The EUR/USD pair is trading in a narrow price range, reacting weakly to the current information flow. Yesterday's release of macroeconomic data was ready to put pressure on the US dollar, but the result turned out to be the opposite: EUR/USD bears updated a local 10-day low, dropping to the level of 1.1303. However, they failed to enter the area of 1.12. During today's Asian session, the buyers took the initiative and organized a modest upward correction.

All this suggests that this pair has not decided on the direction of its movement. The US dollar index focuses more on the dynamics of Treasury yields, and not on macroeconomic reports. Meanwhile, the euro is moving in the wake of the US currency, not having its own arguments to turn the situation around. Even the ECB minutes published yesterday, which did not rule out tightening monetary policy parameters, did not help the euro. The US dollar is still taking the lead while waiting for the Fed's verdict.

Given the dynamics of EUR/USD trading this week, it can be assumed that this situation will continue at the beginning of the next one, namely until Wednesday when the results of the Fed's January meeting will be announced.

Although the euro actually ignored the minutes of the ECB yesterday, it is necessary to still discuss it in more detail. The importance of this document lies in the fact that it reflected the existing split in the camp of the European Central Bank. Moreover, some officials of the European regulator cautiously spoke about the tightening of the ECB's monetary policy during the discussion. Such remarks were made for the first time in a long time.

Inflation became the issue over which there is continuing disagreement. According to some Governing Council officials, the record growth in EU's inflation is temporary, and so, there is no need to make hasty decisions on this issue. According to representatives from the "hawkish" wing, the scenario of higher and longer inflation cannot be ruled out. Therefore, the Central Bank cannot rule out any options for further action. As one speaker noted, "the regulator should be equally open to tightening or loosening policy." Unfortunately, the minutes do not "personify" the speakers, so it is unknown who said this. However, this is not so important. What's more important is that there is disunion in the ECB. According to the minutes, the decisions of the December meeting were not supported unanimously: 5 of the 25 members of the Board of Governors opposed. On the one hand, this is not enough to talk now about the prospects for tightening monetary policy. On the other hand, this is quite a lot for the ECB, which, as a rule, tends to make unanimous decisions.

In other words, the minutes of the ECB's December meeting reflected the presence of "internal opposition". So far, the number of "oppositionist" is quite small, but if European inflation continues to rise this year, contrary to the forecasts of most members of the Governing Council, the number of "hawkish" representatives will increase.

However, judging by the price behavior, EUR/USD traders are not ready to live with such long-term expectations. In fact, the "hawks" of the ECB are now in the overwhelming minority, and this is quite enough for the euro to continue to remain without the support of the European regulator.

On another note, the US currency may receive additional support from the Fed next week. At least, this is what many experts are sure of, who expect "hawkish" hints from Fed members. The minimum program is the announcement of the first rate hike at the March meeting and hints of additional rounds of hikes this year. The scale of the US dollar's growth will depend on how "aggressive" the rhetoric of the accompanying statement and Jerome Powell will be. In my opinion, the market has quite high expectations, which may not come true in the end. But in this case, it is difficult to predict the degree of "aggressiveness" of the Fed, given the record US inflation growth.

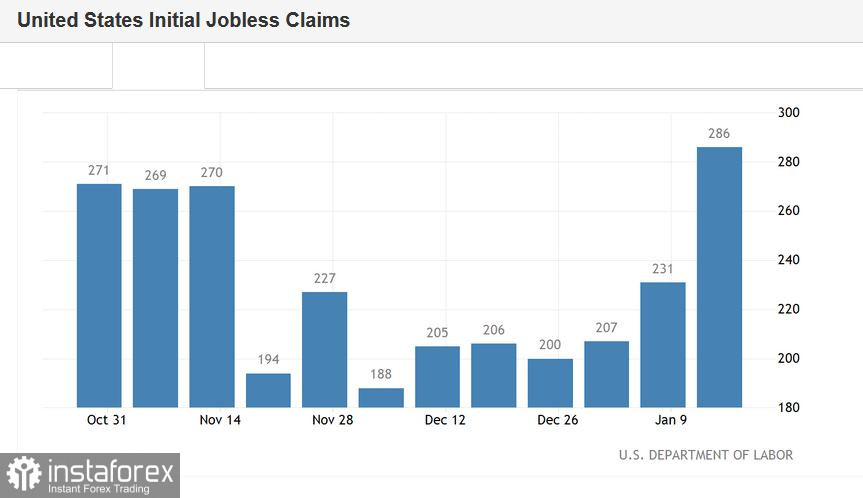

Actually, that's why dollar bulls are on the defensive – both in pairs with the euro, and in almost all other major pairs. At the same time, traders ignore many fundamental factors or demonstrate a formal reaction. For example, the macroeconomic statistics published yesterday went almost unnoticed despite the fact that this week's number of initial applications for unemployment benefits in the States rose to 286 thousand against the expected growth to 220 thousand. This is the worst result since October last year. The indicator of the volume of housing sales in the secondary market also came out in the "red zone" (-4.6% with a forecast of a 2% decline). But on the contrary, the Fed-Philadelphia manufacturing index came out in the "green zone". It rose to a 23-point value, although most experts expected it to rise to 18 points.

However, traders ignored all of the above releases. The market is waiting for the results of the Fed's meeting in January, so all other fundamental factors have faded into the background – both American macro indicators and the ECB minutes.

All this suggests that the EUR/USD pair is likely to trade in the already familiar range of 1.1260-1.1360 until next Wednesday. When approaching the upper limit of the range (1.1360, which corresponds to the middle line of the Bollinger Bands indicator on the D1 timeframe), it is advisable to consider short positions with the main targets of 1.1300 and 1.1260.