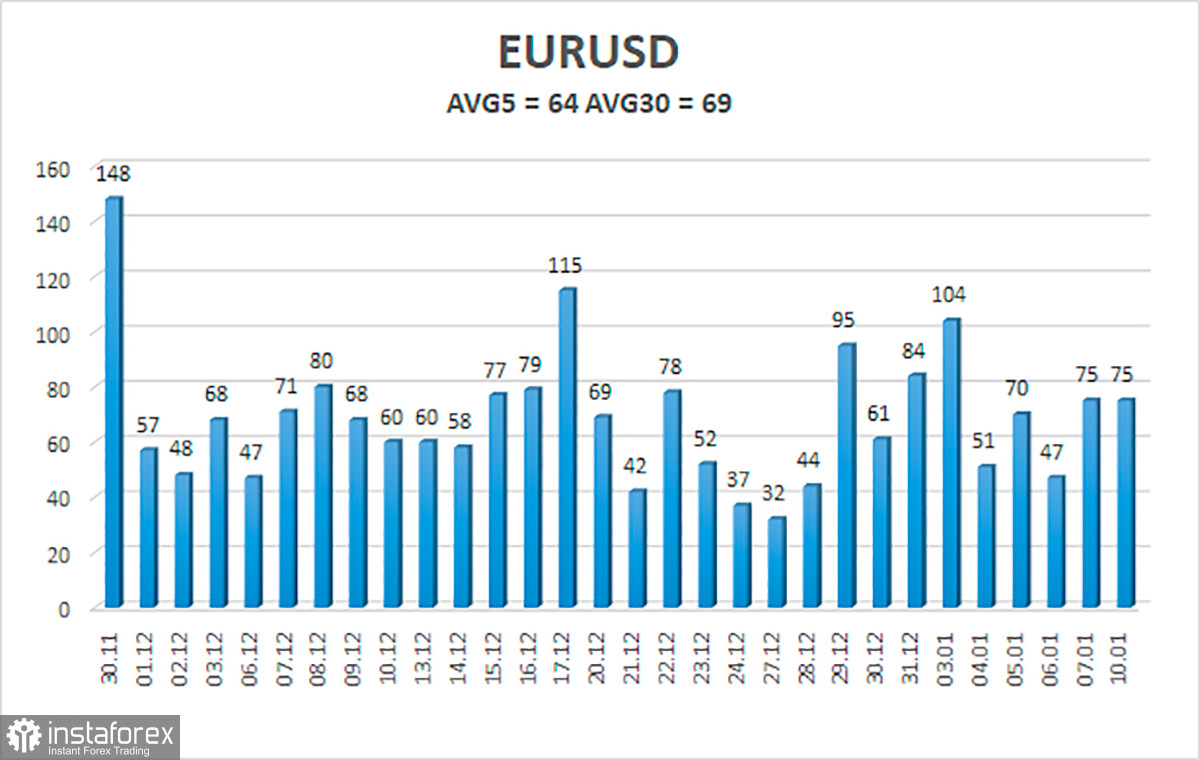

The volatility of the euro/dollar currency pair as of January 11 is 64 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1267 and 1.1394. The upward reversal of the Heiken Ashi indicator signals a new round of upward movement in the limited range of 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1261

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1322

R2 – 1.1353

R3 – 1.1383

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230 - 1.1353 channel. Thus, the movement now remains as lateral as possible and inconvenient for trading. It was not possible to gain a foothold above this channel on Monday. Therefore, you can still trade between the boundaries of the channel using far from the most accurate signals.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.