The main event of Tuesday and perhaps the whole week was Jerome Powell's confirmation hearings in the US Senate. Although it was largely a formality, the tone of Fed chairman's statements always has influence on the markets. As expected, Powell said no new information and largely focused on inflation. He told the senators that the Fed is using all its tools to prevent a persistent rise of inflation. This could likely mean an earlier hike of the Fed funds rate, as well as reduction of the balance sheet. The Federal Reserve expects inflation to decrease in 2022 - if it does happen, it remains unknown whether the regulator's tone would remain hawkish or not.

In Europe, the COVID-19 situation continues to deteriorate. France now leads the EU in daily confirmed cases, with 360,000 infections reported. Earlier, the French government and president Macron were very optimistic about the ongoing wave of the pandemic, calling Omicron less dangerous than Delta.

Today's important data releases for EUR/USD are the eurozone industrial production data and the US CPI data.

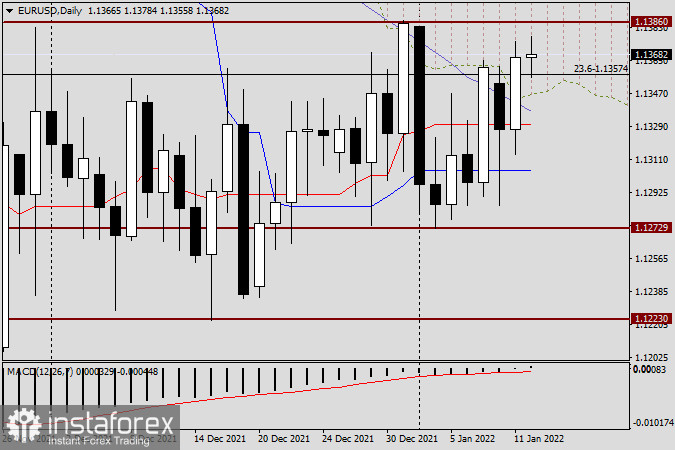

Daily

Yesterday, EUR/USD declined early on, but reversed upwards at 1.1313 and closed at 1.1366. During its rally, the pair managed to surpass the 50-day SMA line and close within the Ichimoku cloud on the daily chart, but it still faces strong resistance at 1.1386. A true breakout of the resistance level at 1.1386 is quite likely at the moment.

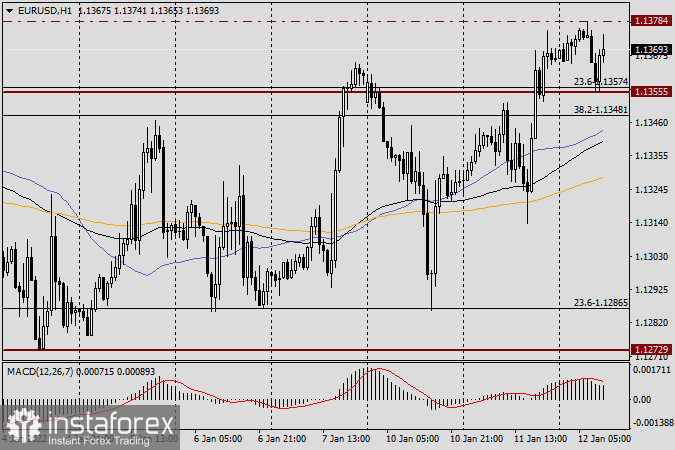

H1

During the Asian session on Wednesday, EUR/USD rebounded to 1.1355, giving opportunities for opening long positions. The pair bounced off that level and is now hovering near 1.1372. Long positions should be opened once EUR/USD breaks through the resistance at 1.1386 and then retraces towards that level. Early on Wednesday, the pair was obstructed by 1.1378 - traders could open long positions if it breaks through that level, but it would be risky. Opening short positions could be considered if reversal candlestick patterns appear below 1.1378 or 1.1386 at either the H1 or H4 charts.

Good luck!