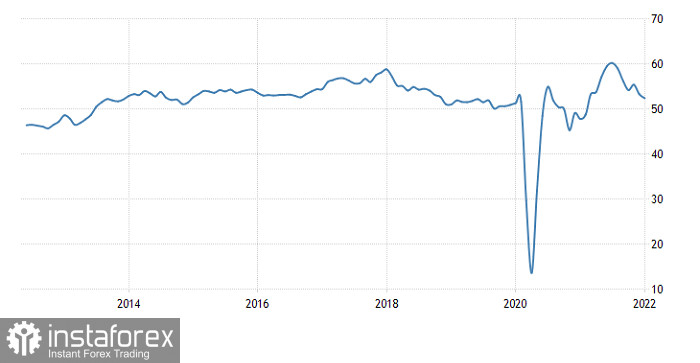

Yesterday, the Euro currency behaved exactly as it should have been within the framework of forecasts based on published data. And this is despite the fact that all this data did not come out as expected. In particular, the EU's index of business activity in the manufacturing sector rose from 58.0 points to 59.0 points, against the forecasted decline of 57.1 points. At the same time, the index of business activity in the services sector fell to 51.2 points, which should have declined from 53.1 points to 52.4 points. As a result, the composite index of business activity plunged from 53.3 points to 52.4 points, although it was expected to fall to 52.6 points.

It can be seen that the data turned out to be slightly worse than forecasts, and the European currency quite moved down. In any case, it should have been declining anyway, since the forecasts were initially negative.

Composite PMI (Europe):

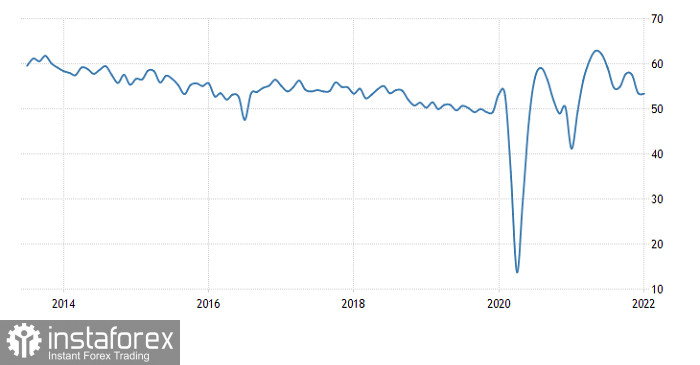

The pound's decline, which began during the European trading session, looks absolutely logical at first glance. After all, preliminary estimates of business activity indices showed a decline instead of growth, except for the manufacturing index which was supposed to fall from 57.9 points to 57.0 points. Other indices should have shown growth. In fact, the manufacturing index declined to 56.9 points, which is generally not much different from the forecast. On the other hand, the index of business activity in the service sector declined from 53.6 points to 53.3 points, while it was expected to rise to 54.0 points. This was the reason for the decline in the composite index of business activity from 53.6 points to 53.4 points, while the forecast was for growth to 54.0 points.

Composite PMI (UK):

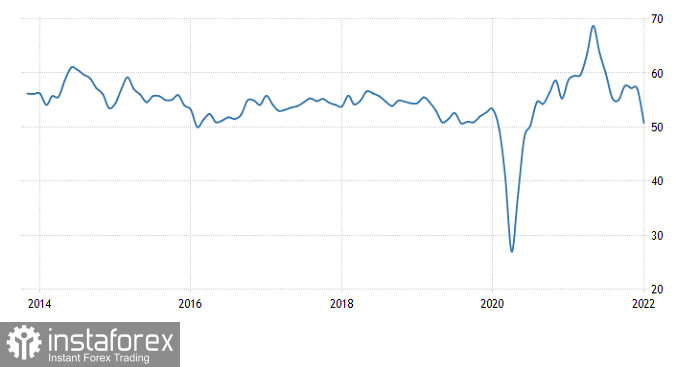

Nevertheless, the pound continued to decline even after the opening of the US session, although the indices in the United States also came out worse than forecasts and were already extremely negative in nature. Here, the index of business activity in the manufacturing sector decreased from 57.7 points to 55.0 points with a forecast of 57.0 points. The index of business activity in the service sector also collapsed from 57.6 points to 50.9 points, while it was expected to collapse only to 56.0 points. As a result, the composite index of business activity fell from 57.0 points to 50.8 points against the expected decline to 56.7 points. This was the reason why the euro returned to the values of the beginning of the day, which was quite expected and predictable.

However, the reason for the further decline of the pound was not about the published data. Judging by the fact that its decline began literally at the opening of the market, that is, before the publication of data, this is due solely to political factors. In particular, the official statement of the Ministry of Foreign Affairs of Great Britain on the evacuation of its employees and their family members from Ukraine.

From the viewpoint of fundamental analysis, the market should standstill today, as the macroeconomic calendar is completely empty. However, the FOMC meeting will take place tomorrow, and, given that there is no consensus on the market regarding its results, we are likely to face all sorts of speculations on this topic, which will begin no earlier than the opening of the US trading session. Considering that the probability of any changes in the parameters of monetary policy during this meeting is close to zero, then speculation will be aimed precisely at strengthening the US dollar.

The EUR/USD pair is gradually restoring the downward interest in the market relative to the correctional one. At the moment, 55% has been recovered, and the price is facing an important level of 1.1270, where a reduction in the volume of short positions was observed earlier in history. So, it is possible to bring the price closer to the reference level, where stagnation is already possible.

The GBP/USD pair declined to the area of 1.3439 during a sharp fall, where a price stagnation arose due to a high level of oversold. In this situation, a technical pullback is possible, but if the speculative hype persists and the price stays below the level of 1.3435, the prolongation of the downward cycle is not ruled out.