The EUR/USD currency pair fell sharply on Friday. This was not due to the fundamental background or macroeconomic statistics. It was just a landslide. Of course, by and large, the word "collapse" is not quite right, since the pair has declined by only 80 points. However, it lost most of the positions that it had accumulated with great difficulty during the week. Recall that during the week, the European currency simply grew, ignoring the "foundation". And on Friday, on the contrary, it fell, ignoring the "foundation". At least, the American statistics were completely ignored. Thus, we can conclude that the movement last week was purely technical. The pair with great difficulty got out of the side channel, in which they spent a month and a half, but now they risk resuming the fall. And here there is a conflict between the technical side of the issue and the fundamental one. The fact is that, from a technical point of view, an upward trend has begun. And on the fundamental side, there are no special reasons for the growth of the European currency now. On the contrary, it has plenty of reasons to fall, because in the States the Fed has embarked on the path of tightening monetary policy, and in Europe, they don't even dream about it. This suggests that the American economy is now feeling much better than the European one. And if so, then the dollar should rise in price, not fall. Thus, we are inclined to the point of view that the market just took overclocking before a new attempt to overcome the level of 1.1230. This happens in the foreign exchange market. However, until the price is fixed below the moving average line, the bullish mood persists.

What if a rate hike doesn't stop prices from rising?

In the last few months, all the market's attention has been focused on the Fed. It was when the Fed made it clear that it was ready to curtail the quantitative stimulus program and raise the rate, the market began to closely study every event related to the regulator. And now the situation is not changing. Of course, we assume that all the decisions that the Fed may take this year may already be taken into account by the market to some extent. However, this is an assumption, not an absolute fact. Naturally, the tightening of monetary policy is aimed at combating inflation. But what if it doesn't help stop prices from rising? It's no secret that prices are rising not only because of the overflow of the money supply. The Fed has been actively pumping money into the economy for a year and a half, this is a fact. But in addition to this factor, there is also a factor of disruption of logistics chains, which is why many goods are in short supply. During the pandemic, when many public places were closed, borders were closed, Americans accumulated decent amounts of money, which began to be spent as soon as the epidemiological situation improved. And then it turned out that companies are simply not ready for the increased demand after the decline in industrial production during the pandemic. There is a shortage, and a shortage generates a rise in prices. It turns out that until the issue with supply chains is resolved, prices will continue to rise. In addition, we should not forget that the rise in prices is provoked by the rise in prices for raw materials, energy carriers, which pull up the cost of consumer goods and services. Accordingly, inflation is a problem caused not only by the actions of the Fed. Accordingly, it is necessary to solve on a large scale and structurally all those problems that provoke it. Therefore, from our point of view, an increase in rates will stop price growth, but at the same time, a slowdown in inflation to the target 2% is unlikely to occur this year. And this means that the Fed can now struggle with high inflation for many years, just as it struggled with low inflation for many years before the pandemic. After all, the pandemic has not yet been completed, so the supply chains remain disrupted. The entire global economy will face new non-standard situations in the coming years and it makes absolutely no sense to predict in the long term how traders will react to them.

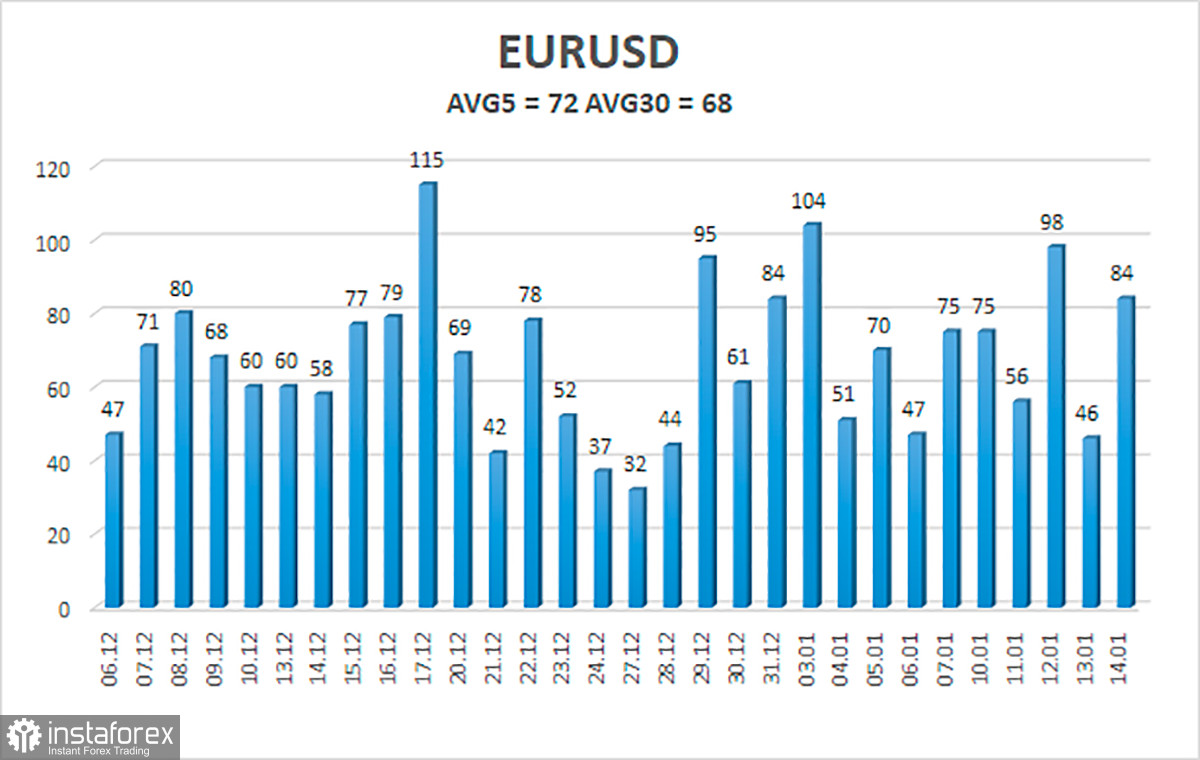

The volatility of the euro/dollar currency pair as of January 17 is 72 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1342 and 1.1486. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.1383

S2 – 1.1353

S3 – 1.1322

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1444

R3 – 1.1475

Trading recommendations:

The EUR/USD pair maintains an upward trend. Thus, now we should consider long positions with targets of 1.1505 and 1.1532, if the pair bounces off the moving average, which should be kept open until the Heiken Ashi indicator turns down. Short positions should be opened after the price is fixed below the moving average line with targets of 1.1353 and 1.1322.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.