Fed enters the "week of silence" before its meeting on January 25-26. Markets expect hints of an imminent rate hike to be reflected in the final document. The yield of 10-year US Treasuries exceeded 1.8% for the first time since January 2020, that is, since the beginning of the COVID-19 panic. This is a serious bullish factor for the US dollar.

Fed representatives actively commented on the increase in inflation to 7% at the end of last week. Their speeches were similar and consisted in "the need to raise the federal funds rate as soon as possible." Accordingly, the spot rate forecast based on the results of the meeting will be the main guideline for investors. It is assumed that the rate will be raised 3 or 4 times this year, but JP Morgan's head Jamie Dimon said on Friday that he expects 6 or 7 increases this year. Such a bullish mood is beginning to dominate in the financial market.

The US dollar has not taken the lead yet, but the dynamics in the next few days will show what the markets expect from the FOMC meeting. The most likely development of events is the cautious growth of the US dollar before the meeting or its trading in a range and a strong growth after the announcement of the results.

NZD/USD

Challenging times for New Zealand may be coming to an end. It can be recalled that the RBNZ was the first to raise the rate back in the summer, responding to the rapid economic recovery and rising inflation, but since the beginning of autumn, everything has changed. Business activity has noticeably dropped, GDP in the 3rd quarter plunged by 3.7%, and another COVID-19 lockdown caused by the outbreak of the Delta strain led to a reduction in commercial construction, labor hiring, and export earnings.

The New Zealand dollar quickly turned from a favorite of the currency market into an outsider. New Zealand T-bills yields fell, while UST yields rose, which provided the US dollar with an advantage in the last 3 months.

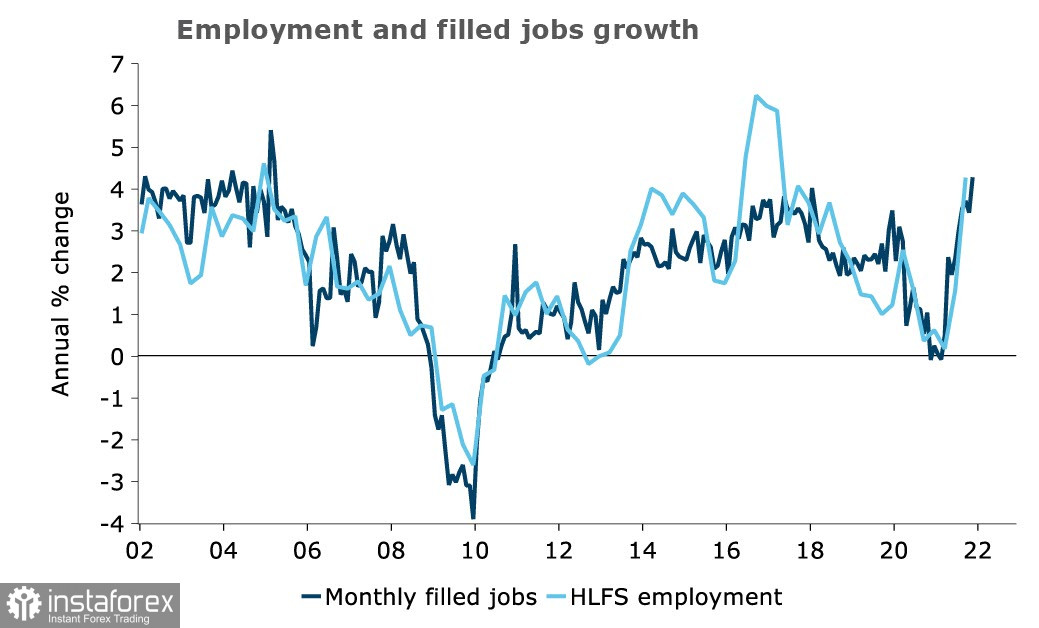

But as everything flows, everything changes. The first data that became available in January show that inflation expectations are not falling, and most importantly, the labor market is growing rapidly. There is a possibility that unemployment will decline to 3%, which is an additional condition for pressure on inflation, that is, the labor market corresponds to higher than lower inflation.

If the trend continues, the inflation forecast for 1Q (approximately 5.8% according to ANZ) will be significantly surpassed. And if so, then inflationary risks will not decline, but, on the contrary, will continue to grow, which automatically means a requirement to continue increasing RBNZ rates.

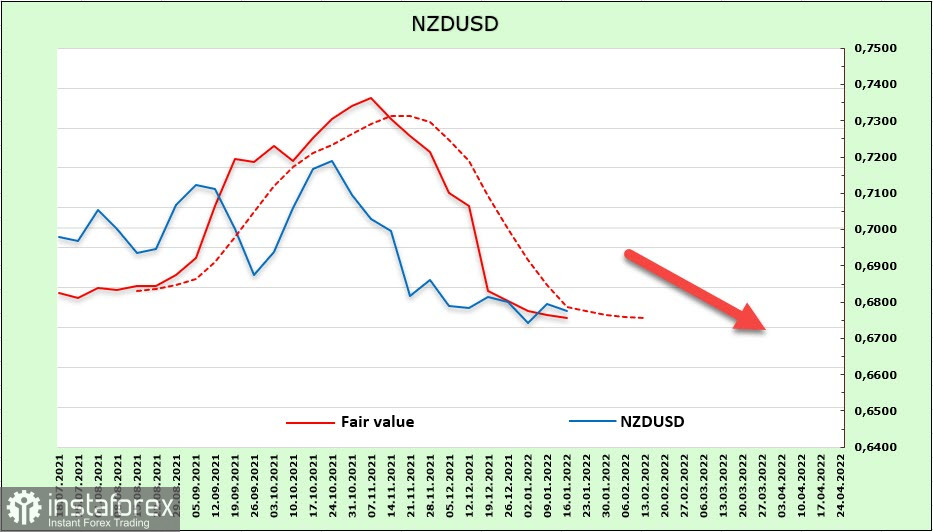

But so far the conditions for revaluation have not developed. The net short position on NZD slightly fell (+18 million) to -584 million during the reporting week. The bearish advantage remains, and the estimated price is still below the long-term average, although a slowdown in momentum can be noted. Perhaps, the New Zealand dollar is one step away from a reversal.

Last week, the lower limit of the bearish channel at 0.6630/40 was considered as the target and it still remains as is. The New Zealand dollar still went to the middle of the channel and made a downward pullback. An attempt to reach the channel border is fundamentally justified, and the target has slightly shifted to 0.6610/30. The time for an upward reversal has not yet come.

AUD/USD

There are no new data from Australia yet, but good news from China and rising oil prices have some influence on expectations. China showed GDP growth of 4% y/y in the 4th quarter, which is slightly higher than expected. Industrial production also rose by 4.3%, and foreign trade forecasts were confirmed earlier. In general, this is a good growth driver for Australia, as it implies export growth.

Oil has already risen by more than 10% since the beginning of the year. This morning, Brent exceeded the level of $87 per barrel for the first time since October 2014, which is generally a good sign of renewed interest in risk.

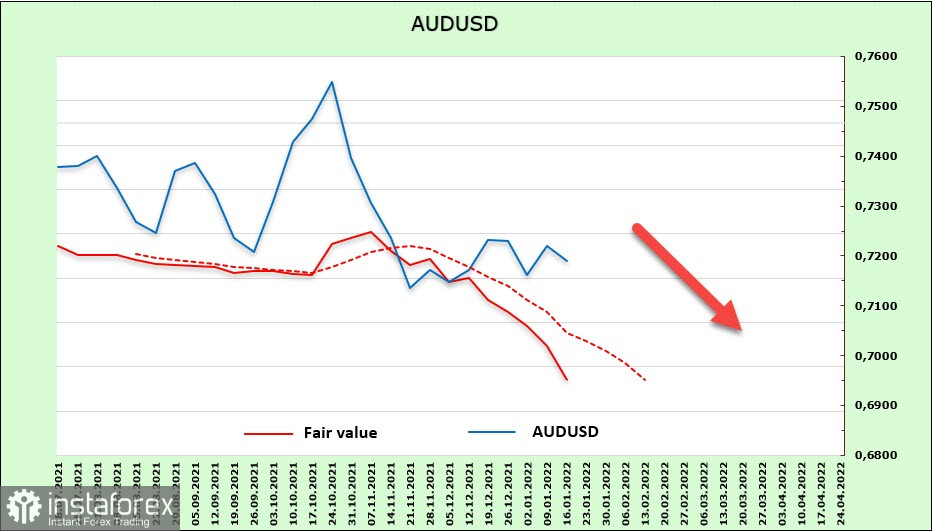

But looking at the settlement price, we will not find any signs of a reversal. According to the CFTC report, the net short position on AUD increased again during the reporting week and reached -6.6 billion. This is a serious bearish advantage, that is, speculators are betting on a further decline. The dynamics of Australian T-bills yields compared to UST looks weaker. In order for the AUD/USD pair to reverse, grounds are needed.

The Australian dollar is trading around the middle of the bearish channel on Monday morning and is more inclined down that up. The nearest target is the level of 0.6995, then 0.6860/80. Growth is possible only in the case of new positive data, which is not yet observed in the market.