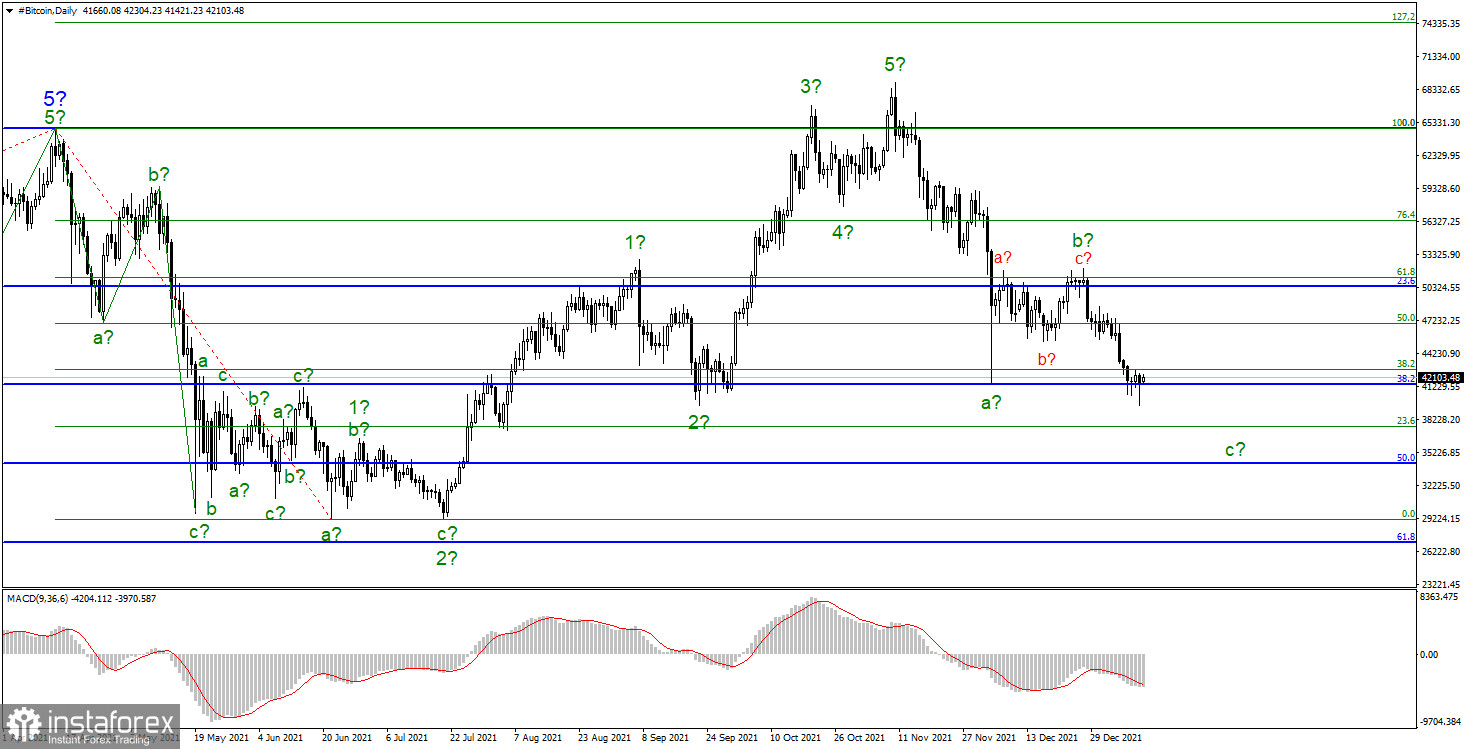

Bitcoin fell below the level of $ 40,000 on Monday. In our opinion, this is a strong signal for further decline. Earlier, it was mentioned that wave analysis indicates the formation of a wave with a downward, possibly corrective, trend section. If this is really the case, then Bitcoin's decline should continue to the targets around $ 37552 and $ 34322.

It is worth noting that the current news background for the first cryptocurrency remains negative. The political situation in Kazakhstan is not improving – unrest and interruptions on the Internet continue. Therefore, a certain part of miners in this country is still cut off from the outside world and from the Bitcoin network. However, the riots in Kazakhstan should not be considered as the only reason why the main digital asset declined. One has only to remember that the fall began long before Kazakhstan; consequently, there can be many more reasons. One of them is the Fed's monetary policy for the coming years. Analyzing the Bitcoin chart over the past 10 years, it is obvious that there were different periods. There were long periods of stagnation, and long periods of decline. If the cryptocurrency has mainly grown in the past two years, then it is logical if a downward trend begins, which most likely has already begun.

- Bill Miller keeps half of his capital in bitcoins

However, most analysts and traders still believe that Bitcoin will continue to rise in the near future. It is good that the forecasts are more moderate. For example, the majority of analysts are now announcing a forecast of $ 100,000 until 2024. This opinion is shared by analysts from both large investment banks and private traders. For example, investor Bill Miller said that he transferred half of his investment capital to bitcoins, and made most of the purchases at around $ 30,000. He called Bitcoin the only asset whose supply does not depend on demand (the supply level is limited and cannot exceed 21 million coins). Moreover, he drew a parallel with gold, stating that if its price rises noticeably, then gold mining companies will receive more incentives to increase the production of precious metals.

- Will Bitcoin support the growth of US inflation?

Bitcoin continues to be considered the best remedy against monetary inflation. And this is a very topical topic since a report on December US inflation will be released this week. The market expects the CPI to continue to rise to 7.0% or more. If so, then the world's first cryptocurrency will be able to receive at least temporary support as it has lost almost $ 30,000 in value in just two months. Although it was Bitcoin that rose the most among all other assets by the end of 2021, this year may be the year of cooling the economy due to tightening monetary policy in many countries. Therefore, such volatility still plays against Bitcoin as an asset.

The formation of a new downward trend section continues. At this time, wave b is considered completed, which has taken a noticeable three-wave form. The instrument declined to the previous low, around $ 41,500, in the expected wave c, and broke it. Around this level, the downward trend may end, but such a shortened third wave is rare. The instrument can be expected below this mark. The news background is not on Bitcoin's side right now, so the expectations of a strong wave c are not unfounded. A successful attempt to break the low waves and, as well as the level of $ 41,515, which equates to 38.2% Fibonacci, is very important. In this case, the decline may resume around the targets levels of $ 37552 and $ 34322, which equates to 23.6% and 50.0% Fibonacci.