Gold's breakout to a two-month high is causing an optimistic mood among retail investors and Wall Street analysts, with some expecting prices to reach $1,850 per ounce in the near future.

Analysts say gold is getting strong as investors begin to pay more attention to the growing threat of inflation, rising volatility in stock markets, and geopolitical uncertainty.

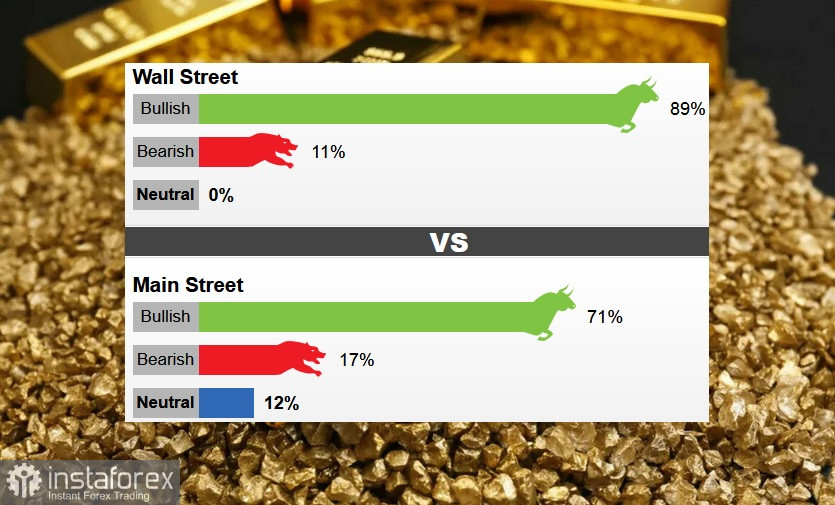

Last week, 18 Wall Street analysts took part in the gold review. Among the participants, 16 analysts, or 89%, were in favor of gold's price growth, while two analysts, or 11%, were bearish in the short term. There were no neutral votes.

In online polls on Main Street, 1,134 votes were cast. Of these, 801 respondents, or 71%, expected gold prices to rise, another 197 voters, or 17%, voted for the price reduction, and 136 voters, or 12%, were neutral.

Not only are retail investors very optimistic about gold this week, but participation in the latest survey has grown to the highest level since mid-November.

And although gold did not reach the highs of the beginning of last week, many analysts believe that it will continue its upward trend in the near future.

Saxo Bank's Head of Commodity Strategy, Ole Hansen, says that he expects higher prices despite the fact that prices are consolidating around $1,840 an ounce.

For many analysts, the main driver for gold remains the Fed's monetary policy, which is becoming more aggressive every day. However, some analysts say that market expectations are somewhat overstated and the US central bank may refute these expectations at a monetary policy meeting.

To date, the Fed's watch tool accounts for a fourfold rate hike for 2022. JP Morgan and Goldman Sachs repeated this a few days ago.

According to Adrian Day, president of Adrian Day Asset Management, he also hopes that the Fed's monetary policy will remain bullish towards gold.