To open long positions on EUR/USD, you need:

Yesterday, several signals were formed to enter the market, but all of them did not bring the expected profit, since, contrary to all expectations, the bearish correction for the euro turned into a larger phase. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.1387 level and advised making decisions on entering the market from it. The data on the index of business sentiment in Germany and the eurozone supported the euro bulls, which allowed them to protect the support of 1.1387 in the first half of the day, forming a signal to enter long positions there. However, the upward movement was no more than 15 points, after which the pressure on the euro returned. The 1.1387 area was very "blurred" in the afternoon, so it was not possible to get a clear signal to sell EUR/USD with a reverse test from the bottom to the top. Long positions for a rebound from the 1.1354 level led to consolidating losses.

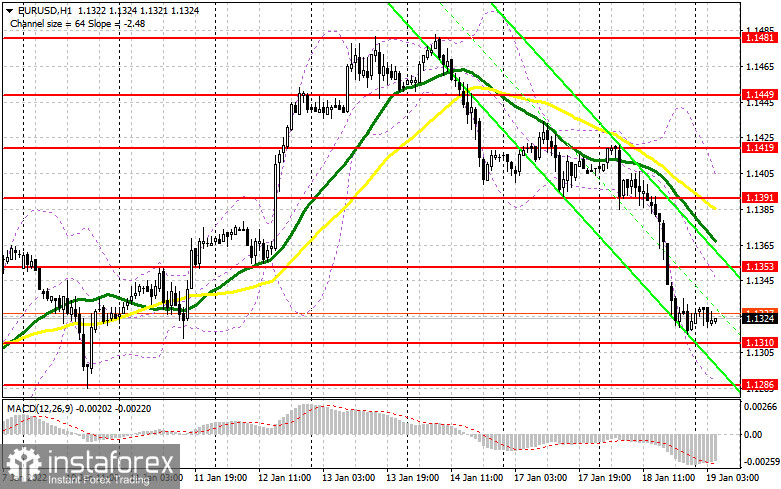

The technical picture has undergone a number of changes, which are very important for building further downward movement on the pair. Much of today will depend on the data on inflation in Germany, which can stop the bearish trend and lead to an upward correction in the first half of the day. The bulls' main task is to protect the support of 1.1310, which was formed last week. Divergence, which is beginning to appear on the MACD indicator, can also act in defense of the bulls. Forming a false breakout at 1.1310 and good inflation data can push the euro to rise to the resistance area of 1.1353, just above which the moving averages are playing on the bears' side. This will significantly limit the pair's upward potential. An equally important task is to surpass this range, and the reverse test from above will lead to a buy signal and open the possibility of a new jump to the levels: 1.1391 and 1.1419, where I recommend taking profits. The 1.1449 level is a more distant target. In case the pair falls further during the European session and bulls are not active at 1.1310, it is best to postpone long positions until the next support at 1.1286. However, I advise you to open long positions there when forming a false breakout. From the 1.1265 level, you can buy EUR/USD immediately for a rebound, counting on an upward correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Bears continue to put serious pressure on the market, and the increased demand for the US dollar due to expectations of a more active increase in interest rates in the US, led to another decline in EUR/USD yesterday afternoon. To continue the fall, a breakthrough of 1.1310 is needed, at which the bears may face active resistance from buyers of risky assets. Protecting resistance at 1.1353 is also an important task. In case EUR/USD grows in today's European session after good inflation data in Germany, forming a false breakout at 1.1353 creates the first entry point into short positions while expecting a return of pressure and a decrease in EURUSD to the support area of 1.1310. A breakthrough and a bottom-up test of 1.1310 will provide another signal to open short positions with the prospect of falling to a large low like 1.1286. A more distant target will be the 1.1265 area, where I recommend taking profits. In case the euro grows and the bears are not active at 1.1353, and the moving averages are slightly above this level, then it is best not to rush with short positions. The optimal scenario will be short positions when a false breakout is formed near the 1.1391 high, from which yesterday's fall of the euro occurred. You can sell EUR/USD immediately for a rebound from 1.1419, or even higher - around 1.1449, counting on a downward correction of 15-20 points.

I recommend for review:

The Commitment of Traders (COT) report for January 11 revealed that long positions had increased while short ones decreased, which led to a change in the negative value of the delta to a positive one. The market is gradually changing and the demand for the European currency, despite the expected changes in the policy of the Federal Reserve, has not gone away. The US inflation data released last week did not make any impression on traders, as the result almost completely coincided with economists' expectations. Against this background, Fed Chairman Jerome Powell spoke quite calmly about future interest rates at a time when many traders expected a more aggressive policy from the central bank. Currently, three increases are projected this year and the first of them will occur in March this year. The sharp decline in retail trade in the United States in December of this year also allows the Fed not to force events. Meanwhile, the European Central Bank plans to fully complete its emergency bond purchase program in March this year. However, the central bank is not going to take any other actions aimed at tightening its policy, which limits the upward potential of risky assets. The COT report showed that long non-commercial positions rose from the level of 199,073 to the level of 204,361, while short non-commercial positions fell from the level of 200,627 to the level of 198,356. This suggests that traders will continue to increase long positions on the euro in order to build an upward trend for the pair. At the end of the week, the total non-commercial net position became positive and reached 6005 against -1554. The weekly closing price rose slightly to 1.1330 against 1.1302 a week earlier.

Indicator signals:

Trading is conducted below the 30 and 50 daily moving averages, which indicates that the downward correction of the pair continues.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decrease, the lower border of the indicator around 1.1286 will act as support. The upper border of the indicator in the area of 1.1350 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.