The pound paired with the dollar shows a corrective growth after a three-day consecutive decline. GBP/USD bulls failed to conquer the 37th figure, after which they turned 180 degrees and plunged down by almost 200 points from the current year's price high. However, the bearish momentum faded around the 1.3570 mark – bears, in turn, could not keep the price within the 35th figure. As a result, the parties settled on "neutral territory", in the range of 1.3600-1.3650.

It is noteworthy that such a modest corrective pullback does not correlate with the current fundamental background. While the dollar is waiting for the Federal Reserve's verdict (the results of the January meeting will be announced on the 26th), the pound receives support from both key macroeconomic reports and the Covid front. The main economic releases came out this week in the green zone, reflecting the recovery of the British economy. At the same time, the British prime minister unexpectedly announced the easing of quarantine restrictions in the country. These fundamental circumstances allowed GBP/USD bulls to approach the upper limit of the above price range. However, the market reaction still looks too impassive. In my opinion, the pound has not exhausted the potential of its corrective growth, given the growth of the main indicators.

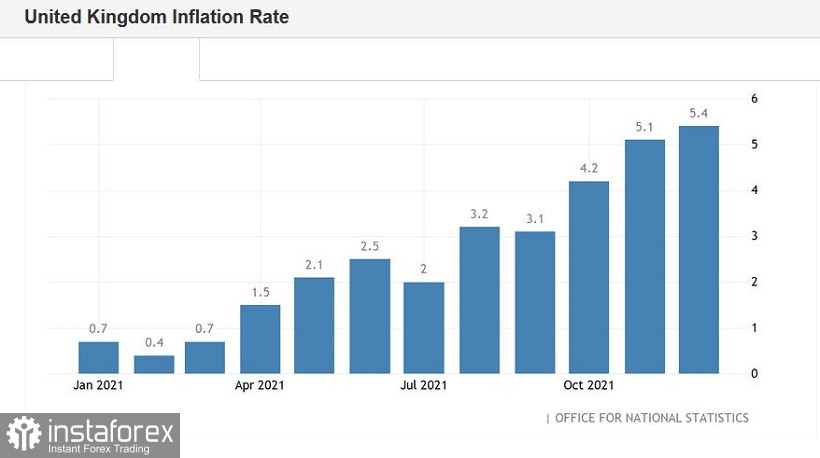

Thus, in annual terms, the overall British consumer price index showed a jumpy growth, reaching 5.4%. This is a 30-year record – the strongest growth rate since March 1992. Core inflation showed a similar trend. The core consumer price index jumped to 4.2%. In this case, we are talking about a 29-year record (the strongest growth rate since 1992). The December CPI jumped mainly due to a sharp rise in prices for food, furniture and clothing, as well as due to a rise in the price of services (residential, restaurant and hotel). Also, the increase in inflation is due to higher prices for electricity, fuel and used cars.

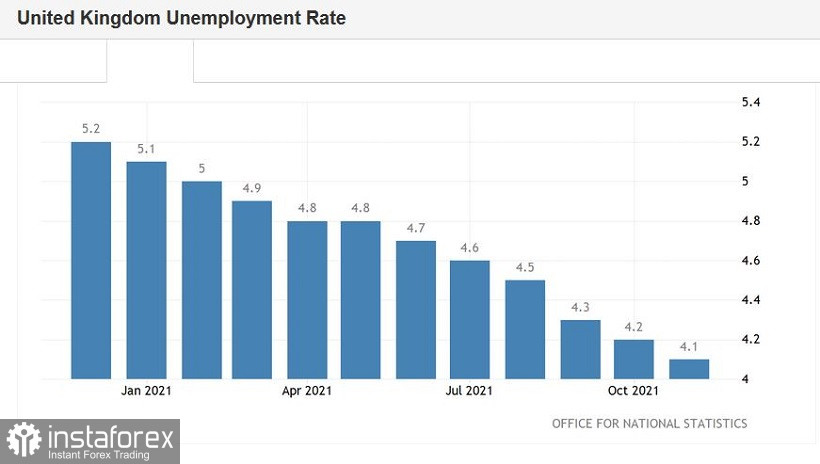

As for the data in the labor market (the release was on Tuesday), there was a decrease in the unemployment rate (up to 4.1%), a decrease in the number of applications for unemployment benefits (-43,000) and a decrease in the level of average earnings (both with and without bonuses). Almost all of the above components of the release were in the green zone, providing some support to the British currency.

After the publication of the above data, the market started talking about the fact that in early February the Bank of England will raise the interest rate again. Let me remind you that at the end of last year, the British central bank decided to tighten monetary policy by raising the rate by 15 basis points. It is expected that on February 3, the central bank will return to this issue, increasing the rate by 10-15 points.

The pound also received some support from the other side. Yesterday it became known that almost all restrictive measures taken in December due to the spread of Omicron will be canceled in the UK from January 26. In particular, restrictions such as the mandatory wearing of a mask in transport or in stores, the need to transfer work to a remote format, as well as the provision of COVID certificates in order to attend mass events are being canceled. Commenting on this decision, Boris Johnson said in Parliament that the peak of the incidence of Omicron in Britain has already passed. This is allegedly indicated by the latest scientific data. As the British press notes, this decision caused a mixed reaction in the House of Commons. First of all, representatives of the opposition were outraged, who demanded that the head of government extend the validity of quarantine measures. But given the balance of power in Parliament, the government's decision will still come to life.

The growth of the British currency is also due to the fact that the recent political scandal related to Johnson's violation of quarantine rules unexpectedly quickly subsided. Although it's too early to put an end to this story. Let me remind you that the so-called "Partygate" has shaken Boris Johnson's position as prime minister quite a lot. He was accused that during last year's lockdown, parties were held at the London government residence without observing quarantine measures. Johnson himself took part in at least one of these parties. The head of the British government apologized for what he had done, appointed an internal investigation of the incident and stated that he was not going to resign voluntarily. Johnson's opponents, in turn, began to reflect on the prospects of declaring a vote of no confidence in him. To begin with, they needed to collect the signatures of 54 conservatives in order to at least launch this process. Almost 30 MPs voted "for" the implementation of this scenario, but the internal party opposition ran out of steam. Johnson has overcome another political crisis, and the pound has received another reason for its strengthening.

Thus, the prevailing fundamental background suggests that the GBP/USD pair may take a few more steps to the upside - up to the resistance level of 1.3740 (the upper line of the Bollinger Bands indicator on the daily chart). A record increase in inflation, a decrease in the unemployment rate and the expectation of an interest rate increase will push the British currency up. At the same time, the next storm clouds that had gathered over Johnson's head, apparently dispersed. The US dollar, in turn, is not showing activity: the greenback has taken a wait-and-see position ahead of the January Fed meeting. GBP/USD bulls can take advantage of this fact to test the area of the 37th figure once again.