To open long positions on EURUSD, you need:

The slight strengthening of the European currency, which was observed in the first half of the day, did not lead to an update of the levels that I described in detail in my morning forecast. Because of this, no signals were formed to enter the market. Let's look at the 5-minute chart and figure out what happened. Inflation data in Germany completely coincided with economists' forecasts, which kept market volatility at the usual low level for the first half of the day. But despite this, the technical picture for the American session has changed slightly, and the advantage has shifted to the side of euro buyers. And what were the entry points for the pound this morning?

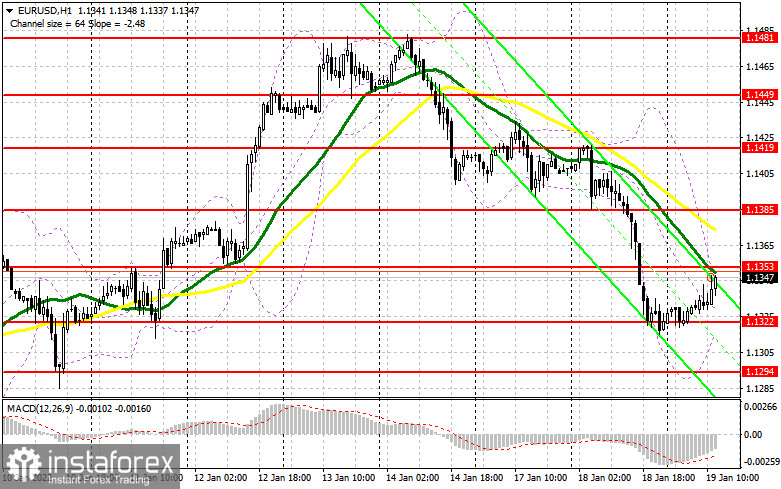

And although the primary task of buyers is to protect the support of 1.1322, the bulls will be aimed at breaking the nearest resistance of 1.1353. The market reaction to the data on the American economy will be a signal for decision-making. In the case of a decline in EUR/USD, only the formation of a false breakdown at 1.1322 and weak data on the volume of construction permits issued and the number of new foundations laid in the United States will lead to an increase in the euro to the resistance area of 1.1353, just above which the moving averages are playing on the sellers' side. This will significantly limit the upward potential of the pair. An equally important task will be the breakdown of this range, and the reverse test from above will lead to a buy signal and open the possibility of a new jump to levels: 1.1385 and 1.1419, where I recommend fixing the profits. The 1.1449 area will be a more distant target, but we will be able to reach it only if we are very bullish. With the pair declining during the American session and the lack of bull activity at 1.1322, it is best to postpone purchases until the next support at 1.1294. However, I advise you to open long positions there when forming a false breakdown. From the 1.1265 level, you can buy EUR/USD immediately for a rebound with the aim of an upward correction of 20-25 points within a day.

To open short positions on EURUSD, you need:

Bulls are still more active, and sellers are in no hurry to return to the market. The most optimal scenario for selling the euro in the afternoon will be the formation of a false breakdown at the level of 1.1353, where the moving averages are playing on the sellers' side, which forms an excellent entry point into short positions with the prospect of a further decline in EUR/USD to the support area of 1.1322. Strong US data, together with a breakdown and a reverse test from the bottom up of this range, will form an additional signal to enter the market, which will push the pair to a new low of 1.1294 and open a direct road to 1.1265. A more distant target will be the 1.1248 area, where I recommend fixing the profits. A test of this level will be the end of the bull market seen earlier this year. If the pair recovers during the US session and weak data on the real estate market of the United States of America, the lack of bear activity at the level of 1.1353 may make it difficult for the euro to fall further. The optimal scenario will be sales when a false breakdown is formed in the area of 1.1385. It is possible to open short positions on EUR/USD immediately for a rebound from the highs: 1.1419 and 1.1449 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for January 11 recorded an increase in long positions and a reduction in short ones, which led to a change in the negative value of the delta to a positive one. The market is gradually changing and the demand for the European currency, despite the expected changes in the policy of the Federal Reserve System, has not gone away. The US inflation data released last week did not make any impression on traders, as the result almost completely coincided with economists' expectations. Against this background, Federal Reserve Chairman Jerome Powell spoke quite calmly about future interest rates at a time when many traders expected a more aggressive policy from the central bank. Currently, three increases are projected this year and the first of them will occur in March this year. The sharp decline in retail trade in the United States in December of this year also allows the Fed not to force events. Meanwhile, the European Central Bank plans to fully complete its emergency bond purchase program in March this year. However, the regulator is not going to take any other actions aimed at tightening its policy, which limits the upward potential of risky assets. The COT report indicates that long non-profit positions rose from the level of 199,073 to the level of 204,361, while short non-profit positions fell from the level of 200,627 to the level of 198,356. This suggests that traders will continue to increase long positions on the euro to build an upward trend for the pair. At the end of the week, the total non-commercial net position became positive and amounted to 6005 against -1554. The weekly closing price rose slightly to 1.1330 against 1.1302 a week earlier.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily moving averages, which indicates a likely decline in the euro in the afternoon.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.1353 will lead to a new wave of euro growth. A breakthrough of the lower limit of the indicator in the area of 1.1315 will increase pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.