To open long positions on EUR/USD you need:

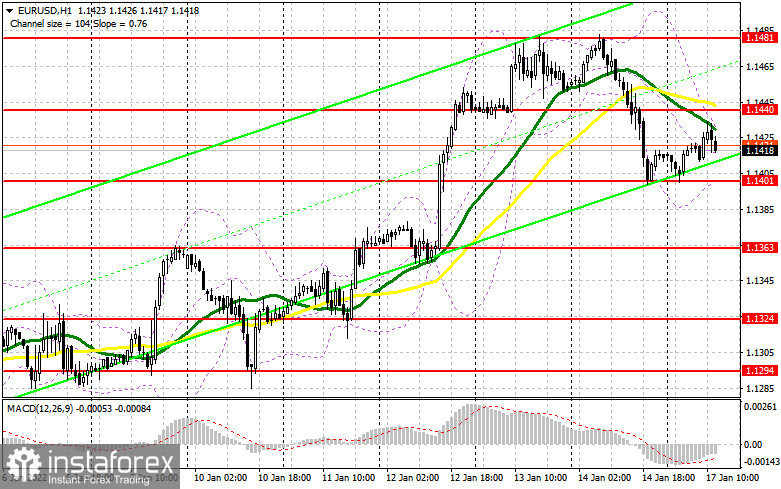

In my morning forecast, I focused on several levels. However, it was not possible to reach them due to extremely low volatility. Let's observe the 5-minute chart and analyze it. No market entry points were formed due to lack of testing of 1.1401 and 1.1440. The same picture will probably remain in the second half of the day. Euro buyers tried to reach 1.1440. However, they lacked confidence after the Italian Consumer Price Index was released as it was in line with the economists' expectations. The technical picture and the strategy for the second half of the day did not change. Besides, what were the pound's entry points this morning?

Despite failing to grow above 1.1440, bulls have no reasons for concern. However, I advise to focus on the nearest support at 1.1401. The Eurogroup meeting will take place today, and there are no other significant events. Volatility may be very low in the second half of the day, especially as the USA celebrates Martin Luther King's Day. Buyers' key aim is to protect the support at 1.1401, which was formed last Friday. A false break in this area will result in the euro's growth to the resistance area at 1.1440 with the moving averages favouring sellers. This fact will limit the pair's upside potential. A breakout of this range is highly significant. Besides, a reversed test from the top down will give a chance for a new jump to the levels of 1.1481 and 1.1514, where I recommend taking profits. A more distant target is the area of 1.1562. In case of the pair's further decline during the US session, and the euro's pressure is gradually returning, the lack of bulls' activity at 1.1401 will lead to a stronger pair's drop. In that case it is better not to buy until the major support at 1.1363. However, I recommend opening long positions there if a false breakout is formed. It is possible to buy the EUR/USD pair on the rebound from the level of 1.1324, aiming for an upward correction of 20-25 pips within the day.

To open short positions on EUR/USD you need:

Sellers waited for the pair's rise to the moving averages and decided to be more active, not allowing it to test the resistance level of 1.1440. A breakout of 1.1401 is necessary for the pair to continue falling. However, the defense of the resistance at 1.1440 is also significant. In case the EUR/USD pair rises during today's US session, only the formation of a false breakout at 1.1440 will form the first entry point into short positions, counting on a return of pressure and decrease of EUR/USD to the area of Friday's support at 1.1401. The moving averages are near 1.1440, giving advantage to sellers to defend this level. A breakout and a test of 1.1401 from the bottom to the top will give an additional signal for opening of short positions with the prospect of falling to the major low at 1.1363. At this level bulls will be more active as it is the euro's last chance to hold the uptrend. Movement beyond this range will change the market direction to the downside and take away some buyers' stop-losses. It will cause the EUR/USD pair to fall to the lows of 1.1324 and 1.1294, where I recommend taking profits. In case of the euro's growth and lack of bears' activity at 1.1440, it is better not to sell. The best scenario is short positions if a false break near last week's high at 1.1481 is formed. It is possible to sell the EUR/USD pair on the rebound from 1.1514, or even higher, around 1.1562, to aim at a downward correction of 15-20 pips.

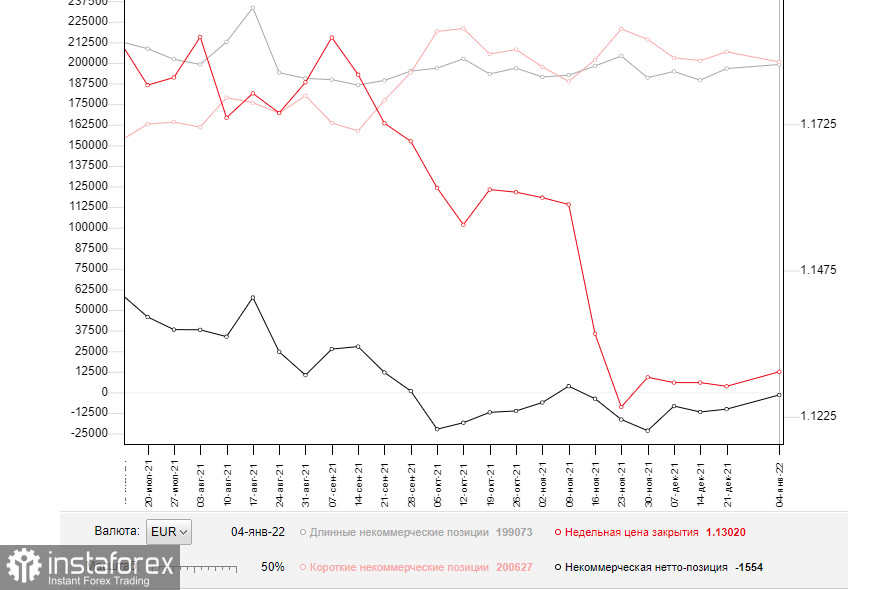

The COT (Commitment of Traders) report for January 4 recorded a sharp increase in long positions and decrease in short ones, which led to a change in the negative delta. This fact indicates that the market is gradually changing, and the demand for the European currency, despite the expected Fed's policy changes, is high. This week, the US inflation report will be released. It will clarify the situation as inflation is expected to grow above 7% per annum. This scenario will lead to US central bank's more aggressive measures concerning interest rates. With an optimistic US labor market at least four interest rate hikes are likely this year. Meanwhile, the European Central Bank plans to complete its emergency bond buying program as soon as March this year. However, the regulator is not going to take any other measures to tighten its policy, which limits the upside potential of risky assets. The COT report shows that long non-commercial positions rose from 196,595 to 199,073, while short non-commercial positions fell from 206,757 to 200,627. This fact indicates that traders will continue to build up the euro's long positions, counting on the pair's further upward correction. At the end of the week, the total non-commercial net position decreased its negative value from -10,162 to -1554. The weekly closing price slightly increased to 1.1302 against 1.1277 a week earlier.

Indicator Signals:

Moving averages.

Trading is conducted below the 30 and 50 day moving averages, indicating a possible euro's decline in the second half of the day.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

Breakout of the indicator's upper boundary at 1.1435 will result in a new wave of euro's growth. In case of decline the indicator's bottom boundary at 1.1405 will be the support level.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. On the chart, it is marked in yellow;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. On the chart, it is marked in green;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.