Bitcoin and ether slightly regained their positions after Federal Reserve Chairman Jerome Powell made several statements, from which it became clear that "nothing is clear yet." The Fed's super-aggressive policy is postponed. The threat of four interest rate hikes in the US this year only remains a threat, as Jerome Powell, although he confirmed the information that the Fed will start raising rates and reducing the balance sheet this year, however, the central bank has not yet decided how aggressive this policy will be. It takes from two to six months to get the full picture.

Today's US inflation data may have some impact on the cryptocurrency market, but it is unlikely that they will seriously diverge from economists' forecasts, so one fundamental problem for traders, even if only for a while, will become less.

Citadel Securities LLC

From the good news, we can also note the fact that another major player has entered the market. There have been rumors that Citadel Securities LLC will seriously engage in financing several Silicon Valley companies that are developing in the crypto industry. This suggests that billionaire Ken Griffin's firm is finally mastering cryptocurrencies, which will add strength and stability to the market in the future.

According to one of the Chicago market makers, Citadel Securities LLC announced investments of $ 1.15 billion from Sequoia Capital and Paradigm - two venture capital companies through which Citadel Securities can enter the cryptocurrency market.

In November, San Francisco-based Paradigm announced it was launching a $ 2.5 billion fund dedicated to crypto companies and protocols. Its co-founder Matt Huang was previously a partner at Sequoia Capital.

Paradigm said in a statement that the company looks forward to working with the Citadel Securities team as they plan to expand into new markets, including cryptocurrency. Sequoia Capital is also jumping into the crypto sphere, funding a variety of startups focused on its ecosystem and underlying technologies.

More recently, Griffin has made several skeptical statements about the cryptocurrency asset class but said that his firm will trade cryptocurrencies if they are properly regulated, and praised the chairman of the Securities and Exchange Commission Gary Gensler for paying closer attention to this area. At the end of last year, Griffin also gave a positive assessment of the DAO and noted that Ethereum will replace bitcoin in the near future.

El Salvador continues to increase Bitcoin mining capacity

Yesterday, Salvadoran President Nayib Bukele confirmed that the country is investing in the development of a source of geothermal energy for the construction and operation of the future Bitcoin City. The financing of this project will be carried out at the expense of income from the so-called "volcanic bonds". Bukele explained that the energy coming from volcanoes, which is managed and maintained by the state company Lageo, annually produces more than 1,000 gigawatts for the country. "We have a 90% chance of finding a well with a capacity of at least 42 MW. This will be enough to provide energy to the entire Bitcoin City," the President of El Salvador noted.

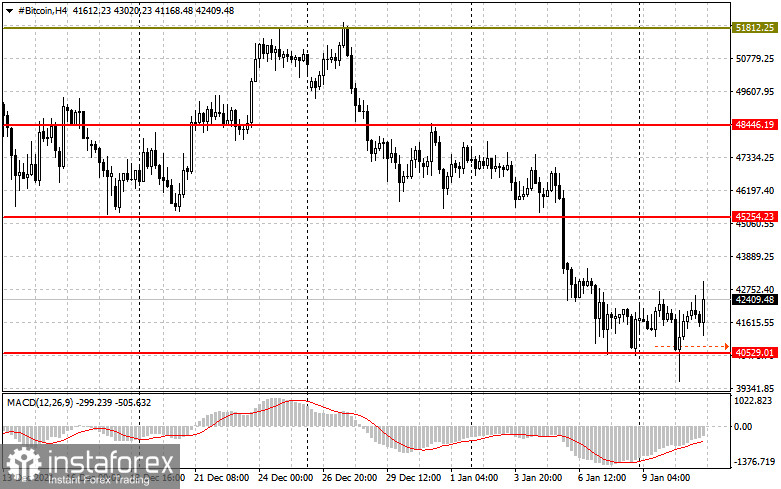

As for the technical picture of bitcoin

The bulls have managed to defend the new support of $ 40,520 and are likely to target the resistances of $ 43,200 and $ 45,524. If the pressure on the trading instrument returns in the near future and we see a breakdown of $ 40,520, in this case, it is better not to wait for anything good in the near future. I advise you to be patient, waiting for the update of the lows: $ 37,380 and $ 33,830. It will be possible to talk about a change in the market direction of the first cryptocurrency only after going beyond $ 43,200, which will open a direct road to $ 45,250, $ 48,400, and $ 51,800.

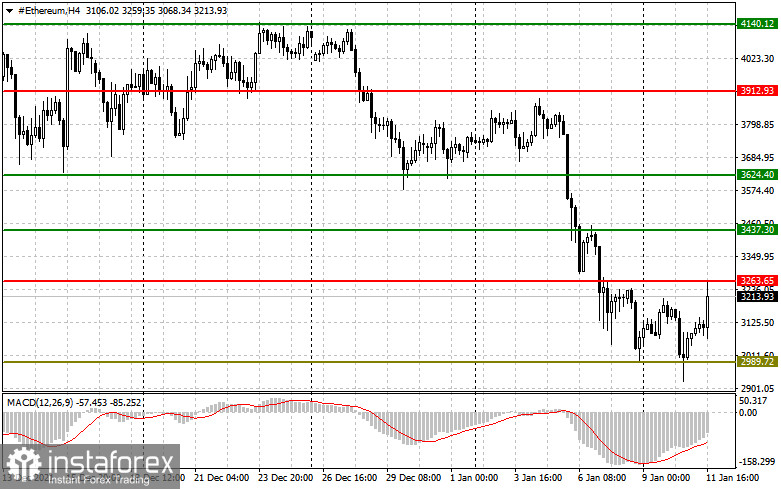

As for the technical picture of the ether

The ether has very big difficulties since the bears have fixed below the 200-day moving average, which is quite a serious problem. Trading below this level will continue to push the trading instrument lower, and a breakdown of the psychological mark of $ 3,000 will lead to a larger sale in the area of lows: $ 2,700 and $ 2,440. To return demand, a breakdown of $ 3,260 is needed, which will open a direct road to $ 3,430, where the 200-day average passes. A break in this range will resume the bullish trend, which will lead to highs of $ 3,600 and $ 3,900.