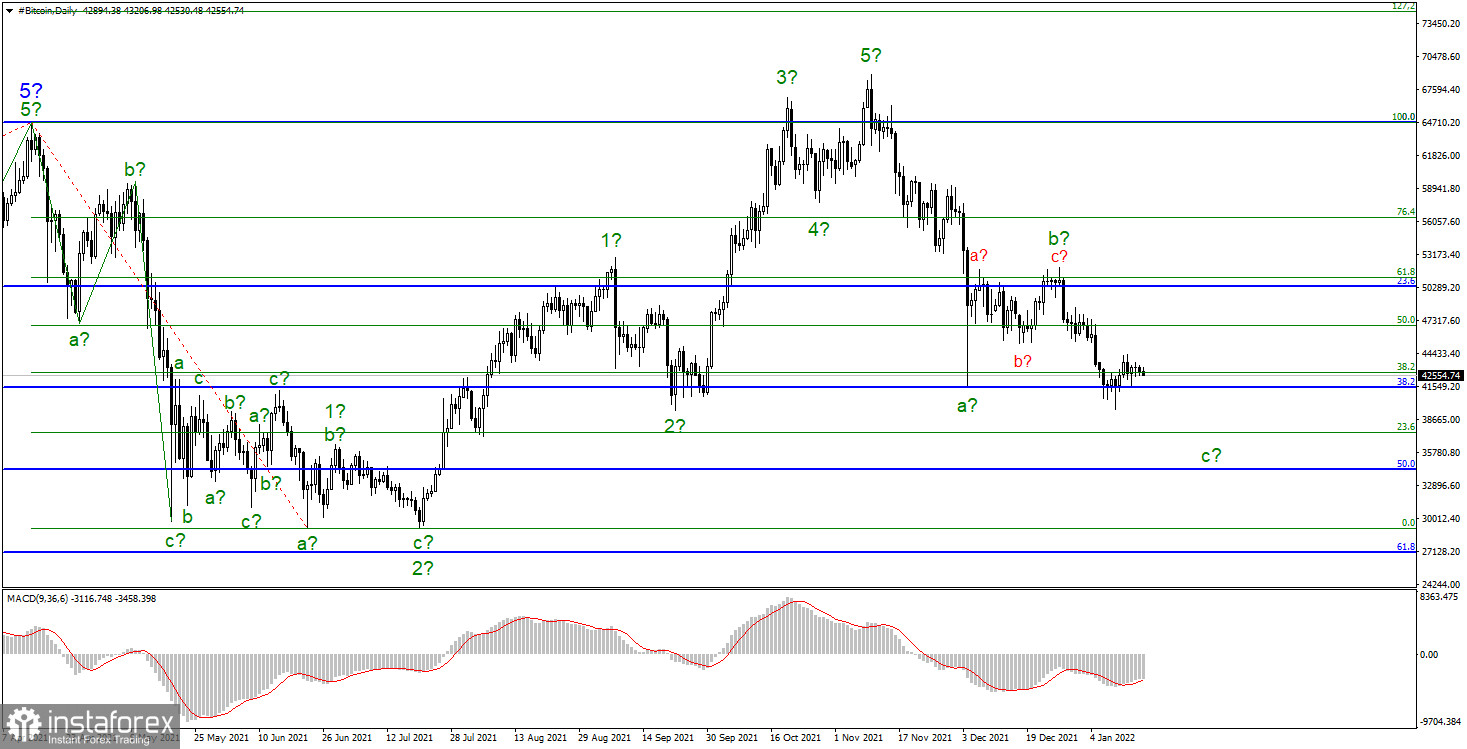

Bitcoin traded with low activity during Friday, Saturday, and Sunday. The cryptocurrency rate hardly moved from its place, being slightly above the level of $41,515, which corresponds to 38.2% Fibonacci. We already paid attention to this level more than once, from which the price rebounded a month earlier. Therefore, the decline of this cryptocurrency is currently suspended. At the same time, the expected wave c still seems incomplete yet, but it may turn out to be shortened. No internal waves are visible inside it, which suggests that it will either turn out to be very long, or it has already been completed. An unsuccessful attempt to break through the level of $41,515 indicates that it is completed. However, a pause could be taken to build an internal corrective wave in C.

Bitcoin continues to sharply look for support in the news background but cannot find it. All the recent news only says one thing: Bitcoin will continue to decline. These include market fears about Fed rate hikes in 2022, a ban on mining in China, and unrest in Kazakhstan. However, some analysts continue to believe that Bitcoin has already reached its "bottom" and its entire downward movement is a correction within an upward trend.

- Fidelity Investments believes that Bitcoin has already reached the "bottom"

Fidelity Investments' Jurrien Timmer believes that Bitcoin has reached its "bottom" and will now start rising again. According to him, the cryptocurrency is in the oversold area, and it is supported by the demand curve model. It can be recalled that a PlanB analyst also believes that Bitcoin will try again to reach the $100,000 mark this year. However, most of the similar forecasts did not come true last year. Three Arrows Capital CEO Su Zhu also believes that it is a great time to buy right now, saying he has spotted a rare signal that has only appeared 6 times in Bitcoin history. This signal was detected on the basis of an inactive flow, during which the coin remained illiquid, after which it began to move. In other words, the indicator now indicates the absence of sellers in the market.

- The Fed does not support Bitcoin's growth

On the other hand, the Fed has made it clear to the markets that it intends to conduct a massive tightening of monetary policy this year, which includes a rate hike, the end of the QE program, and even a sale of bonds accumulated on the Fed's balance sheet. It is considered to be the main factor on a par with wave analysis. To simply put it, this factor may continue to put pressure on the cryptocurrency for the whole year. But this does not mean that Bitcoin will decline throughout the year, instead, it will go in the "red zone" by the end of the year. However, when a descending set of waves is already being formed now, this factor may be supporting the downward trend.

A new downward trend section continues to form. At this time, wave b is considered completed, which has taken a noticeable three-wave form. The instrument declined to the previous low, around $ 41,500, in the expected wave c, and broke through it. The downward trend may end around this level, but such a shortened third wave is still rare. The instrument can be expected below this mark. The news background is not on Bitcoin's side right now, so the expectations of a strong wave c are not unreasonable. A successful attempt to break the low of wave a, as well as the level of $ 41,515, which equates to 38.2% Fibonacci, is very important. In this case, the decline may resume around the targets levels of $ 37,552 and $ 34,322, which equates to 23.6% and 50.0% Fibonacci.