The markets are still fully on the subject of the expected increase in the Fed's interest rates, which has already led to the decline of US stock indices last week.

However, the new week can either turn the mood of the markets upside down and cause either a pullback in the opposite direction or only increase sales.

Why can this happen and what are the reasons for this likely behavior of investors?

Following J. Powell's announcement in December that the Fed would start raising interest rates in 2022, and his announcement earlier this month that the rates could be raised not the promised three times, but four amid strong inflation, markets fell in despair, and expectations of the first rise in the cost of borrowing increased from mid-summer to the month of March.

Against this background, Treasury yields gradually rose. The yield of the benchmark 10-year T-Note rushed to the mark of 2.0%. This led to a drop in demand for borrowed money and, as a result, to a decrease in purchases of speculative investors in company shares, which caused sales on the US stock market.

On Tuesday, a very important meeting regarding the Fed's monetary policy will begin. We do not expect the rates to be changed, but the bank's communique published after the meeting, as well as the speech at the press conference by J. Powell, can greatly change market sentiment. If the bank expresses hope once again that inflation will slow down, and then begin to gradually decline, then this will undoubtedly serve as a basis for a reversal in the markets. The reason for such rhetoric of the Fed and Powell may be the December inflation data published in early January, which showed a strong slowdown in the growth of its monthly value in December.

Why can the Fed seize on this data and soften its rhetoric tomorrow?

It was previously pointed out that raising interest rates in the current crisis in America is like death. This will simply deal a serious blow to the economy and lead to a new wave of crises and social upheavals amid the COVID-19 pandemic. A sharp increase in interest rates will provide a shock to the economy and financial markets. Rising yields will increase the cost of servicing debt and may even trigger a default in the long run. Geopolitical problems will also worsen on this wave. Therefore, the regulator may cling to the hope of slowing down inflation and try to delay the start of rate hikes. He can give a hint about this as early as tomorrow, based on the results of the meeting.

The fact that such a scenario is real is fully indicated by the dynamics of the currency market. The ICE dollar index still remains in a narrow range and is consolidating near the 96-point mark. In addition, the yields of treasuries made a corrective decline by the end of the previous week.

So, if the Fed and Powell clearly say that the inflation rate may slow down with the timing of rate hikes due to the decline, this will be an important signal for the end of the correction in the stock markets, primarily in the US, and then for the local increase in demand on company shares. In this case, the Treasury yields will plummet and the US dollar will be under pressure.

However, if the content of the bank's summary and Powell's speech do not show any changes, then the markets will see the opposite of the above picture.

Forecast of the day:

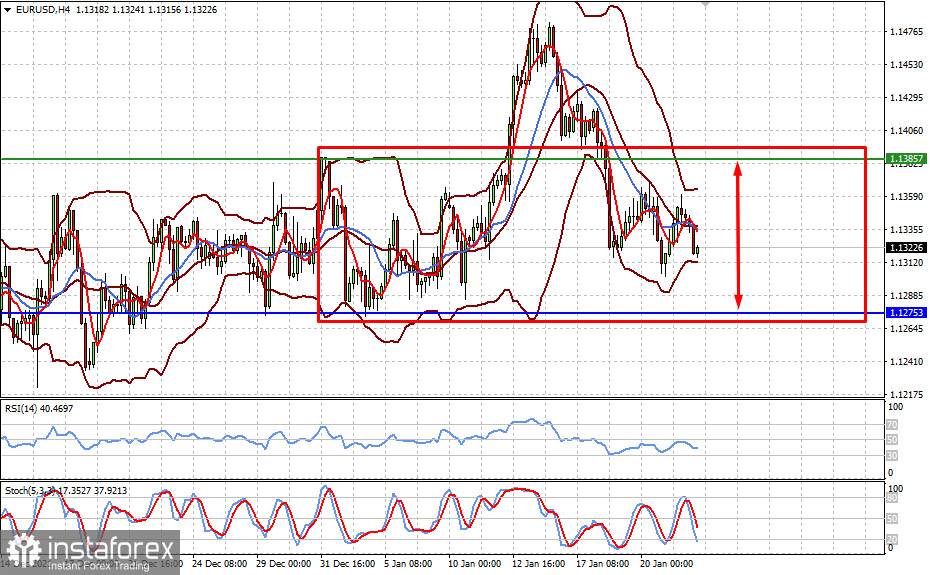

The EUR/USD pair is expected to remain in the range of 1.1275-1.1385 until the Fed meeting.

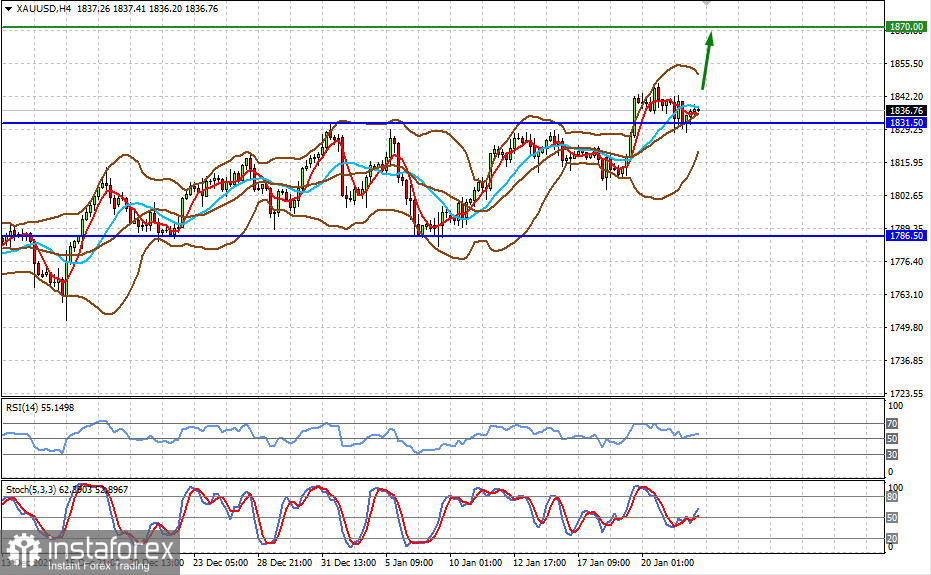

Spot gold stood still before a possible upward surge to 1870.00 following the Fed meeting.