Yesterday, several stock sectors and asset classes came under pressure, as traders brace for the Federal Reserve's interest rate hikes, which are expected to begin in March.

Recent statements by Fed chair Powell indicated that the Federal Reserve is more flexible in its policy than previously assumed. December's statements by Powell and other Fed board members were notably hawkish. However, judging by statements made by various board members over the past few days, the rate hike could begin in March 2022.

US equities suffered the biggest losses, with the S&P 500 losing 1.42%:

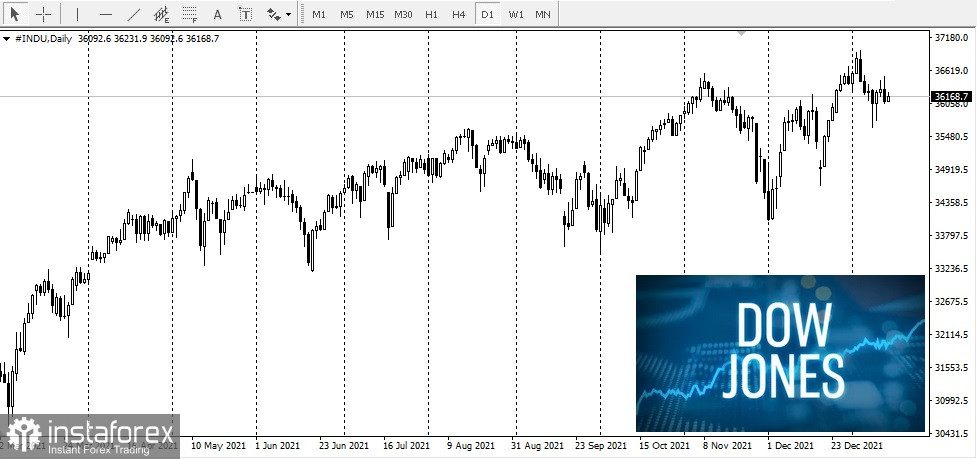

The Dow Jones Industrial Average declined by 0.49% after showing good performance yesterday:

The Dow Jones Industrial Average declined by 0.49% after showing good performance yesterday:

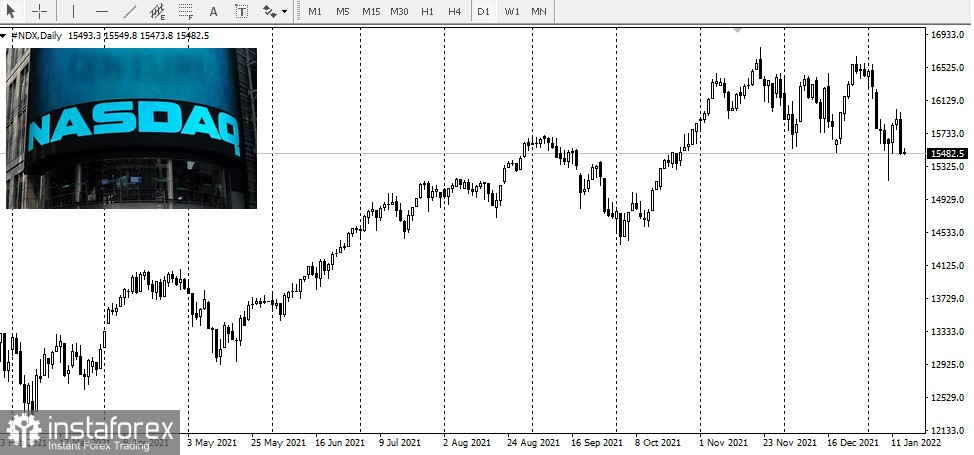

The NASDAQ Composite slumped by 2.51%:

The NASDAQ Composite slumped by 2.51%:

In the commodity futures market, all four precious metals decreased slightly.

In the commodity futures market, all four precious metals decreased slightly.

Palladium declined by 1.56% or $29.80:

Platinum decreased by 1.30% or $12.70:

Platinum decreased by 1.30% or $12.70:

Silver lost 0.37% or $0.09:

Silver lost 0.37% or $0.09:

Gold fell by 0.27% or $4.90:

Gold fell by 0.27% or $4.90:

Yesterday, US PPI data was released. Producer prices increased by 0.2% in December - the lowest increase in the past 13 months. Economists polled by the Wall Street Journal expected prices to rise by 0.4%.

Yesterday, US PPI data was released. Producer prices increased by 0.2% in December - the lowest increase in the past 13 months. Economists polled by the Wall Street Journal expected prices to rise by 0.4%.

Wednesday's CPI data showed that consumer prices have increased by 7% for the first time since 1982.

If we examine previous periods of high inflation in the US, several measures were taken to reduce it, with high interest rates being only one of them. Raising the Fed funds rate by 1% will not ease inflationary pressures much. Reducing inflation from 7% to at least 3% would require fixing the underlying cause for inflation - the lack of workers to resolve supply issues. Full employment would not be resolved by a rate hike - in fact, it could only exacerbate the problem.

Many analysts believe that inflation would only reach the target level in mid-late 2023. The long-term outlook for gold could remain bullish.