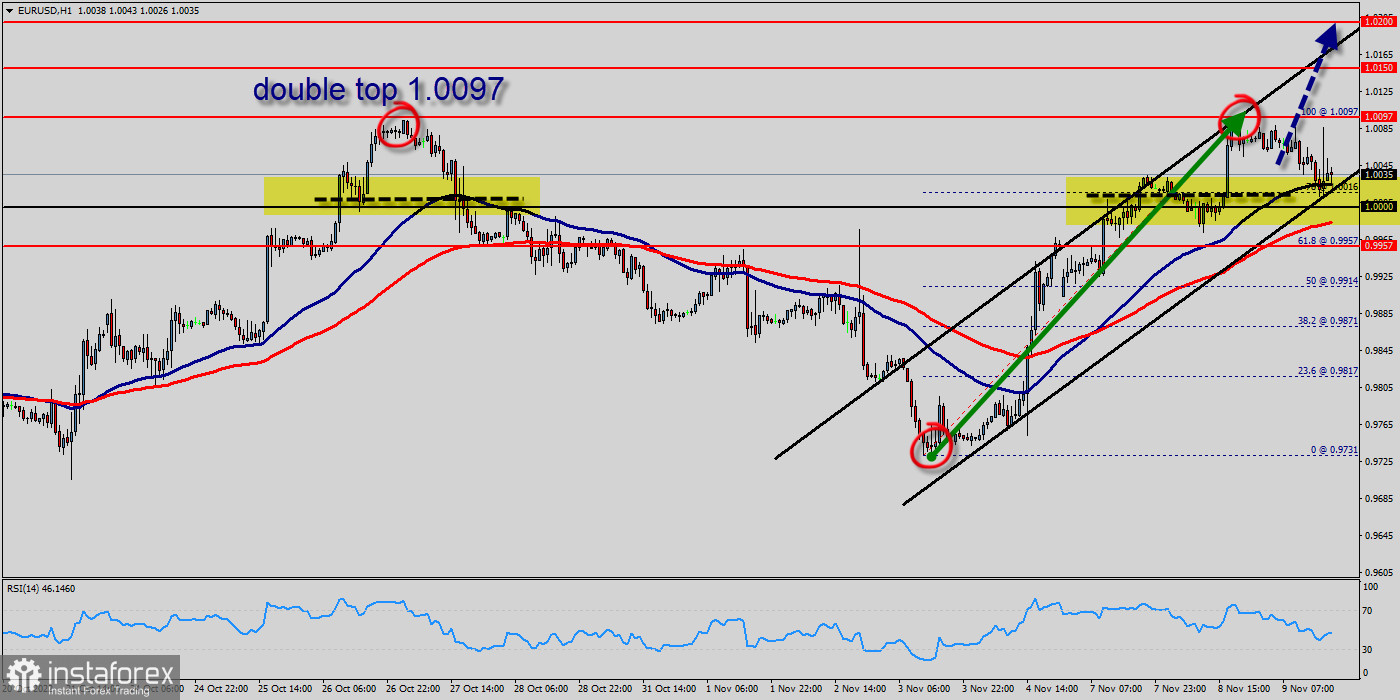

The bullish trend is currently very strong for EUR/USD. As long as the price remains above the support at the level of 1 USD, it could try to take advantage of the bullish rally. The first bullish objective is located at 1.0102. Crossing it would then enable buyers to target 1.0143. Be careful, given the powerful bearish rally underway, excesses could lead to a short-term rebound. If this is the case, remember that trading against the trend may be riskier. It would seem more convenient to wait for a signal indicating reversal of the trend. The trend has closed above the pivot point (1.0042) could assure that EUR/USD will move higher towards cooling new highs. The bulls must break through 1.0042 in order to resume the uptrend. The EUR/USD pair is at an all-time high against the dollar around the spot of 1 USD since a month. The EUR/USD pair is inside in upward channel.

Closing above the major support (1.0042) could assure that EUR/USD will move higher towards cooling new highs. The EUR/USD pair is continuing rising by market cap at a range between 0.9946 and 1.0143. The EUR/USD pair is trading at 1 USD after it reached 1.0042 earlier. The EUR/USD pair has been set above the strong support at the price of 1 USD, which coincides with the 23.6% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend. In the very short term, the general bullish sentiment is not called into question, despite technical indicators being neutral (RSI).

The market is likely to show signs of a bullish trend around the spot of 1 USD. Buy orders are recommended above the area of 1 USD with the first target at the price of 1.0072; and continue towards 1.0102 in order to test the last bullish wave. The bullish momentum would be revived by a break in this resistance. Buyers would then use the next resistance located at 1.0143 as an objective. The EUR/USD pair closed last week above the 1 USD level, starting today with bullish bias in attempt to move away from this level, which encourages us to propose the bullish bias in the upcoming sessions, targeting visiting 1.0143 as a first positive station.

Further recovery should motivate the pair to challenge recent highs around 1.0143 to allow for extra gains to, initially, the interim hurdle at the 50-day EMA at 1.0042. The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 50 EMA is headed to the upside Bias will be back on the upside for retesting 1.0143 high. On the upside, above 1 USD will resume the rebound to 1 USD resistance turned support. On the other hand, if the EUR/USD pair fails to break through the resistance price of 1.0042 today, the market will decline further to 1 USD (return to the last bearish wave).

Forecast:

The trend is still bullish as long as the price of $ 1.0000 is not broken. Thereupon, it would be wise to buy above the price of at $ 1.0000 with the primary target at 1.0097. Then, the EUR/USD pair will continue towards the second target at 1.0150 (a new target is around$ 1.0175).

Alternative scenario:

The breakdown of 0.9957 will allow the pair to go further down to the prices of 0.9900 and 0.9871.

Range: 1.0000 - 1.0175 (+175 pips).