The "bulls" on EURUSD did not find the strength to take quotes above 1.15, which, in my opinion, looks logical. The eurozone economy, weighed down by the energy crisis and the new wave of COVID-19, is not able to compete with the U.S., and the ECB is not going to raise rates in 2022. Unlike the Fed, which predicted in December that it would tighten monetary policy three times. Now the futures market insists on four acts of monetary restriction.

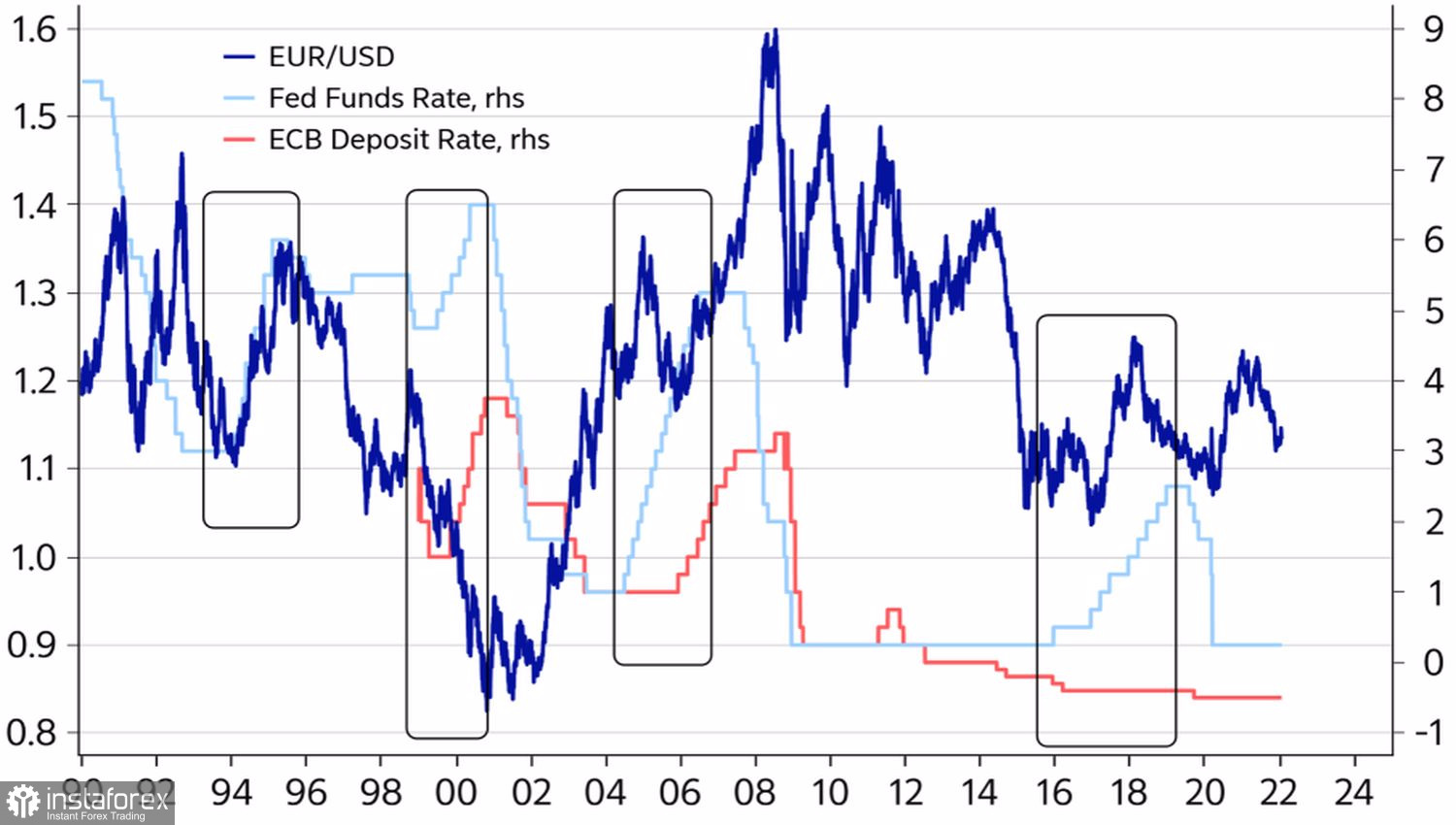

The dollar is also in no hurry to play its own cards. History shows that the USD index rose until the first increase in the federal funds rate in the cycle, and then the dynamics of EURUSD was mixed. This is typical for 2015-2018, when the Fed raised borrowing costs by 300 basis points. The euro soared to $1.15, then fell to $1.05, then rushed to $1.25 thanks to the victory of Emmanuel Macron in the presidential elections in France and the hawkish rhetoric of Mario Draghi in Sintra, Portugal, but after that dived to $1.15.

EURUSD dynamics and Fed tightening cycles

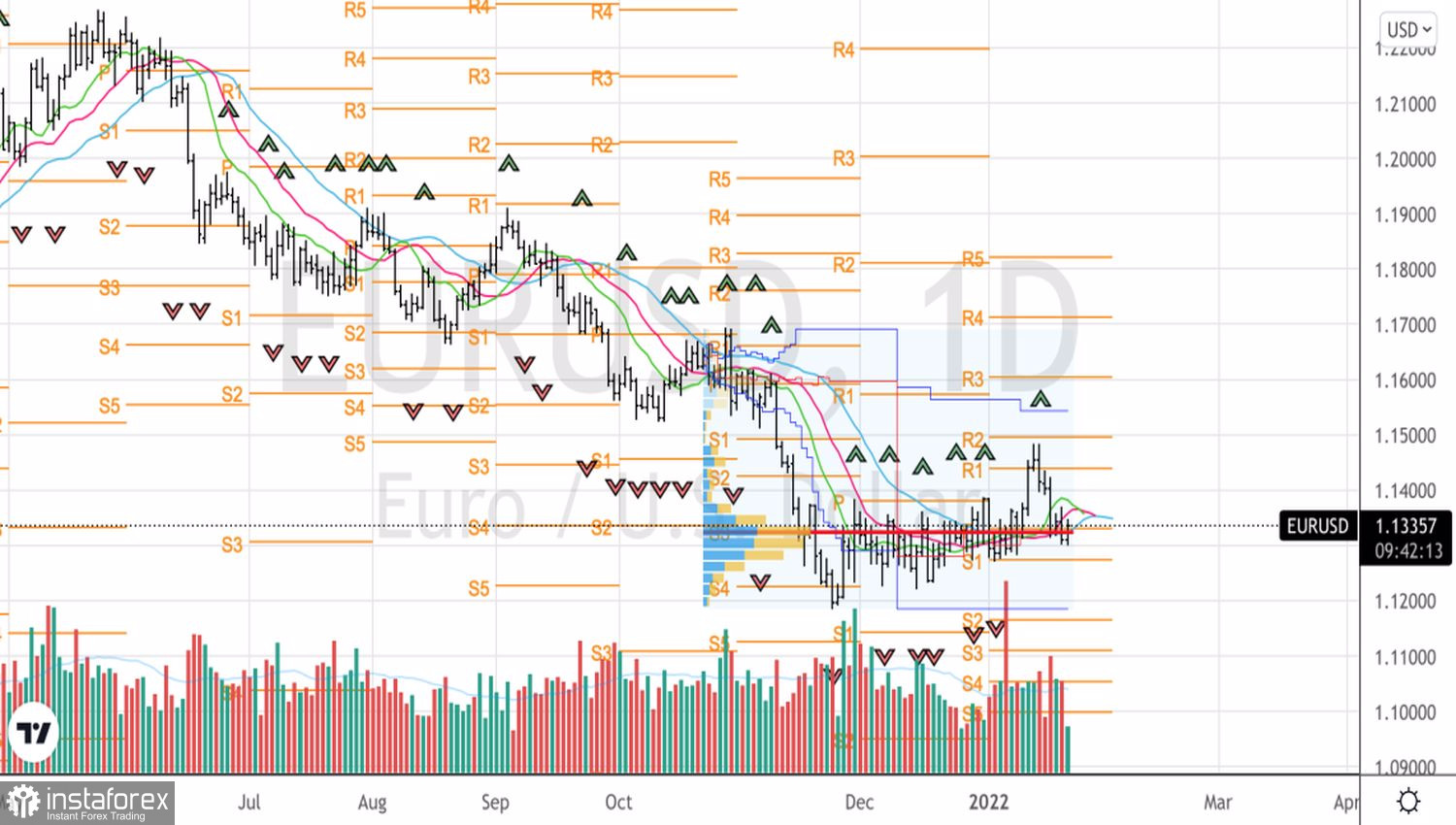

Traders use patterns in both technical and fundamental analysis, so the peak values of the USD index by the time of the first act of monetary restriction by the Fed in the cycle of many of them hold back EURUSD from selling. As a result, the main currency pair has been bored in the consolidation range of 1.122-1.138 for more than two months now. At the same time, the exit of quotes beyond its upper border became a real fiasco for the bulls.

The U.S. dollar cannot benefit from the rising Treasury yields nor from a downturn in the U.S. stock market. In the latter case, the U.S. dollar should theoretically benefit as a safe-haven asset, but so far, this has not happened.

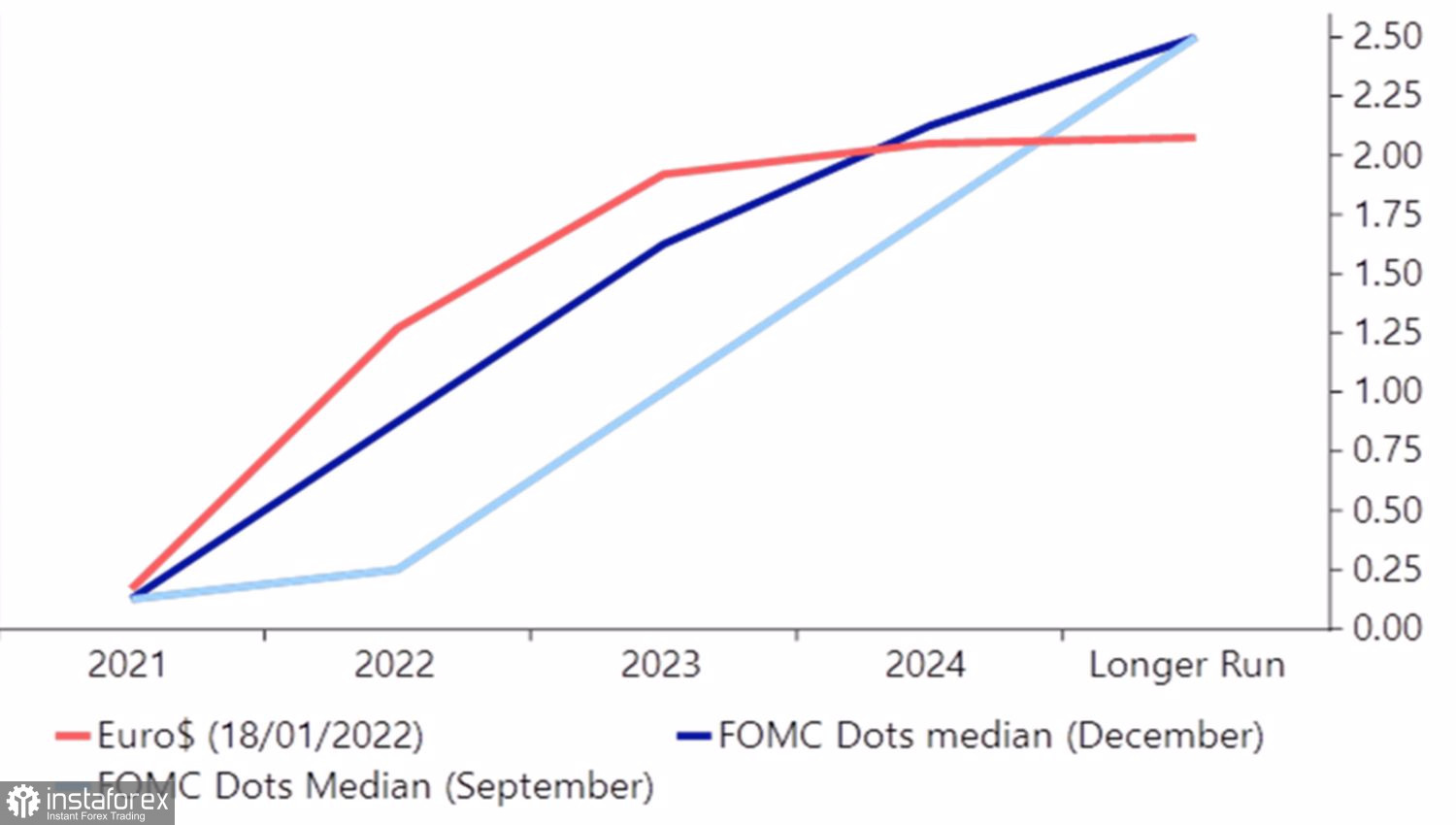

However, on the eve of the FOMC meeting, which is considered the key event of the week to January 28, the dollar managed to lick some of its wounds. The Fed is gradually catching up with market expectations in its forecasts for the rate, and is ready to raise it in March. Will the first meeting of its representatives bring a "hawkish" surprise in the form of the completion of QE or rising borrowing costs? Investors reinsure themselves and return to the U.S. currency. Probably, the absence of something new from the Fed will bring EURUSD buyers back to the market.

Dynamics of forecasts for the Fed rate

In my opinion, the consensus forecast assumes a 100 basis points increase in the federal funds rate in 2022 while maintaining the ECB deposit rate at -0.5%. These events are already included in EURUSD quotes. If the Fed surprises with a large number of monetary restrictions or starts to roll up the balance sheet before the third quarter, the U.S. dollar will have an opportunity for further growth against major world currencies. If, on the contrary, this does not happen, and the European Central Bank nevertheless raises rates in 2022, as the derivatives market expects, we should expect a reversal of the downward trend for the main currency pair.

Technically, a repeated successful test of the fair value at 1.132 is fraught with the activation of the false breakout pattern, which will become the basis for building up the EURUSD shorts formed from the level of 1.1435 .

EURUSD, Daily chart