Today we will analyze yesterday's reports. Then we will briefly mention today's most important fundamental events. After this, we will discuss the technical analysis of EUR/USD and the trading recommendations for EUR/USD.

Yesterday's main releases were the indexes for manufacturing and service sector activity in the Eurozone and the United States. Business activity in the manufacturing sector of the Eurozone exceeded the forecast of 57.5 and came in at 59. In contrast, business activity in the service sector was worse than expected at 52.2 and came out at 51.2. Notably, similar US reports as well as the Chicago Fed economic activity index were worse than forecasted. However, the market does not pay attention to yesterday's macroeconomic statistics. Otherwise, how can we explain the fact that with such unfavorable US data, the US dollar has strengthened against the Euro. The market seems to be so focused on the upcoming US Federal Reserve meeting that it pays no attention to other macroeconomic data.

However, I do not think that the rather hawkish rhetoric will be changed. If that is the case, the market will be in turmoil for a while, and then it will calm down, and the dollar will appreciate slightly. I believe this is the most likely scenario. With tougher rhetoric, the US dollar would undoubtedly receive more support. However, I don't think it will be very significant. Although, if Powell announces a three-fold rate hike this year, the US dollar could rise substantially. With the rate likely to remain at 0.25%, the main investor reaction will turn to the interest rate decision as well as the tone of Jerome Powell's speech. Today, however, we should pay attention to the Germany Ifo Business Climate Index, the US housing statistics, and the US consumer confidence index.

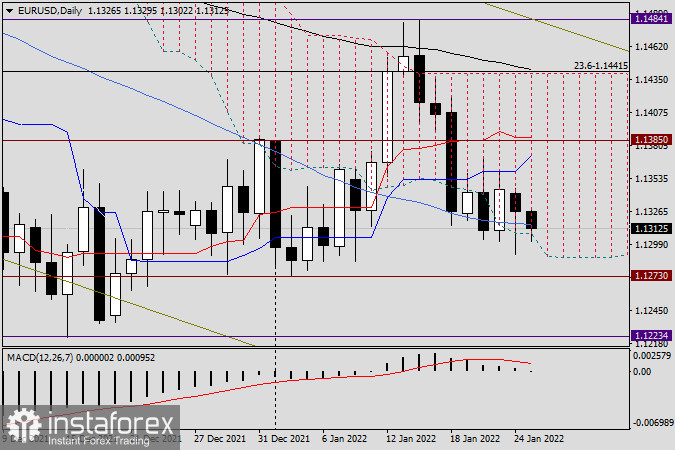

Daily

So, in yesterday's trading, the bears failed to squeeze the pair down out of the Ichimoku cloud. As a result of yesterday's trading, the candlestick had a rather long lower shadow, but the closing price was still within the daily cloud. This indicates a struggle between the parties, and no one is compromising. Apart from the fact that the session of January 24 ended within the Ichimoku cloud, it also ended above the 50 simple moving average. All these factors indicate that the euro bulls have not yet completely lost control of EUR/USD trading, and tomorrow's Fed-related events seem to put the things right. At least, I would like to think so, because the EUR/USD trading has become too slow and annoying. Based on the daily chart, the bears not only have to take the price down out of the cloud, but they also have to renew yesterday's lows and then break the support at 1.1273. The Euro bulls, on the other hand, needs to take the price above the blue Kijun line and then break up at 1.1385 and the red Tenkan line.

EUR/USD trading tips

In the run-up to the outcome of the Fed meeting and Jerome Powell's press conference, it is difficult to speculate about the market reaction. However, it is not possible to buy the US dollar all the time due to the same factor. There is an old adage among the stock market traders, "Buy on rumours, sell on news." However, at the moment, selling EUR/USD has the highest priority. Sales of the major currency pair should be taken into consideration after it briefly rallies to the 1.1345/60 area. Should bullish Japanese candlestick patterns start to appear near the support level at 1.1273, you may try to buy with small targets at 1.1320/30. In the run-up to the Fed meeting, I also don't recommend to set big selling targets. Instead, you should focus on the price area of 1.1300-1.1285.

Good luck!