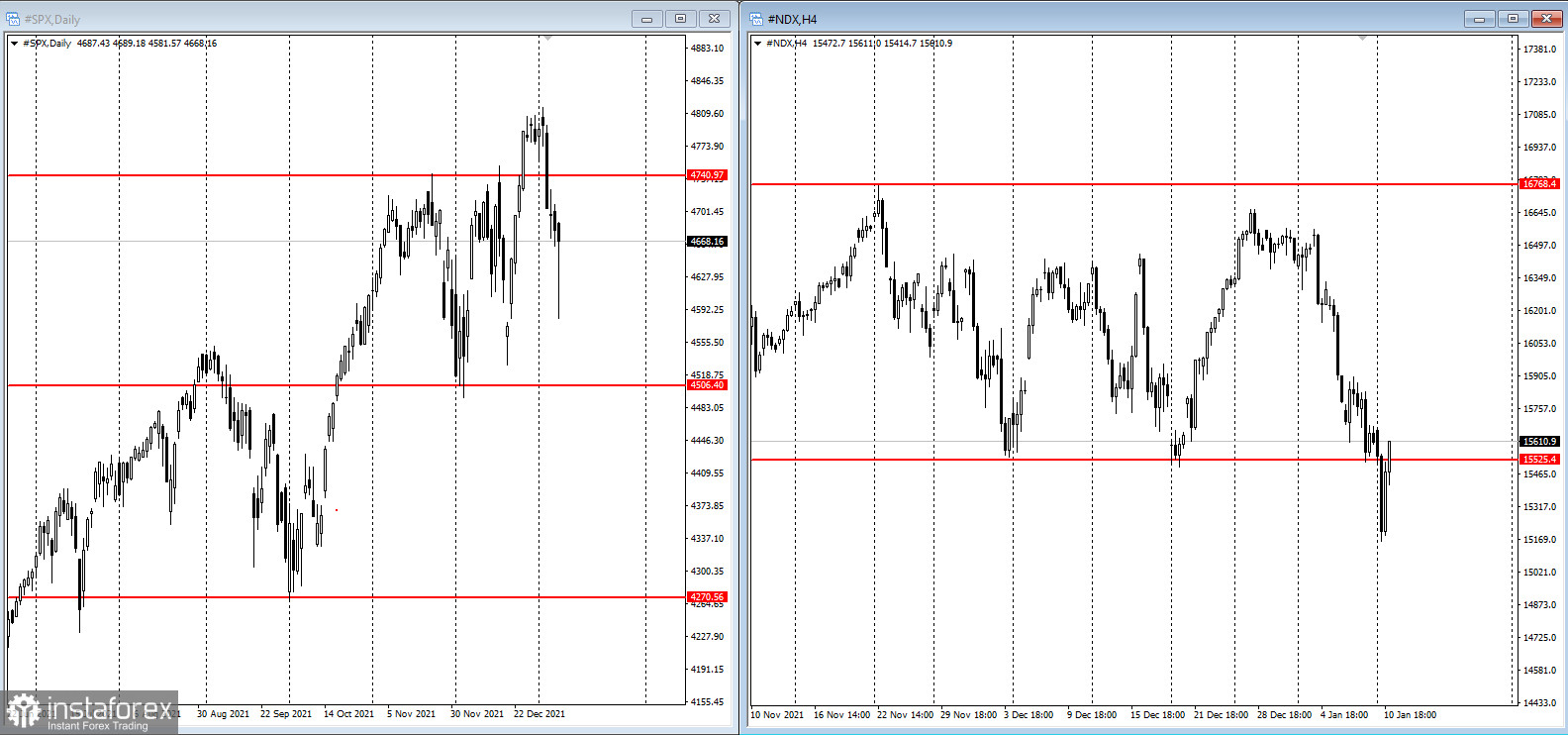

On Monday, the US stock market went down, extending its biggest losing streak since September 2021.

The S&P 500 declined by about 1.3% amid reports that the Omicron strain could reach its peak in New York. The NASDAQ 100 recovered some of its losses after a massive sell-off earlier in the day, which was triggered by an 8.5% slump of Microsoft Corp and Apple Inc stocks. Investors were uneasy over the Federal Reserve's upcoming rate hike, as well as the impact of the resurgent COVID-19 on economic growth.

Despite certain real risks connected to interest rate hike and other factors, some tech companies with falling stock prices have sizeable cash reserves, ETF Defiance's chief investment officer Sylvia Jablonski noted. "We're in a fairly good spot and these are great buy-on-the-dip opportunities right now," she added.

According to Goldman Sachs, the Federal Reserve is likely to raise interest rates 4 times this year, with a balance sheet reduction beginning in July or earlier. A key US inflation measure, which is anticipated to have increased in December, is putting additional pressure on the Fed to tighten its policy. It is due to be released on Wednesday.

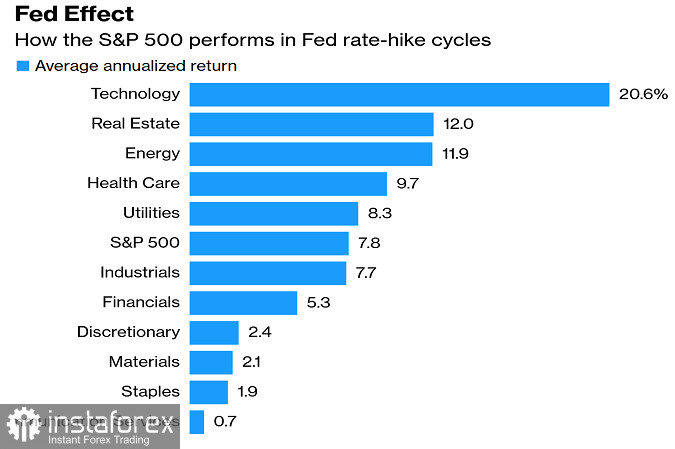

There has been 4 different interest rate hike cycles over the past 3 decades, Strategas Securities analysts noted. The technology sector, which has been under pressure amid prospects of earlier and faster rate increases, is among the best-performing sectors during these cycles on average.

Here are some of this week's key economic events:

Tuesday:

- Fed Chair Jerome Powell's confirmation hearing in the Senate Banking Committee,

- Speeches by Esther George, President of the Fed Reserve Bank of Kansas City, and James Bullard, President of the Fed Reserve Bank of St. Louis.

Wednesday:

- EIA crude oil inventory report,

- China PPI, CPI data,

- US CPI and Fed Beige Book report.

Thursday:

- US initial jobless claims report and PPI data,

- US Senate Banking Committee hearing for Lael Brainard, nominated as Fed vice-chair,

- Speeches by Richmond Fed President Thomas Barkin, Philadelphia Fed President Patrick Harker, Chicago Fed President Charles Evans.

Friday:

- Bank of Korea's policy decision and briefing,

- Wells Fargo, Citigroup, JPMorgan due to report earnings,

- US industrial production data, University of Michigan consumer sentiment and retail sales reports,

- Speech by New York Fed President John Williams.