EUR/USD stuck in a sideways channel

The main Forex currency pair was trading mixed on Monday. We will return to this later in our technical review. Now let us quickly recap the most important events that may possibly affect the trajectory of the EUR/USD pair. Yesterday, the unemployment data in the eurozone came in line with the forecast and amounted to 7.2%. The previous reading of this important indicator stood at 7.3%. This can hardly be called a breakthrough but is still a positive factor for the pair. Today, no macroeconomic reports are expected either in the US or in the EU. At the same time, the speech by Fed Chair Jerome Powell is scheduled for the second half of the day. He will deliver a semi-annual report on monetary policy. Powell is likely to focus on the results of his reappointment as the head of the Federal Reserve. Jerome Powell is expected to report on what has already been done and outline the plans and objectives that will be implemented during his second term. Markets do not expect to hear anything new. Jerome Powell is likely to speak about inflation surges, the COVID-19 situation, and the measures the Fed is going to take in this regard. I assume that the Fed Chair will maintain a hawkish stance. The extent of his aggressive rhetoric will determine the further direction of the US dollar.

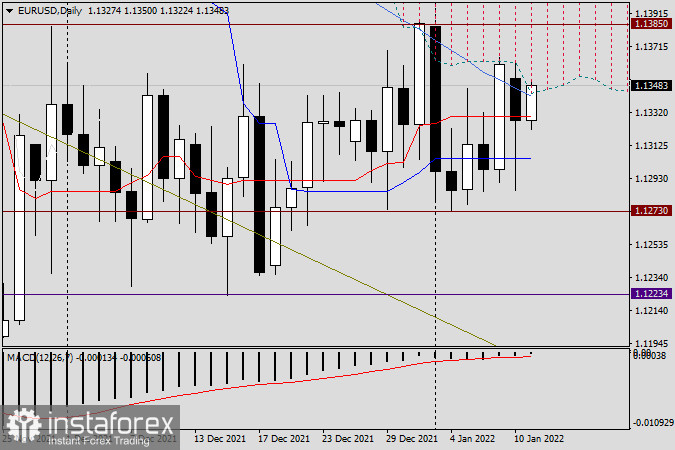

Daily chart

After a rapid rise on Friday, the pair returned to the previous levels on the first day of the week. Both buyers and sellers attempted to reach the set targets. The euro bulls made another attempt to break through the 50-day simple moving average and enter the range of the daily Ichimoku cloud. However, they failed to do so. Bears, on the other hand, managed to push the quote below the red Tenkan line and the blue Kijun line, as well as below an important level of 1.1300 towards 1.1285. Yet, sellers also failed to settle below the level of 1.1300. As a result, the trading session on Monday ended with the formation of a candlestick with a vague bearish body but with a long lower shadow and a price closure above 1.1300, at 1.1327. At the moment of writing, the euro bulls are trying to send the quote inside the Ichimoku cloud, the lower boundary of which serves as a strong obstacle for growth. So, the EUR/USD pair keeps trading in the sideways channel between 1.1385 and 1.1273. The market is struggling to find direction. Notably, even such important events as Nonfarm Payrolls cannot push the pair out of the given range. We hope that today's speech by Jerome Powell as well as tomorrow's CPI in the US will serve as drivers and help the pair find its further direction.

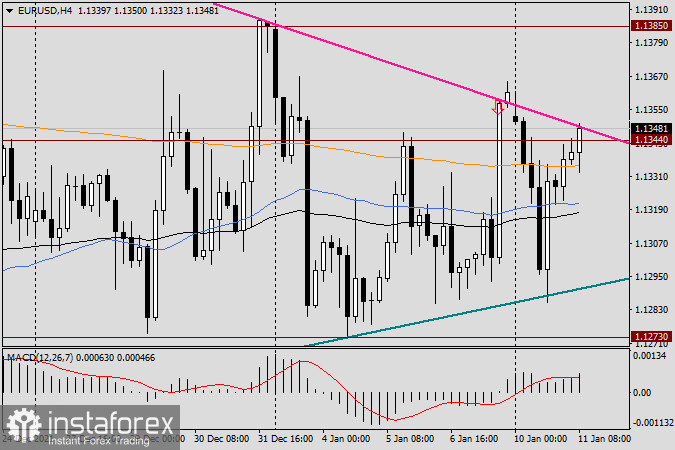

H4 chart

On the H4 timeframe, the EUR/USD pair is trading within the triangle pattern and is struggling to leave it after several attempts. Yet, the possible growth of the pair looks more valid at the moment. It is recommended to open buy positions after a real breakout of the pink resistance line at 1.1609-1.1386. A breakout of a strong resistance level of 1.1385 is even more preferable. However, even in the latter case, bulls will have to face a solid obstacle at 1.1400. Short positions will become relevant when a reversal candlestick pattern appears under the pink resistance line and/or the level of 1.1386 on the H4 or H1 charts.

Good luck!