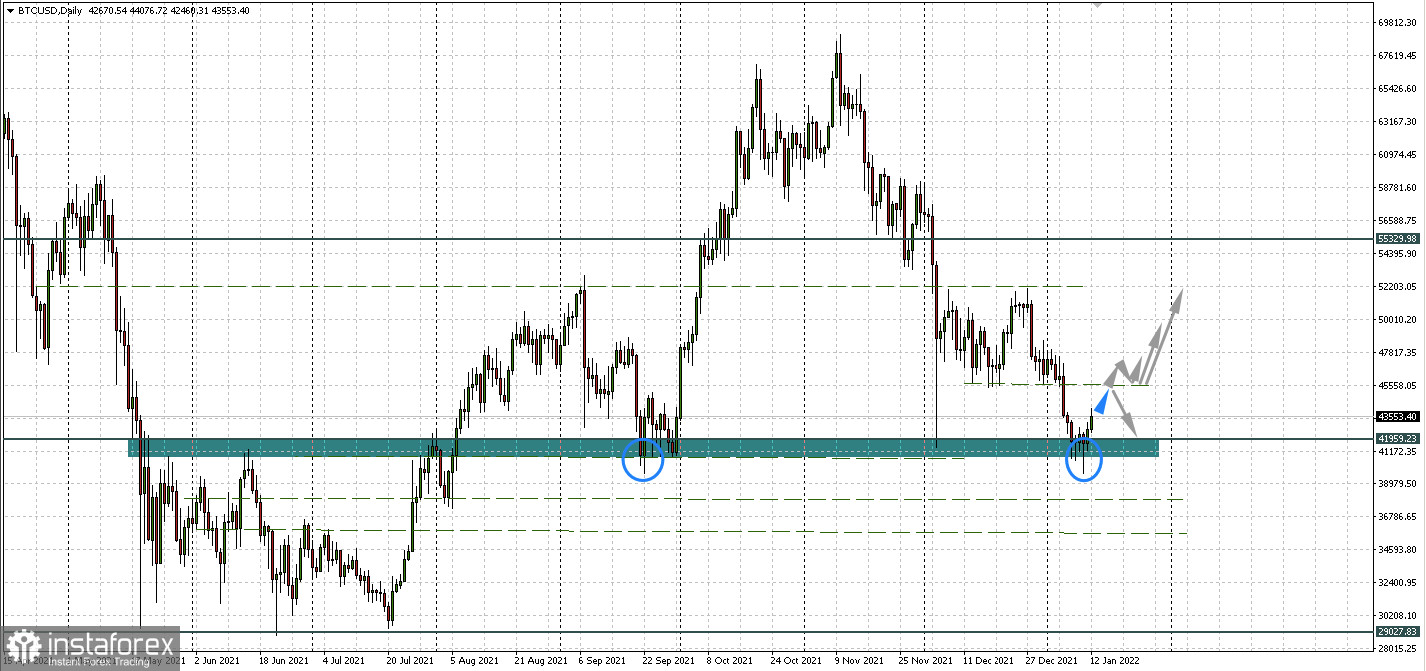

The $40,000 level has proven to be solid enough for crypto bulls. Although the main cryptocurrency has now bounced upwards, approaching $44,000, it is unclear whether this is a return to a bull market or not.

Nevertheless, today cryptoinfluencers believe that the major cryptocurrency will continue its rally. So, before we examine their arguments, I'll update my forecasts.

From a technical point of view, the picture looks impressive. Overcoming this mark and fixing above it would open the way for BTC/USD to reach the next levels of $47,000, $50,000 and $52,000 per coin.

$75,000 per bitcoin in 2020

There is still hope for the main cryptocurrency to rise to $100,000. However, analysts at Swiss Bank SEBA believe it is possible to reach $75,000 per bitcoin this year. Moreover, the bank's analysis models suggest a range of $50,000 to $75,000. The timeline, as always, is difficult to predict.

The SEBA Bank CEO cites the growing institutional adoption of bitcoin as the main growth driver. As can be seen, globally, the fundamental factors in the market remain the same. They are generally favorable.

Significance of Dormancy Flow

As we now see a local upside and wonder about the duration of this period, one important local signal is worth paying attention to.

Crypto analyst Will Clemente notes: "Bitcoin entering the Buy Zone on Dormancy Flow. This bottoming signal has only flashed 5 times before in Bitcoin's history".

What is a dormancy flow? Dormancy in this situation is the average number of days each coin transaction has remained without moving. The higher the dormancy, the older the coins are. This means that more long-term holders are releasing their bitcoins into circulation.

This factor, combined with a technical upside bounce, increases the possibility of a recovery. This is probably one of the reasons why all cryptoanalysts believe bitcoin appears to have bottomed, and these are areas where a long tail candle signals the strength of $40,000 support.