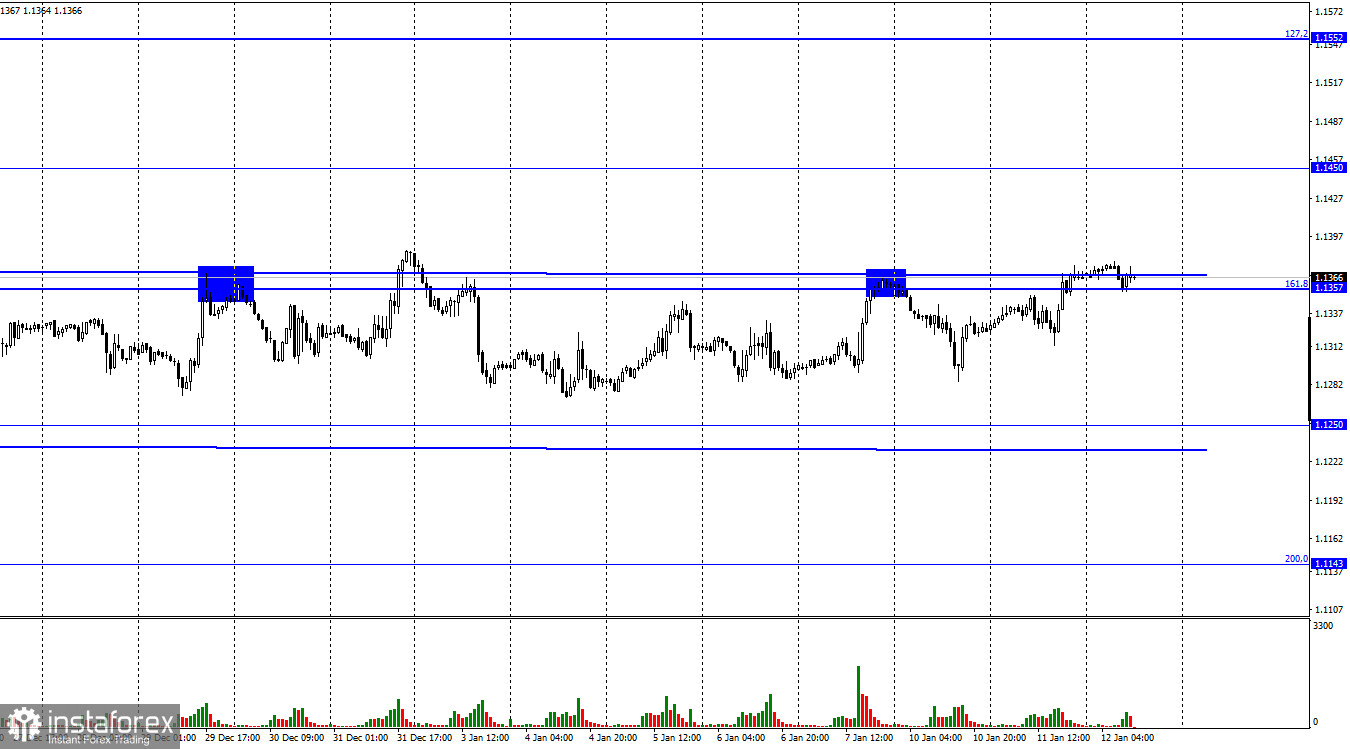

Hello, dear traders! On Tuesday, the EUR/USD pair made a new reversal in favor of the EU currency and increased slightly to the correction level of 161.8% at 1.1357 and the upper border of the sideways corridor. However, even this time I am not confident that a clear close above these two resistances was made. The pair's quotes closed only 5-6 pips above the corridor. This situation occurred before, however it did not lead to the end of the sideways movement, which I have been monitoring for a month and a half already. Therefore, even Jerome Powell's speech in the Senate did not cause any changes in the chart pattern. As the US dollar was falling during last night, it can be assumed that the Fed Chairman's rhetoric was dovish or it wasn't hawkish. However, there were no big statements or surprises. Jerome Powell said that the Fed was willing to start raising interest rates to avoid overheating the economy and to keep inflation from rising further. All other statements were so predictable that there is no need to mention the reaction of traders to them.

For example, Powell noted that it would take time for interest rates to rise to pre-pandemic levels. Moreover, Powell did not make a single dovish statement, and the rest of his talking points were obvious to traders. Thus, the US dollar's decline, while coinciding with the Fed Chairman's speech, may not be associated with it. Observe the chart: the US dollar has shown such small segments of growth inside the sideways corridor many times over the past month and a half. A 50-point rise is not enough to mention the traders' reaction when the pair continues to stay inside the sideways corridor. Therefore, I believe the traders may have reacted to Powell's speech. However, the facts were obvious, for example, the rate would be raised as early as January. It is common that Powell does not make loud statements. His colleagues, for example, are much more likely to make hawkish statements.

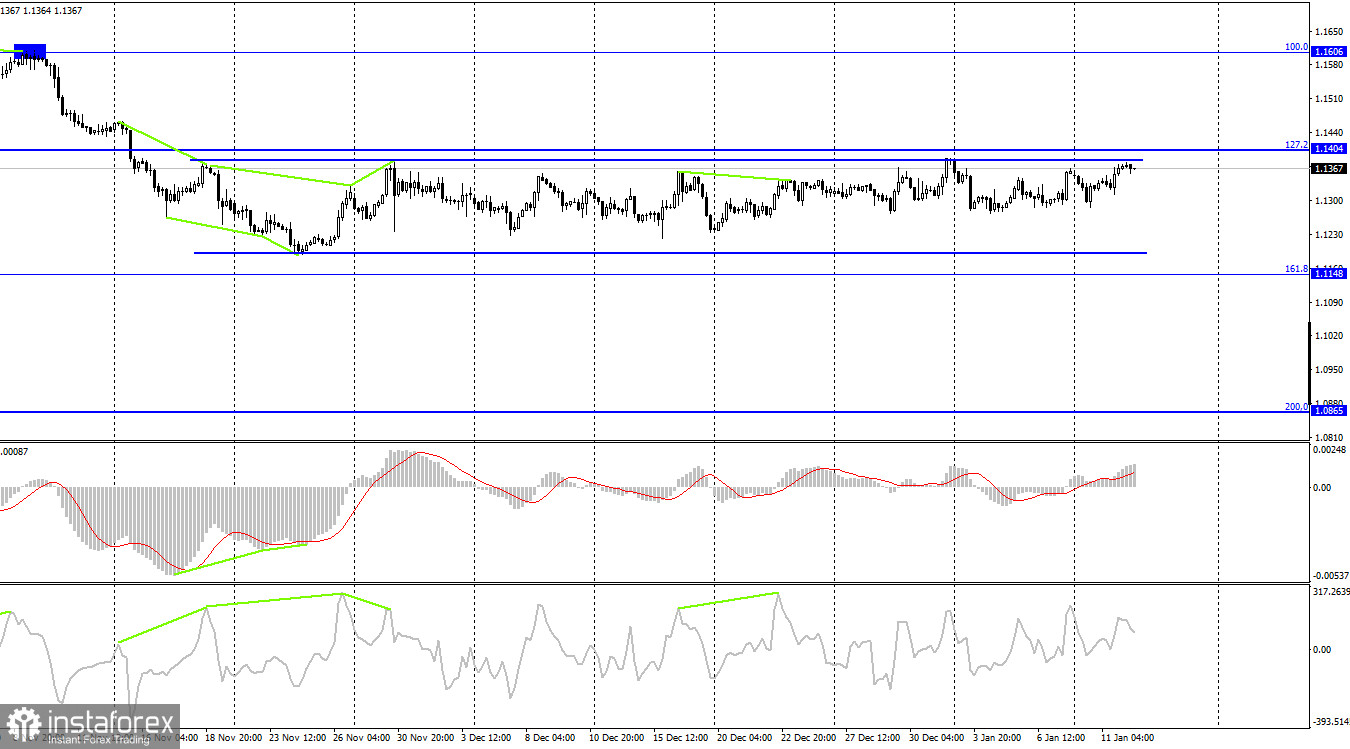

On the 4-hour chart, nothing has changed since yesterday. The pair continues to trade near the upper boundary of the sideways corridor. Besides, I am inclined to assume that no significant changes occurred. A reversal from the upper boundary of the corridor, slightly different from the hourly one, can already be made today. Besides, a new fall towards the lower boundary of the corridor may start. I expect the pair's growth after the price rebounds above the 127.2% Fibo level at 1.1404.

US and EU economic news calendar:

US - Consumer Price Index (13-30 UTC).

On January 12, the EU and U.S. economic calendars contain one significant entry for both. US inflation, especially after Jerome Powell's speech, is of great importance. Therefore, I expect traders to react to this report.

EUR/USD outlook and recommendations for traders:

I recommend opening new sales of the pair in case the quotes rebound from the upper boundary of the corridor with the target of 1.1250 on the 4-hour chart. I recommend buying the pair if the pair closes above the level of 1.1404 with the targets of 1.1450 and 1.1606 on the 4-hour chart.