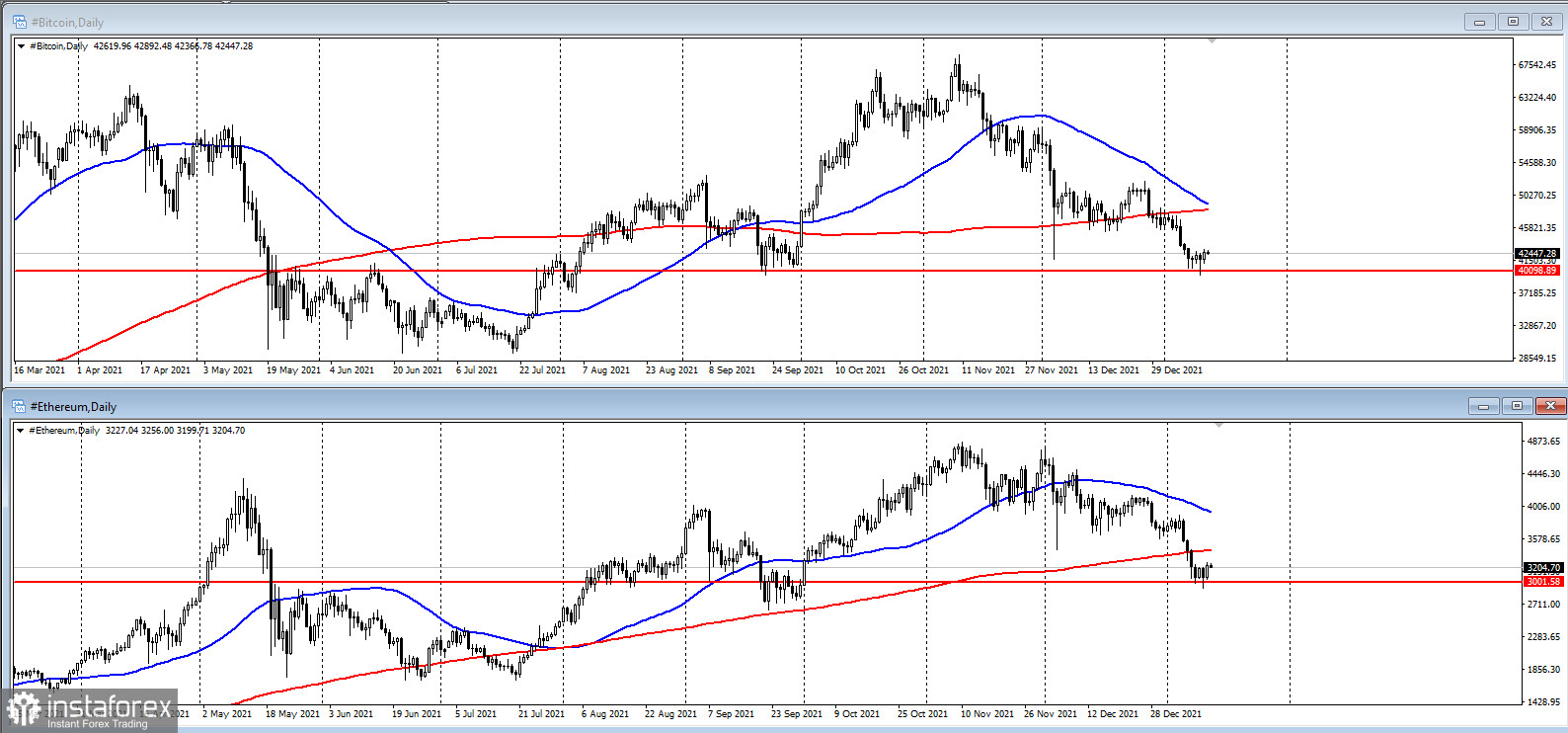

After one of the roughest patches for bitcoin enthusiasts, holders of the largest digital currency are facing an ominous technical price pattern whose name suggests more pain ahead. This pattern, dubbed the cross of death, shows up whenever an asset's average price over the last 50 days drops below that of its 200-day moving average, an indication that its momentum is headed downward. Though it hasn't occurred yet for Bitcoin, it looks to be on course to hit it later this week, according to Mati Greenspan, founder of Quantum Economics. "The chart is pretty clear," he said.

Bitcoin dropped less than 1% to around $41,622 as of 10:48 a.m. in New York. Before Tuesday, there had been just three days of gains since the new year started. Ethereum, the second-largest digital token by market capitalisation, is also on track to form a death cross and was trading around $3,125 on Tuesday.

Cryptocurrencies have been under pressure in recent weeks, with bitcoin down more than 30% since reaching a high of almost $69,000 in November. The latest stretch lower for digital assets is happening as odds rise that policy makers could commence a series of rate hikes as soon as March, and that's just one of several steps they're set to take in removing liquidity. In such an environment, speculative investments are losing their lustre. Only 5% of JPMorgan Chase & Co clients foresee Bitcoin hitting $100,000 by the end of 2022.

The indicator is supposed to be bearish, but Bitcoin's track record around death-cross formations remains murky. It marked the grim-sounding pattern in June of last year, and another one in March 2020 proved no impediment to gains as it turned higher and formed a golden cross (when the pattern is reversed) two months later. But a death cross in November 2019 saw the coin trading lower one month later.

"Some people say it's bearish, but for Bitcoin, just about all previous death crosses or golden crosses have proven to be a good buying opportunity, along with any other indicator under the sun for everyone who entered before 2021," Greenspan said.

Craig W. Johnson, chief market technician at Piper Sandler & Co, says that whenever a death cross has occurred in the broader market indexes or stocks, most - though not all - of the bad news was priced in already. "I think time could be a bigger risk to BTC than price at this point," – he added.

Meanwhile, the International Monetary Fund has issued the latest warning that parallels between cryptocurrency price movements and the stock market could pose a risk to financial markets. According to the multinational organisation, correlation between US stock indices and bitcoins jumped to 0.36 in 2020, up from 0.01 between 2017 and 2019.

Analysts have long noticed that bitcoin, as well as other cryptocurrencies, tend to move in tandem with stocks, and this relationship has strengthened recently. Both have been volatile amid signs that the Federal Reserve was comfortable withdrawing stimulus at a faster pace than previously anticipated.

The 100-day correlation coefficient between Bitcoin and the S&P 500 is currently at 0.44. This is the highest since the fourth quarter of 2020 and one of the highest in a decade. A coefficient of 1 means the assets are moving in lockstep, while minus-1 would show they're moving in opposite directions.

The increasing interconnectivity between asset classes permits the transmission of shocks that can destabilize financial markets. Officials are particularly concerned that more and more emerging market countries are adopting cryptocurrencies as legal tender, notably El Salvador, which last year embraced bitcoin as a form of payment.