Before the Fed's monetary policy meeting this January, Monday was marked by massive sell-offs in global stock markets, which dragged commodity assets along with them.

European trading floors closed in the "red" zone with a noticeable decline. In turn, the three major US stock indices, after testing local lows, managed to close in the green zone. Today, the Asia-Pacific region, which recovered yesterday's negative, shows a downward trend before the opening of the European trading session.

Despite yesterday's collapse followed by an upward pullback of the US stock market, the yield of the 10-year Treasury benchmark remained practically unchanged after Monday's volatile trading. The dollar index, although it has risen, is still below the level of 96.00 points.

We believe that all this indicates that investors, despite the closing of a significant number of positions in the stock markets, are still not sure if the markets will be given a clear signal about the start of the process of raising rates in March after the results of the Fed meeting, which begins today and ends tomorrow with the publication of a resolution and a speech by Chairman J. Powell. As indicated earlier, it is likely that the Fed chairman will try to soften the effect of negative sentiment, expressing hope that inflation may continue to lose momentum. This will be based on the published monthly inflation figures for December, published at the beginning of this month.

According to the data presented, consumer inflation rose by 0.5% in December against the forecast of an increase of 0.4%, but its growth rate declined against an increase of 0.8% in November. At the same time, the American stock market received support after the publication of this information, and the US dollar was under temporary pressure.

Again, it should be recognized that such a probability of events is less than what is now generally expected in the markets, where it is believed that the first rate hike will take place in March, but cannot be discounted, since the current extremely difficult economic situation in America, and even the rapid pace of tightening the monetary policy, can lead to a shock in the economy and financial markets, which is extremely dangerous, primarily for the United States, and can lead to serious social change.

If Powell does not say anything about the likely rise in the cost of borrowing in March and even, on the contrary, tries to be optimistic about reducing the prospects for further strong inflation growth, this will become the basis for a sharp increase in demand for company stocks and commodity assets with a simultaneous weakening of the US dollar, which may be quite strong.

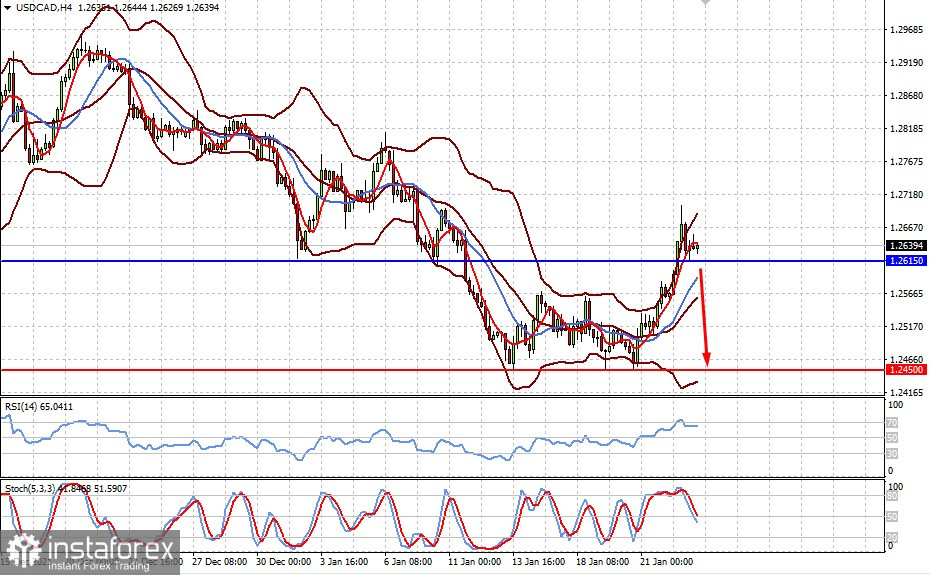

Forecast for the day:

The USD/CAD pair is consolidating above the level of 1.2615. It is likely that the Fed's soft position and further growth in crude oil prices will put pressure on the pair, and may decline to the level of 1.2450.

The USD/JPY pair is also trading almost unchanged above the level of 113.65. The weakness of the US dollar following the Fed meeting may lead to the pair's local fall to 112.70.