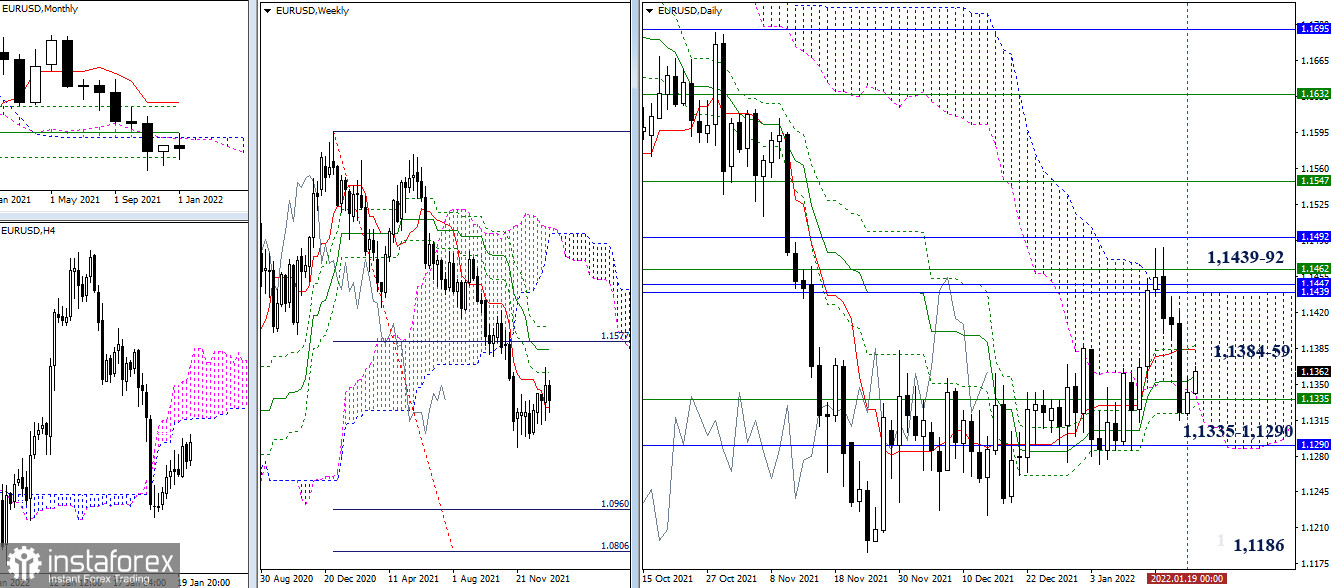

EUR/USD

The euro marked a slowdown again after returning to the attraction and influence zone of the past levels that participated in the formation of consolidation. A return to weekly consolidation may once again delay the development of the movement and the strengthening of the advantages of one of the parties for a long time. As a result, the levels of 1.1335 - 1.1290 (weekly short-term trend + monthly level) still provide the main value.

The nearest resistance levels are the levels of the daily cross 1.1384 - 1.1359 (Tenkan + Kijun). The prospects for the emergence of a new movement rest against the borders of 1.1439-92 (monthly levels + weekly Fibo Kijun + upper limit of the daily cloud) and 1.1186 (minimum extremum).

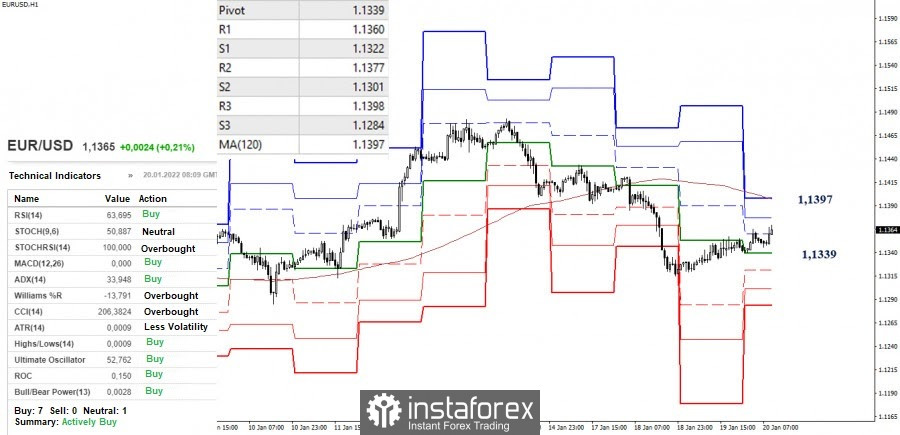

The development of an upward correction allowed the bulls to assault the central pivot level of the day (1.1339) and reform the preferences of most of the analyzed technical indicators to support their interests. However, the main advantage remains on the bearish side. In order to change the current balance of power, the bulls should break through the resistance of the weekly long-term trend (1.1397), securely consolidate above it, and deploy the moving average. But if the decline continues and the downward trend recovers, the support of the classic pivot levels located at 1.1322 - 1.1301 - 1.1284 will be considered as intraday downward pivot points.

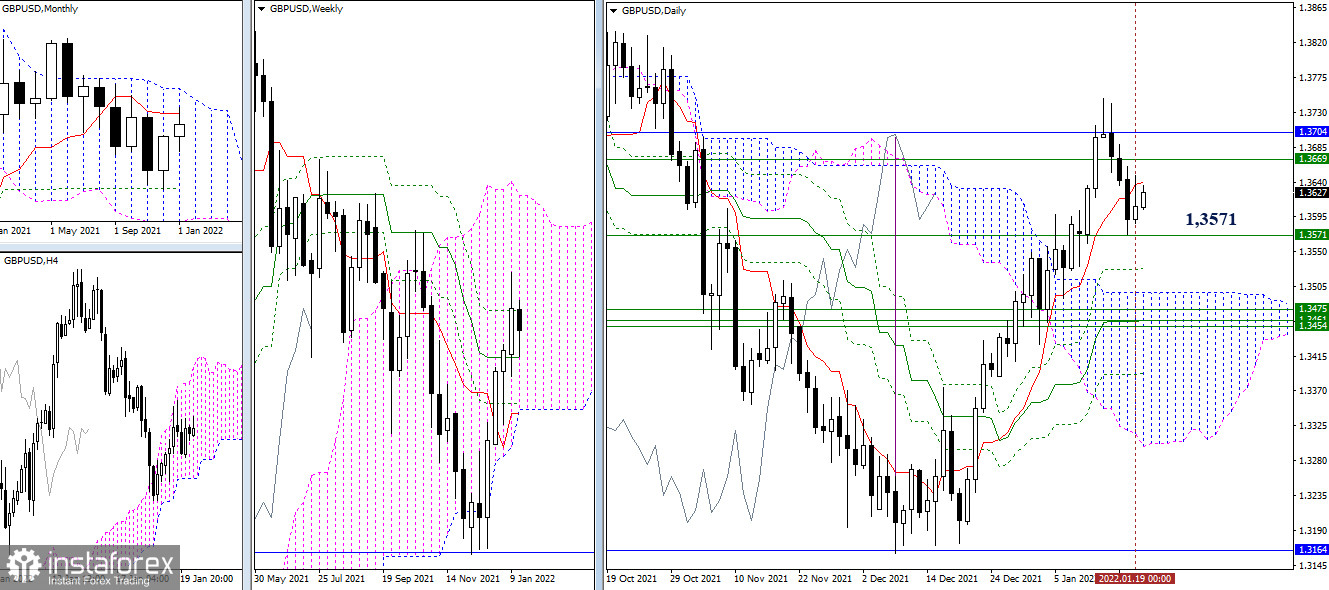

GBP/USD

There has been a slowdown on the daily timeframe after encountering the support of the weekly medium-term trend (1.3571), while the bulls still failed to form a full-fledged rebound. To recover bullish positions, the resistance levels noted at 1.3639 (daily Tenkan) - 1.3669 (weekly Fibo Kijun) - 1.3704 (monthly Tenkan) can be considered. As for the bears, the support zone is currently set at 1.3528 (daily Fibo Kijun) and in the accumulation area of levels 1.3497 - 1.3454 (weekly and daily levels).

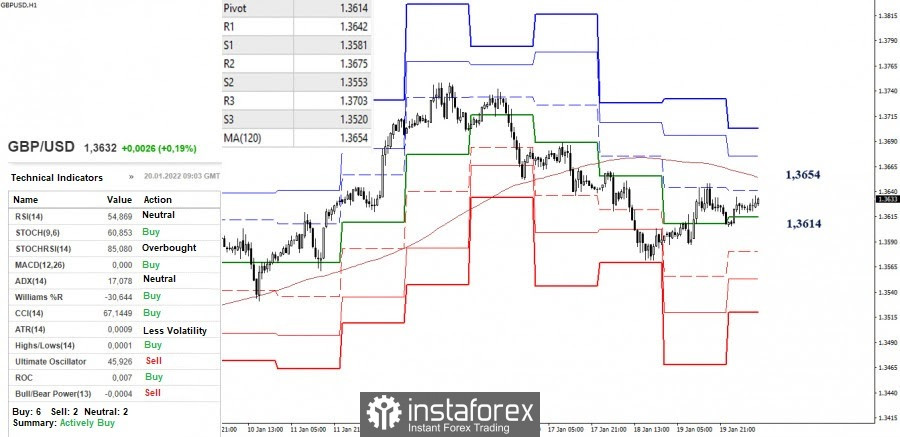

The bulls continue their upward correction in the smaller timeframes. There is an important level ahead of 1.3654 (weekly long-term trend), whose breakdown can change the current balance of power in favor of the bulls. The next upward pivot points are at 1.3675 (R2) and 1.3703 (R3).

In turn, important support right now is the central pivot level (1.3614). If a decline occurs, further supports located at 1.3581 - 1.3553 - 1.3520 (classic pivot levels) can be used.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.