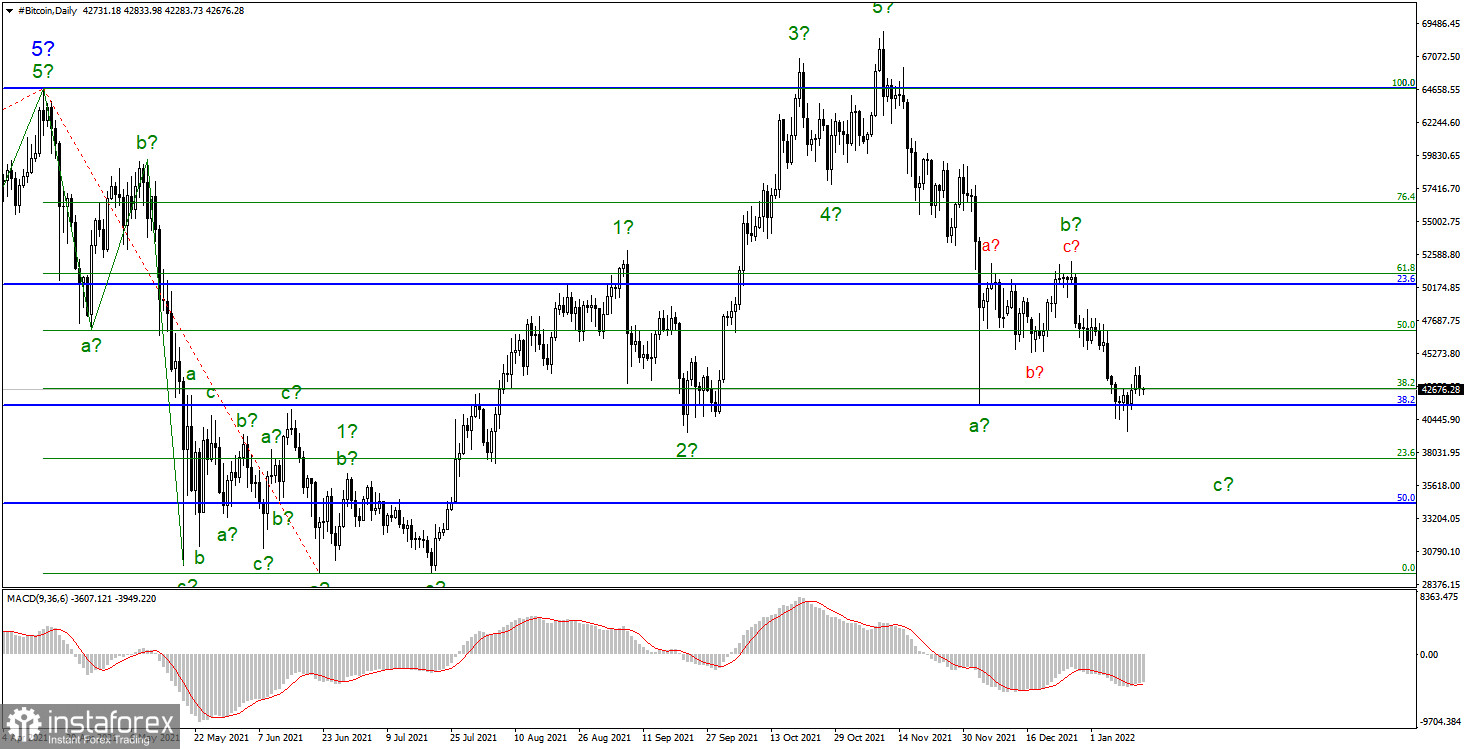

Yesterday, Bitcoin continued to moderately rise. Its price has increased by $3,000 over the past few days, although this is not a very big price change. Based on it, it is impossible to draw a conclusion about a change in the market mood. However, an unsuccessful attempt to break through the level of $41,515, which equates to 38.2% Fibonacci, indicates that the market is not ready to sell the cryptocurrency again. At the moment, a correctional wave can be built, but according to the current wave counting, this will be either the first wave of a new upward trend section (possibly a correctional one), or a correctional wave as part of five wave c. In the first case, a new increase in instrument quotes will begin with a potential to rise to $60,000. In the second case, the decline will resume very soon with targets below $40,000. Since the current downward trend section seems not yet complete, it is possible to trade on MACD "down" signals.

- Bitcoin's price has risen after inflation

Bitcoin's growth by several thousand dollars may be due to a strong US inflation report. It has long been known that many investors are trying to avoid the depreciation of their capital during the period of the highest inflation in the last 40 years with the help of Bitcoin and other cryptocurrencies. Money is depreciating rapidly, and stocks and bonds do not give such a return that would block inflation. Therefore, as long as inflation remains at such a high level, Bitcoin remains in a position from which its price will begin to rise at any time. At the same time, this cryptocurrency has only been declining in the last two months, although inflation is already 7%.

- The prospects for monetary policy will not help Bitcoin

On the other hand, the Fed has made it clear to the markets that it intends to conduct a massive tightening of monetary policy this year, which includes a rate hike, completion of the QE program, and even a sale of bonds accumulated on the Fed's balance sheet. All these measures will calm the market and are expected to reduce inflation. Many analysts believe that this means a strong and prolonged correction for the stock market and for the cryptocurrency market. The Fed puts the fight against inflation as their current priority since it will no longer be possible to ignore it.

To date, the reduction in the volume of the QE program has not even led to a slowdown in the acceleration of the consumer price index. We believe that all monetary policy instruments will be used to combat rising prices, which means that inflation will begin to slow down. In this case, investors will have fewer reasons to invest in Bitcoin.

A new downward trend section continues to form. At this time, wave b is considered completed, which has taken a noticeable three-wave form. The instrument declined to the previous low, around $ 41,500, in the expected wave c, and broke it. Around this level, the downward trend may end, but such a shortened third wave is rare. The instrument can be expected below this mark. The news background is not on Bitcoin's side right now, so the expectations of a strong wave c are not unreasonable. A successful attempt to break the low of wave a, as well as the level of $ 41,515, which equates to 38.2% Fibonacci, is very important. In this case, the decline may resume around the targets levels of $ 37552 and $ 34322, which equates to 23.6% and 50.0% Fibonacci.