GBP/USD

Analysis:

The latest, incomplete wave structure on the pound chart today: an ascending extended plane from November 12 of last year. The wave has a reversal potential. In a larger wave pattern, this wave may be a correction or give rise to a new ascending wave. Price has reached the limits of a strong potential reversal zone.

Outlook:

Today, the price movement is expected to move mainly sideways. After the probable attempt of pressure on the resistance zone in the first half of the day further change of the course and decrease to the support area is likely.

Potential reversal zones

Resistance:

- 1.3770/1.3800

Support:

- 1.3690/1.3660

Recommendations:

Trading in the British pound sterling market today can only be successful in individual trading sessions. It is recommended to close purchases at the first rate change signals. Selling is possible after the confirmed reversal signals of the relevant trading systems appear.

AUD/USD

Analysis:

The upward wave of the Australian dollar from December 3 led the quotations to the lower boundary of the strong potential reversal zone. The structure of the wave has entered the final phase. Calculated resistance indicates the lower boundary of the preliminary target zone.

Outlook:

In the first half of the day, the completion of the downward pull back that started yesterday is likely. A reversal and resumption of price growth is further expected in the area of the support zone.

Potential reversal zones

Resistance:

- 0.7330/0.7360

Support:

- 0.7260/0.7230

Recommendations:

There are no conditions to sell the Australian dollar in the major pair today. It is recommended to monitor emerging signals for buying in the area of calculated support.

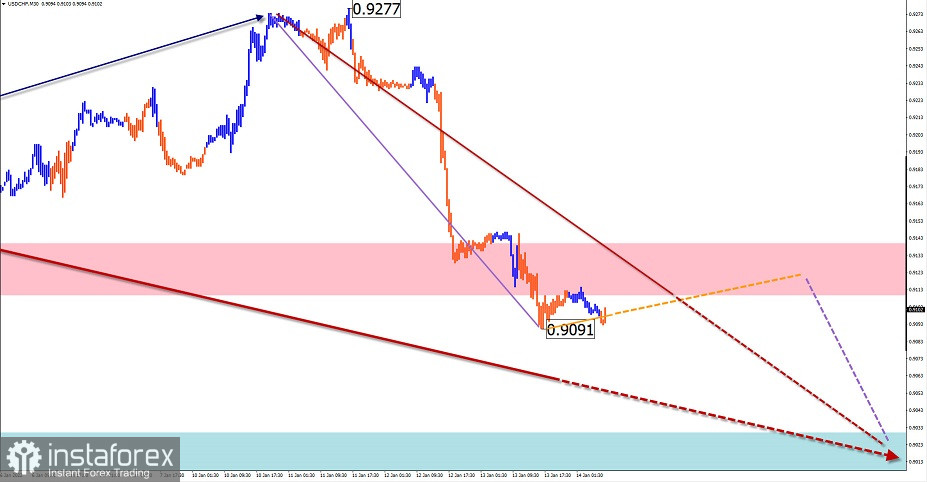

USD/CHF

Analysis:

A downward plane, lacking its final part, has been forming on the chart of the Swiss franc since last June. On January 10, an intermediate correction ended. After it the quotes rapidly declined. Calculated support demonstrates the nearest zone, where a temporary stop of decline is possible.

Outlook:

A general downtrend is likely today. In the first half of the day, a sideways movement or short-term rise to the resistance area is possible. Resumption of the decrease can be expected at the end of the day.

Potential reversal zones

Resistance:

- 0.9110/0.9140

Support:

- 0.9030/0.9000

Recommendations:

There will be no buying conditions on the franc chart in the coming days. It is recommended to sell the instrument at the end of all counter-movements.

USD/CAD

Analysis:

The trend direction on the Canadian dollar chart has been set by an ascending wave algorithm since last May. The price forms a downward wave from the intermediate resistance on December 20. In terms of its wave level, this movement replaces the correction of the main trend.

Outlook:

In the first half of the day, short-term price rise to the resistance zone is possible. At the end of the day, a return to the downward trend is expected. The support zone shows the expected lower boundary of the pair's daily move.

Potential reversal zones

Resistance:

- 1.2520/1.2550

Support:

- 1.2430/1.2400

Recommendations:

Today, there are no conditions for buying the USD/CAD pair. It is recommended to monitor the moment of reversal in the area of calculated resistance to sell the pair.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!