Hi, dear traders!

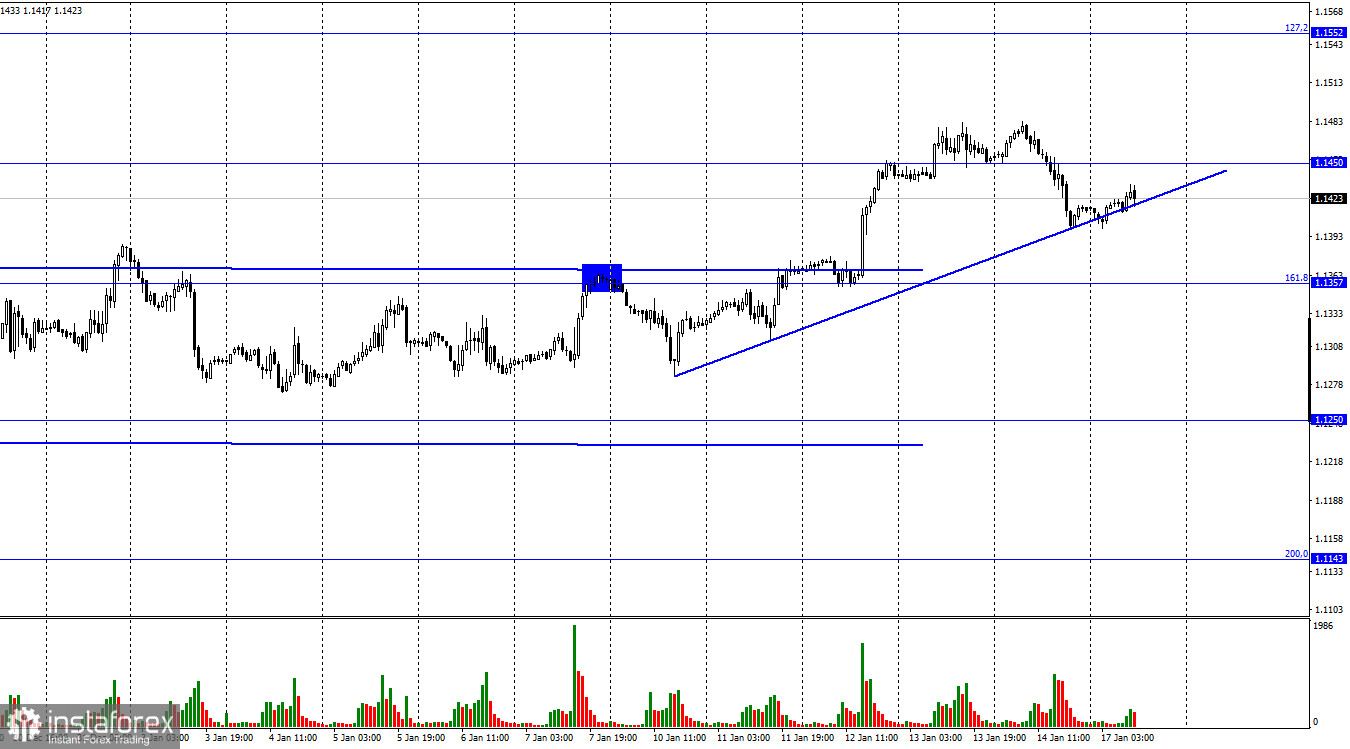

On Friday, EUR/USD reversed downwards and began to decline towards the retracement level of 161.8% (1.1357). Today's rising trend line indicates the current sentiment of traders is bullish, however the pair is very close to it and could consolidate below the trend line in the next few hours. This would lead to further downward movement for the pair. ECB's president Christine Lagarde stated on Friday that inflation in the eurozone is too high and that the regulator will take all necessary measures to tackle it. Lagarde gave no more important information. USD was on the upswing during most of the day, as traders focused on US data releases.

US economic data did not meet market expectations - retail sales fell by 2% in December, while industrial production declined by 0.1%. The University of Michigan's consumer sentiment index decreaed once again. In theory, the disappointing data releases should have pushed the US dollar down alongside the euro, but market players ignored it. This could mean traders are not ready to open new long positions today. It would be confirmed if the quote closes below the trend line on the H1 chart, which would also create a sell signal. Monday's trading session is very quiet and has limited volume. Furthermore, there are no important events at the beginning of the week. Low trader activity could prevent the pair from closing below the trend line. EUR/USD could move sideways, but it would not be a sell signal.

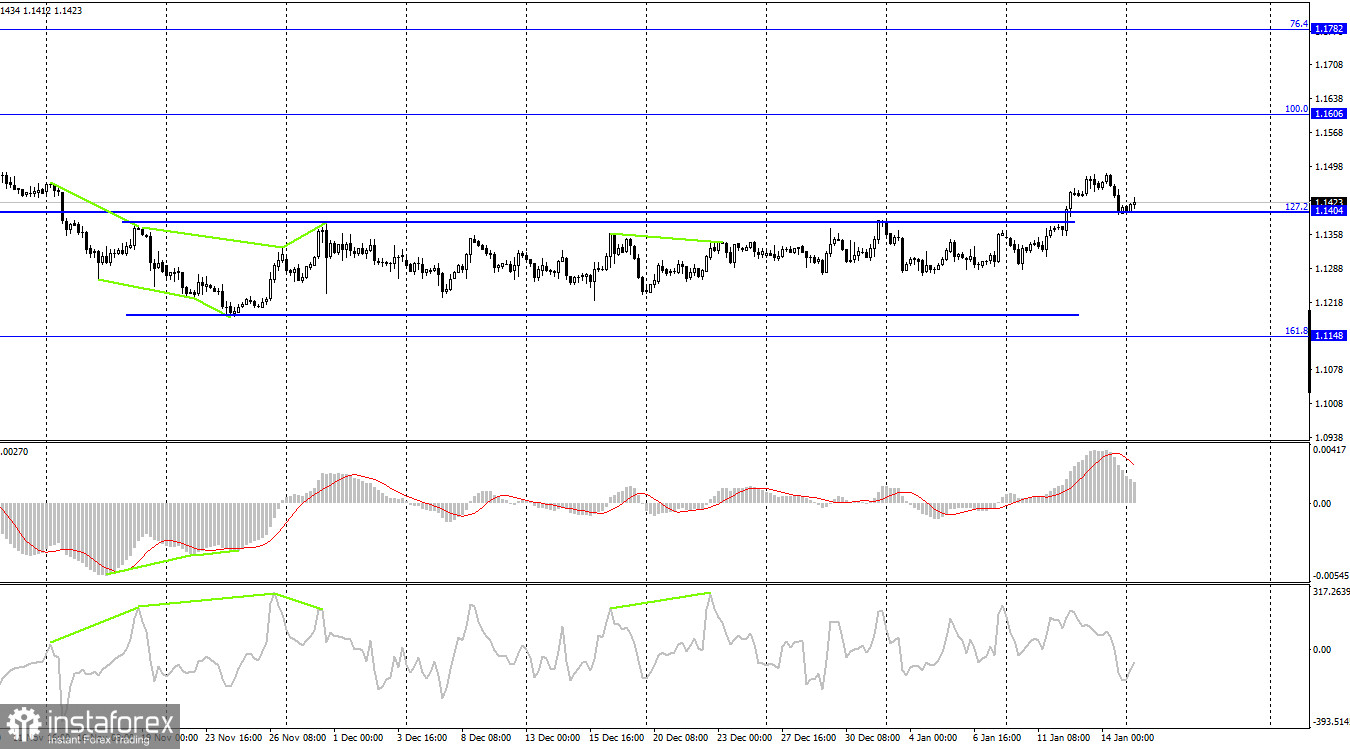

According to the H4 chart, the pair closed above the sideways price channel and returned to the retracement level of 127.2% (1.1404). If EUR/USD bounces off that level, it could resume its upward movement towards the retracement level of 100.0% (1.1606). If the pair closes below 1.1404, it could then continue to fall towards the Fibonacci level of 161.8% (1.1148). Today, the indicators show no signs of emerging divergences.

US and EU economic calendar:

There are no important events on the economic calendar today, as well as on Tuesday and Wednesday.

Outlook for EUR/USD:

Traders are recommended to open short positions if the pair closes below the trend line on the H1 chart, with 1.1357 being the target. Long positions could be opened if the pair bounces off the trend line on the H1 chart, targeting 1.1450 and 1.1552. Currently, the pair is moving alongside the rising trend line.