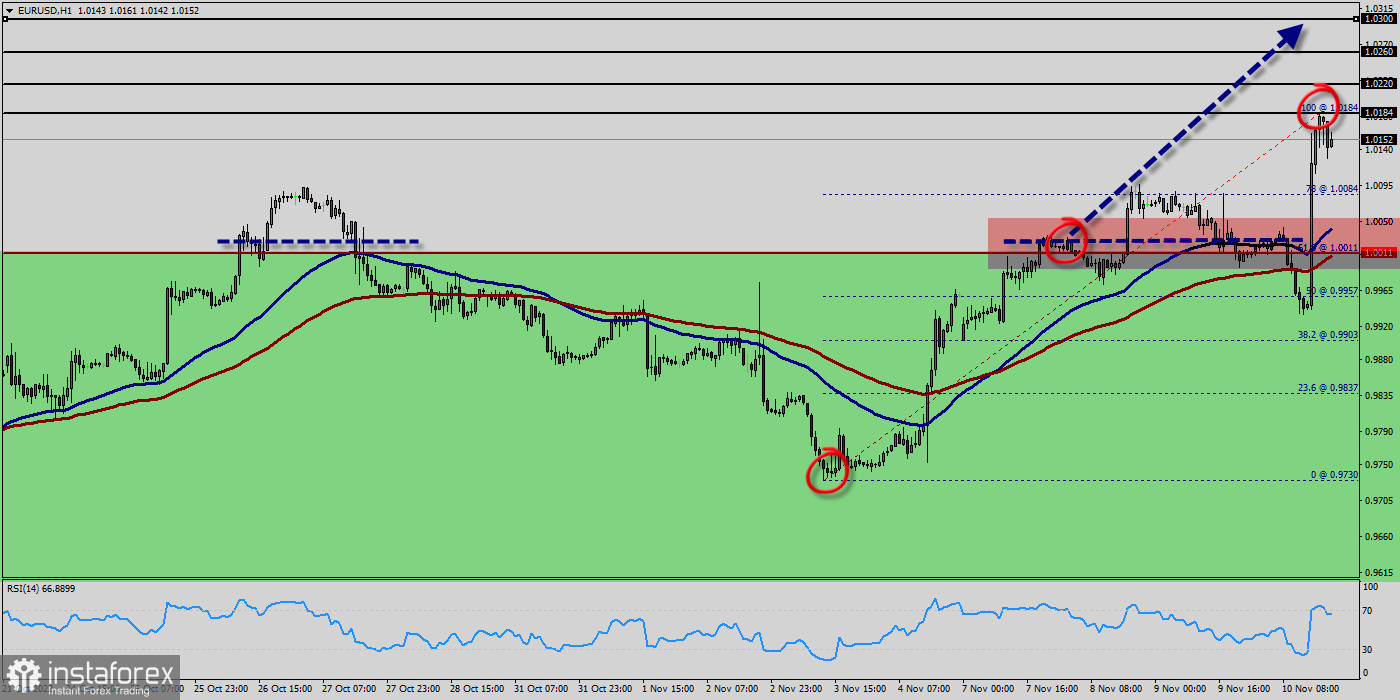

The EUR/USD pair is at highest against the dollar around the spot of 1.0011 - 1.0100 for three weeks. The EUR/USD pair is inside in upward channel. This week, the EUR/USD pair decreased within an up channel, for that Euro its new highest 1.0184. But the trend rebounded from the resistance 1.0150 to close at 1.0150 on the hourly chart. Closing above the daily pivot point (1.0011) could assure that the EUR/USD pair will move higher towards cooling new highs. The bulls must break through 1.0150 in order to resume the uptrend. Consequently, the first support is set at the level of $ 1.1127. Hence, the market is likely to show signs of a bullish trend around the area of 1.0150 and 1.0110. The EUR/USD pair reverses from 1.0150 and drops to multi-day lows near 1.0110 - this price formed a bottom this morning in the hourly chart. Right now, the EUR/USD pair dropped further and bottomed at 1.0140.

It then trimmed losses, rising to from 1.0100. The move lower took place amid a stronger US dollar across the board. Probably, the main scenario is continued decline towards 1.0200 (sentiment level).

The level of 1.0011 coincides with the golden ratio (61.8% of Fibonacci retracement) which is acting as major support today. Another thought: the Relative Strength Index (RSI) is considered overbought because it is above 60.

The EUR/USD pair price could be awaiting a major upswing if the digital savings manages to slice above a fatal line of the first resistance that sets at the price of 1.0220 (Horizontal black line). The prevailing chart pattern suggests that if the leading the trend could be expecting to rebound from the levels of 1.0011 and 1.0100 so as to continue uptrend.

Moreover, if the EUR/USD pair fails to break through the support prices of 1.0011 today, the market will rise further to 1.0220 so as to try to break it.

The EUR/USD pair is one the best overall investment for in coming weeks. However, if you want to try to improve the growth of Euro, thus it seems great to buy above the last bearish waves of 1.0220.

Forecast :

The pair will move upwards continuing the development of the bullish trend to the level 1.0011 - golden ratio 61.8%. Buy orders are recommended above the major's support rates of (1.0011) with the first target at the level of 1.0220. Furthermore, if the trend is able to breakout through the first resistance level of 1.0220.

We should see the pair climbing towards the next target of 1.0260. It might be noted that the level of 1.0260 is a good place to take profit because it will form a new double top in coming hours.

Overall, we still prefer the bullish scenario. Consequently, there is a possibility that the EUR/USD pair will move downside. The structure of a rise does not look corrective.

Besides, the weekly resistance 2 is seen at the level of 1.0260. The market will climb further to 1.0300. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs.

The pair is expected to rise higher towards at least 1.0300 in order to test the third support (1.0300) in coming hours. However, traders should watch for any sign of a bullish rejection that occurs around 1.0011.