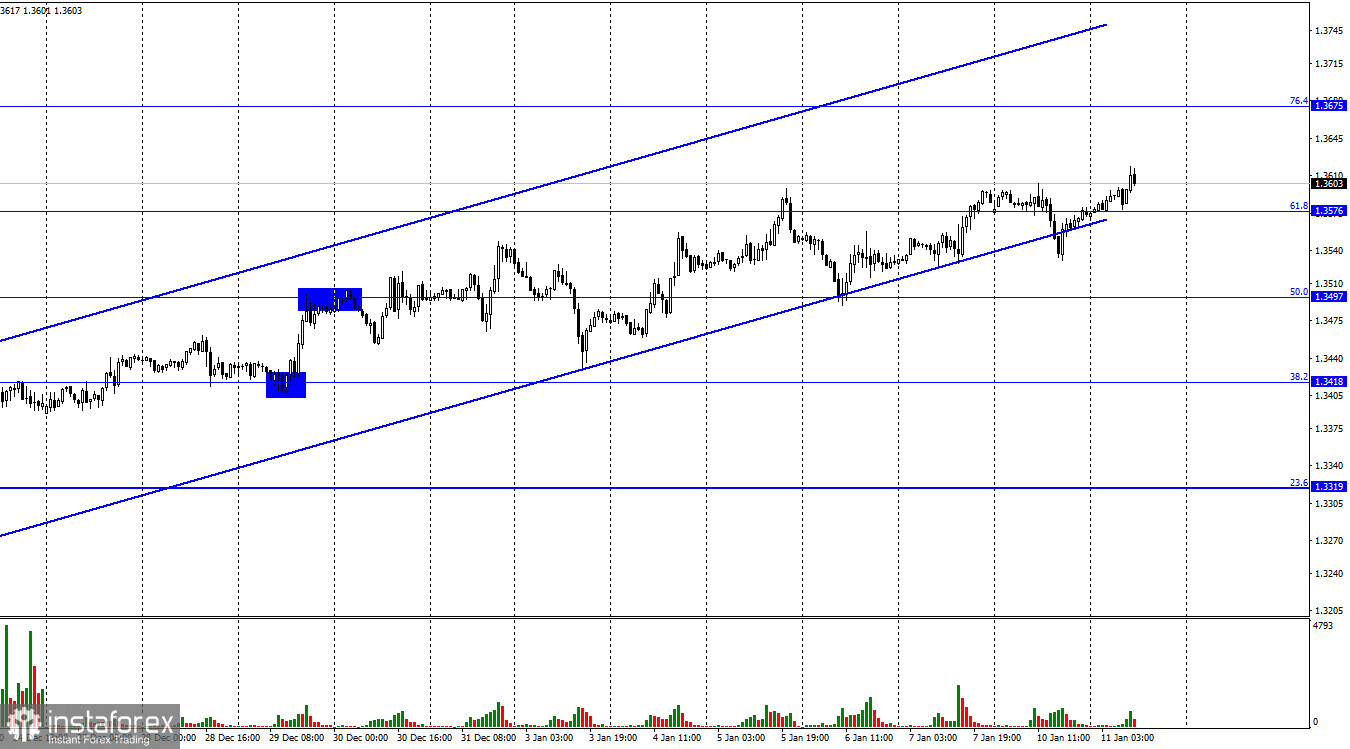

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US currency on Monday and began the process of falling, and even performed a closure under an upward trend corridor. It's not the first time. However, in the evening, the growth of the British pound was restored, and at the moment a new closure has been made above the corrective level of 61.8% (1.3576). Thus, traders can again count on some growth of the British dollar in the direction of the corrective level of 76.4% (1.3675). From my point of view, the growth of the Briton is very amazing. If the euro/dollar pair is tightly stuck inside the side corridor, then the British are growing quite confidently and do not want to consolidate even a little after strong growth. And all this is provided that there is no information background in the UK now if we consider economic data. The American information background should affect the euro and the pound equally, but we see an opposite situation.

Complicating the situation is also the fact that the Briton ignores graphical analysis. It has already fallen below the ascending corridor several times, but it continues to grow. If we take into account the general information background, then there is also nothing positive in the UK that could contribute to the growth of the British. All events in Britain are now connected with the coronavirus, which continues to update sad records (150,000 deaths since the beginning of the pandemic), as well as with the government, which is increasingly being criticized. However, this news should, on the contrary, restrain the growth of the British. Therefore, traders ignore them, so why is the pound growing? Under the circumstances, I recommend analyzing the older charts more, starting with the 4-hour chart. The ascending corridor on the hourly chart has shown its incapacity, and there is a new trend line on the 4-hour chart. At the end of the week, several important economic reports will be released in Britain, but at the moment the pound does not show much interest in a strong information background to continue growth.

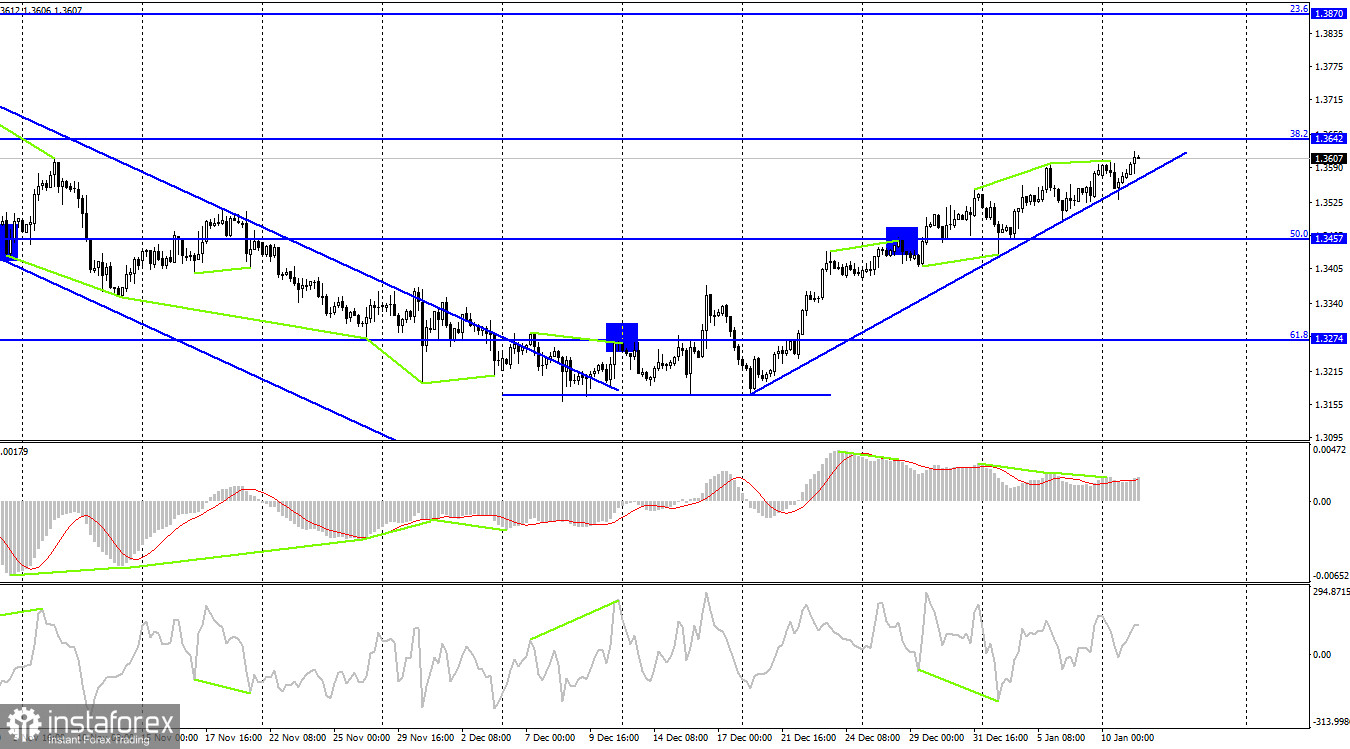

On the 4-hour chart, the pair performed a slight drop twice after the formation of two "bearish" divergences at the MACD indicator. I also built a new upward trend line, fixing under which will allow us to count on a strong fall of the British dollar in the direction of the corrective level of 50.0% (1.3457). Also, a rebound from the Fibo level of 38.2% (1.3642) may work in favor of the British. I believe that the British dollar is slowly exhausting its strength to grow, and the fall should still begin in the coming days.

News calendar for the USA and the UK:

US - Chairman of the Fed Board of Governors Jerome Powell will deliver a speech (15:00 UTC).

On Tuesday, there is one important entry for two in the calendars of Great Britain and America. I have already said that the text of Powell's speech is already known, and it does not contain anything that could affect the mood of traders. Thus, I believe that the information background will be very weak today.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the pound if there is closure under the ascending trend line on the 4-hour chart with a target of 1.3497. I recommended buying the British with a target of 1.3576, as the rebound from the level of 50.0% (1.3497) was performed. Since the level of 1.3576 has been overcome, it is possible to stay in purchases with a target of 1.3642.