The EUR/USD currency pair resumed its decline on Tuesday, which began on Friday. Recall that on Friday, the markets ignored a whole package of rather weak macroeconomic statistics from overseas, and the US dollar rose in price at the end of the day. On Monday, traders tried to continue the downward movement, but on Mondays, there is quite often reduced volatility and no trend. Plus, there were no important events on the first trading day in either the US or the EU. Thus, it was only on Tuesday that traders "woke up", although the fundamental and macroeconomic backgrounds remained almost zero. Nevertheless, we drew the attention of traders to the fact that the growth of the European currency was quite weak (only about 150 points) and quite groundless, from a fundamental point of view. In favor of the growth of the euro, there was only the assumption that market participants may already have had enough of dollar purchases based on the tightening of the Fed's monetary policy in 2021-2022. All the information about this has long been known to the markets, and they could have worked it out several times already. But practice shows that traders are not going to change their preferences yet and, it seems, they will continue to buy the US currency, since the ECB does not give any signals about tightening monetary policy. Thus, the consolidation below the moving average line on Monday indicates a new trend change and now the downward trend of 2021 may resume. The pair may gradually fall to the level of 1.1230, and then try to overcome it again. We also note that the European currency fell on Friday when the fundamental background was against it and fell on Tuesday when the fundamental background was absent.

There is only a 20% chance of an ECB rate hike in 2022.

In principle, recently all the talk in the foreign exchange market concerns the monetary policies of the ECB and the Fed. We have already said enough about the Fed, but with the ECB it is getting harder and easier at the same time. Yesterday, we already talked about why the ECB is not going to raise the key rate this year. Today, we will talk about possible alternatives. According to Reuters, the markets are laying down only a 20% probability of a rate hike this year. It is not known what this conclusion was based on, but, of course, one should not completely put an end to the ECB either. The factor of "relatively low inflation" speaks in favor of the fact that the rate may be increased at least once this year. Inflation in the EU is also very high. Like the United States, the European Union could not disperse it to 2% for a long time, but the pandemic helped all countries of the world to achieve this. Now the consumer price index is 5% and the path from 5% to 2% is much shorter than the path from 7% to 2%. Consequently, the European Union can count on a slowdown in price growth in 2022 to a greater extent. According to some experts, the ECB will start raising the rate only when inflation has already fallen to 2%, as well as after the completion of the PEPP and APP programs. Recall that after the completion of the PEPP program in March this year, an expanded APP program for 40 billion euros per month will be in effect. It is also expected to be completed by the end of the year. Thus, it is by the end of the year that we can theoretically count on an increase in the key rate. Of course, with such reasoning, it will be very difficult for the European currency to expect growth throughout this year. By and large, the hope of the euro currency is based on the same possible saturation of dollar buyers against the background of the same factors. But we should not lose sight of the fact that the Fed will tighten monetary policy one way or another throughout the current year, that is, dollar bulls will constantly receive new reasons to buy the US dollar. Thus, so far, the prospects for the euro currency look very vague.

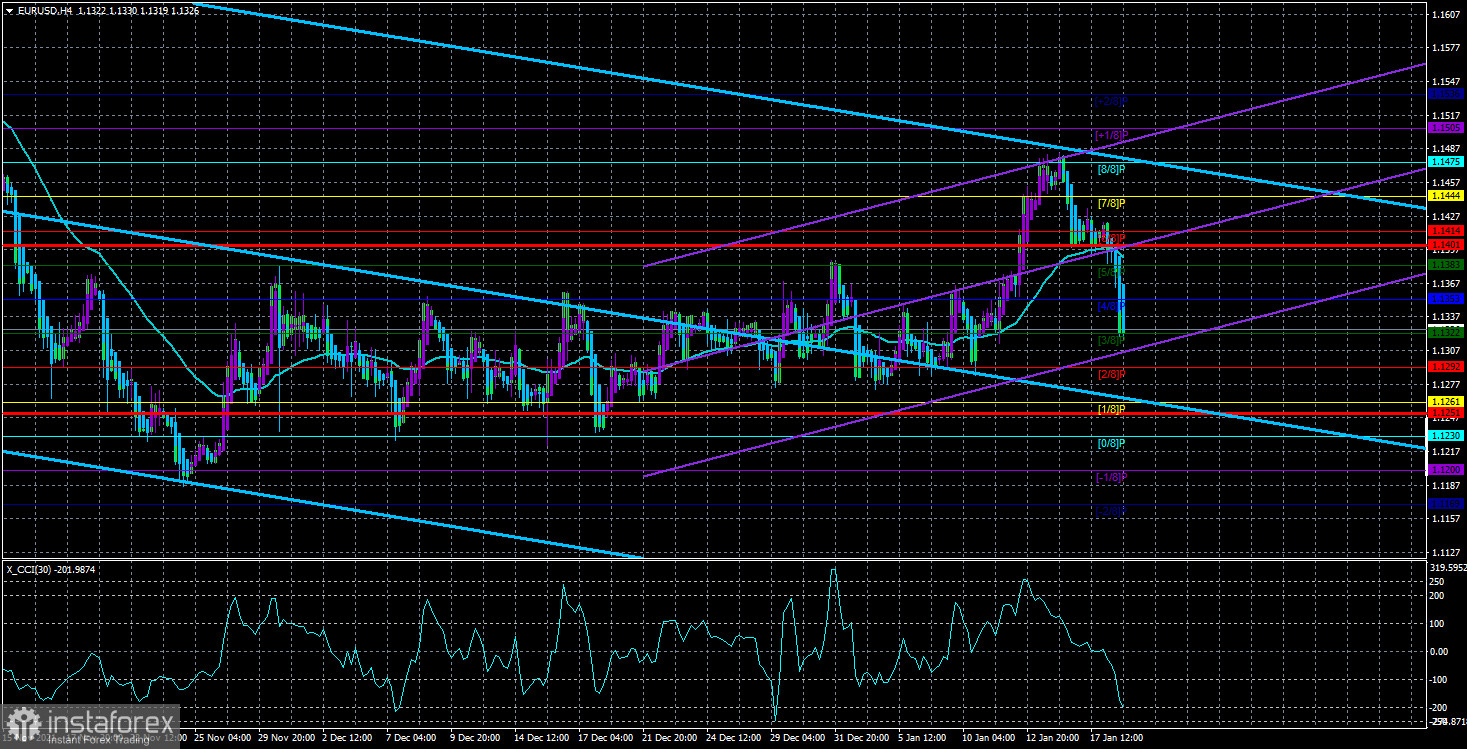

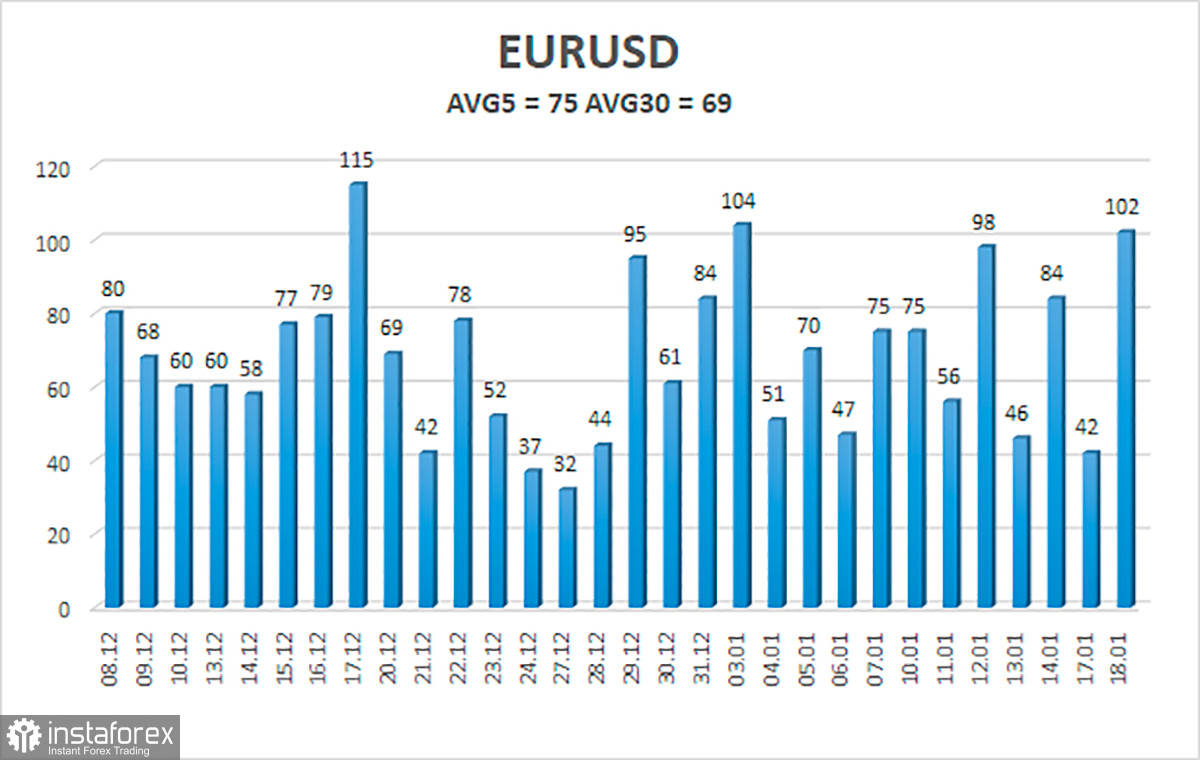

The volatility of the euro/dollar currency pair as of January 19 is 75 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1251 and 1.1401. A reversal of the Heiken Ashi indicator upwards will signal a round of corrective movement.

Nearest support levels:

S1 – 1.1322

S2 – 1.1292

S3 – 1.1261

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1383

R3 – 1.1414

Trading recommendations:

The EUR/USD pair consolidated below the moving average line and began a strong downward movement. Thus, now you should stay in short positions with targets of 1.1292 and 1.1261, which should be kept open until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1444 and 1.1475.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines)- the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.