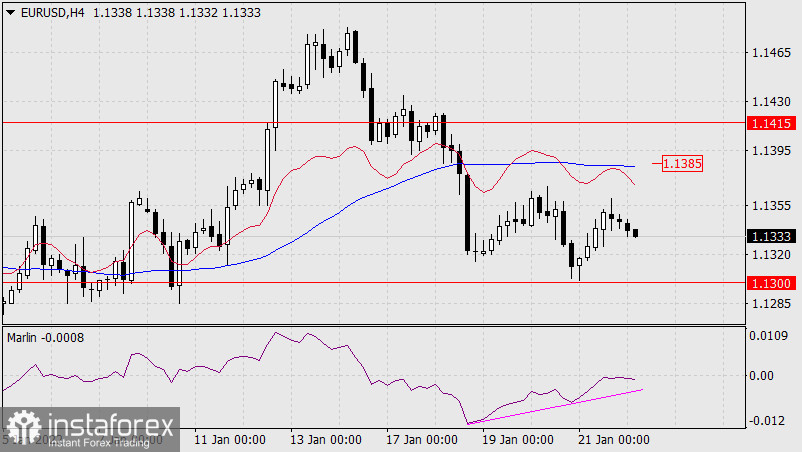

Last Friday, the euro bounced up from MACD's indicator line, blocking Thursday's decline. The probability of the price rising to the nearest target level 1.1415 (June 2019 high) has slightly increased.

The signal line of the Marlin Oscillator went sideways along the neutral zero line. Consolidation is not long, so there may well be a reversal to the upside. Long-term horizontal movements of the oscillator after the signal line exits the overbought zone mainly precede the subsequent decline.

Consolidating below 1.1300 opens the way for the price to 1.1170 (June 2020 support).

The price converged with the Marlin Oscillator on the four-hour chart. The exit above Friday's high (1.1360) will be a signal to attack the price of the MACD line (1.1385). After the price crosses the indicated level, it is likely that the price will consolidate to break through 1.1415. By this time, the Federal Reserve will have announced its decision on monetary policy.