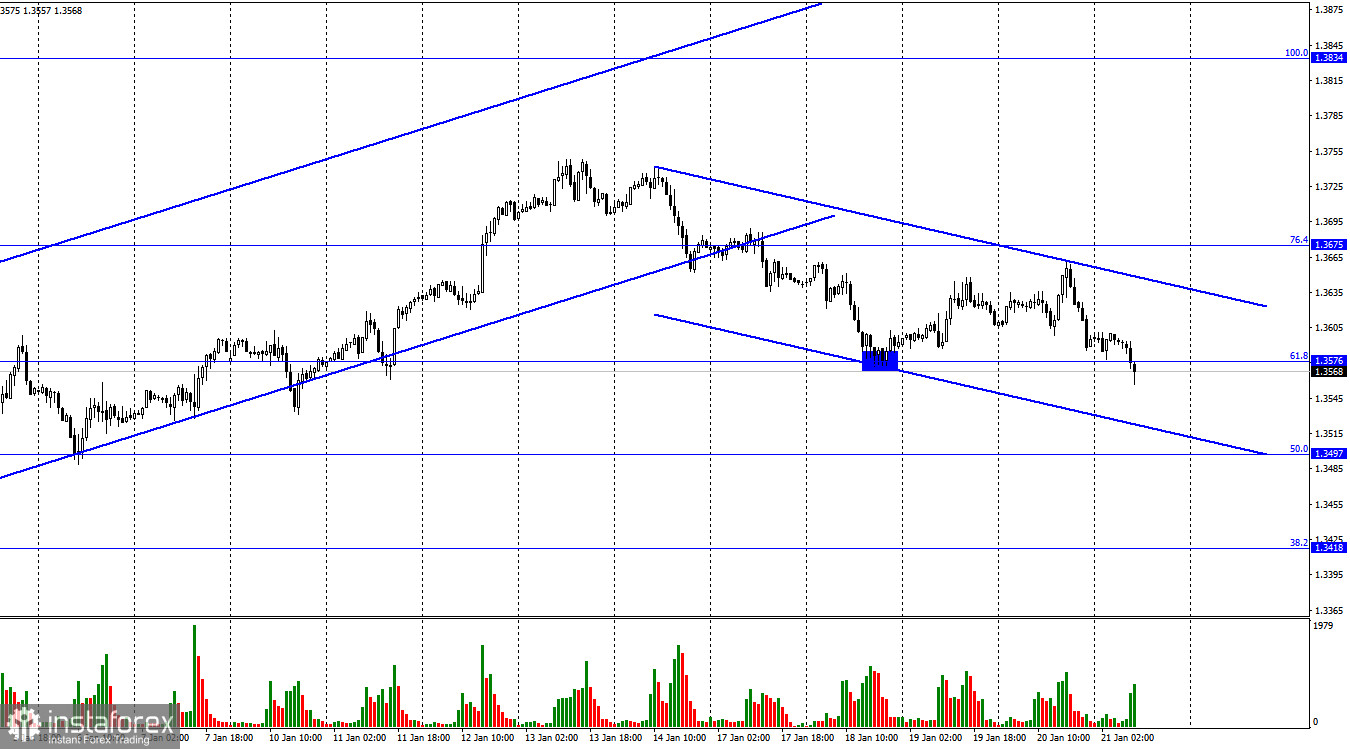

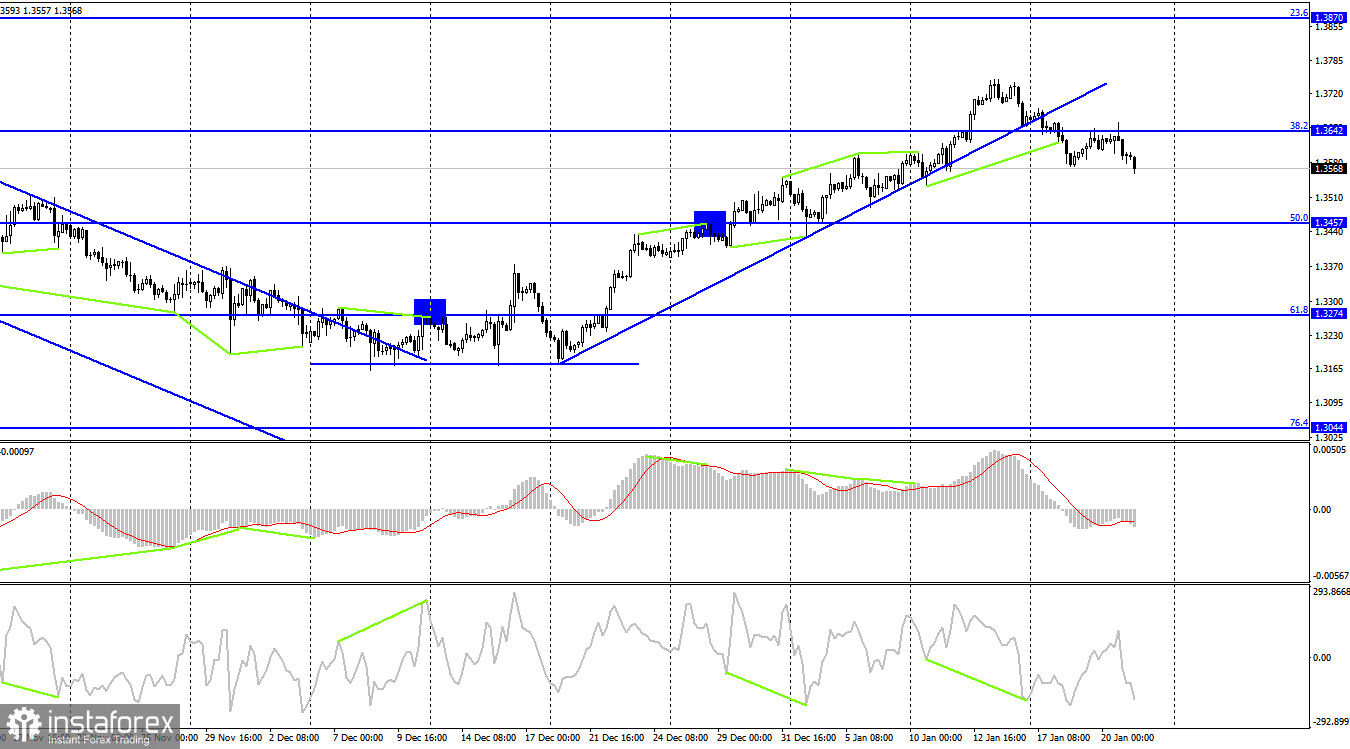

Yesterday, on the hourly chart the GBP/USD pair made a new reversal in favour of the US dollar and started a new descending trend. Today it has already consolidated under the retracement level of 61.8%, 1.3576. Thus, the decline could continue towards the next Fibonacci level of 50.0%, 1.3497. The downtrend corridor, which I have built today, has a more promising appearance than the actual trend line. It is a stronger one. Meanwhile, the information backdrop for the pound has become much worse at the end of the week than at the beginning of the week. The unemployment and payrolls reports were quite optimistic. The inflation report was a little worse, while the retail trade report was weak. Retail trade fell by 3.7% monthly in December. Traders were expecting retail trade to decline by a maximum of 0.6%. Thus, the coronavirus pandemic is hitting the economy hard. It is quite possible that other indicators will also show a negative trend in the coming months.

Boris Johnson has announced the end of all Covid measures from January 27, including compulsory mask-wearing on public transport and in shops and vaccine certificates. However, the number of new infections every day reaches 100,000. Although they are no longer forced to wear masks and stay at home, British consumers are aware that the situation is dangerous. This is reflected in the consumer confidence indicator, which fell from -15 to -19 in January. Any figure above 0 is positive. Boris Johnson faced new calls for his resignation over a party he attended with Downing Street staff, when the country was under lockdown. His approval ratings are plummeting rapidly. Boris Johnson faced a new wave of discontent over a party he attended with Downing Street staff, when the country was under lockdown. Boris Johnson's approval ratings are plummeting rapidly. An internal investigation has been launched in the UK Parliament. Johnson was also faced new calls for the resignation.

On the 4H time frame, the pair consolidated below a key trendline which has been acting as resistance for quite a long time. The price is likely to keep falling towards the retracement level of 50.0%, 1.3457. A rebound from the Fibonacci level of 38.2% raises the possibility of another drop. There are no new emerging divergences in any indicator today.

Economic calendar for US and UK:

UK - GfK Consumer Confidence Indicator (00-01 UTC).

UK - Change in retail sales volume including and excluding fuel costs (07-00 UTC).

US - Janet Yellen's speech (16-30 UTC).

All the most important events have already taken place on Friday. Only Janet Yellen's speech is expected. However, it is unlikely to provoke a market reaction from traders. After the release of weak data from the UK, the bears started trading.

GBP/USD forecast and trading tips:

I recommended selling the pound if there is a pullback from 1.3642 on the 4-hour chart with targets of 1.3497 and 1.3457. These can now be held open. I would not advise you to buy the pound as the pair may have just started to develop a new descending trend.