Speculative hype switched from the number of hikes to the timing of the start of the increase in interest rates after Jerome Powell made it clear that there would be no four hikes in the refinancing rate, and that no more than three should be expected. Rumors began to appear that the Fed would still do the previously announced plans, and would increase the rate in January instead of April due to the sharp inflation growth. But if the human factor decided everything in the matter of the number of increases, then in the case of deadlines, the statistics themselves ignored everything.

It should be noted that inflation increased only to 7.0%, but all assumptions about the timing of interest rate increases were based on an increase of 7.1%. The difference seems to be insignificant, but still. After all, it turns out that inflation is growing more slowly than the Fed expects. Therefore, the regulator simply has no reason to rush. And if interest rates will remain unchanged in the near future, then there are no reasons for the US dollar to rise. And due to all kinds of insinuations, market participants were waiting for a slightly different development of events.

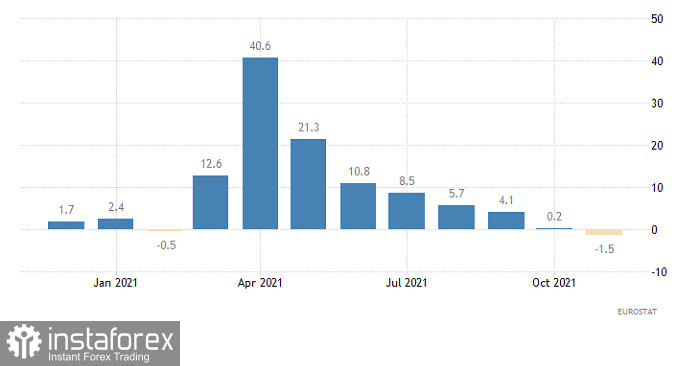

Inflation (United States):

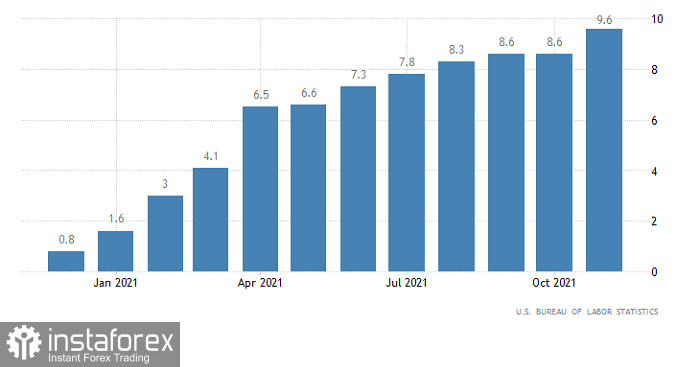

In turn, Europe's industrial production data were left without any attention, although they are just disappointing. Industrial production growth was expected to slow down from 3.3% to 0.8%. It can be seen that the forecasts were already extremely negative but the previous data was revised for the worse – up to 0.2%. At the same time, the industry showed a decline of -1.5% instead of growth in annual terms. In other words, European industry, which was never able to recover from the collapse of 2020, not only is not growing, it continues to decline. Apparently, this is the result of the energy crisis that has covered it, which is now reflected in statistics. In general, there are actually no reasons for the euro's growth.

Industrial production (Europe):

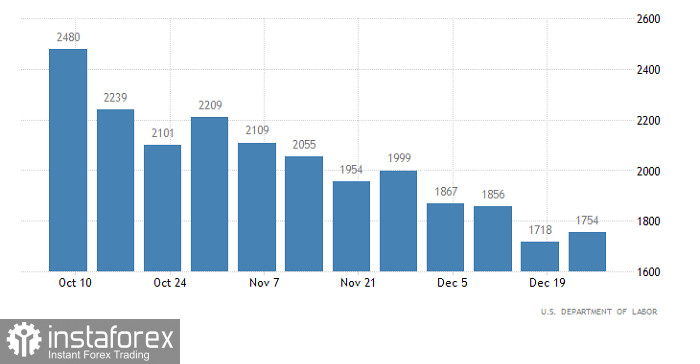

In the current situation, one simple conclusion can be drawn. At the moment, the market moves only under the influence of factors directly related to the United States whether it's some kind of a statement or statistics. Anything else is irrelevant to the market. Today, applications for unemployment benefits are to be published, the number of which should increase slightly. Here, the number of initial requests may rise by 8 thousand, while repeated requests may rise by 6 thousand. And although the growth seems quite insignificant, the very fact of an increase in the number of requests is important. This will be perceived by the market as an extremely negative factor that will significantly reduce the attractiveness of the US currency. If this happens, the euro, which does not suffer from overbought, can further strengthen its position.

Number of re-claims for unemployment benefits (United States):

Meanwhile, the data on producer prices will only have a slight effect, despite the fact that their growth rates should accelerate from 9.6% to 9.8%. It doesn't matter anymore after yesterday's inflation data even though it indicates the potential for further growth in consumer prices. However, this will not affect the timing and pace of the refinancing rate increase in any way, because the Fed already assumes that inflation will begin to slow down by the end of this year.

Producer Price Index (United States):

The side channel for the EUR/USD pair was completed by a breakdown of its upper border. This led to a speculative surge towards the level of 1.1452, where, as a result, the consolidation of 1.1435/1.1452 appeared. In this situation, trading tactics will proceed from stagnation, where the breakdown of one or another consolidation border will indicate a local price move.

The GBP/USD pair continues to develop an upward trend in the market despite the high overbought level. This has already led to a breakdown of several important price levels, but this fact does not stop speculators. Here, it was a logical step to see a technical pullback by 50-70 points, but if the local high of the upward cycle is updated, speculators may continue to increase the volume of long positions.