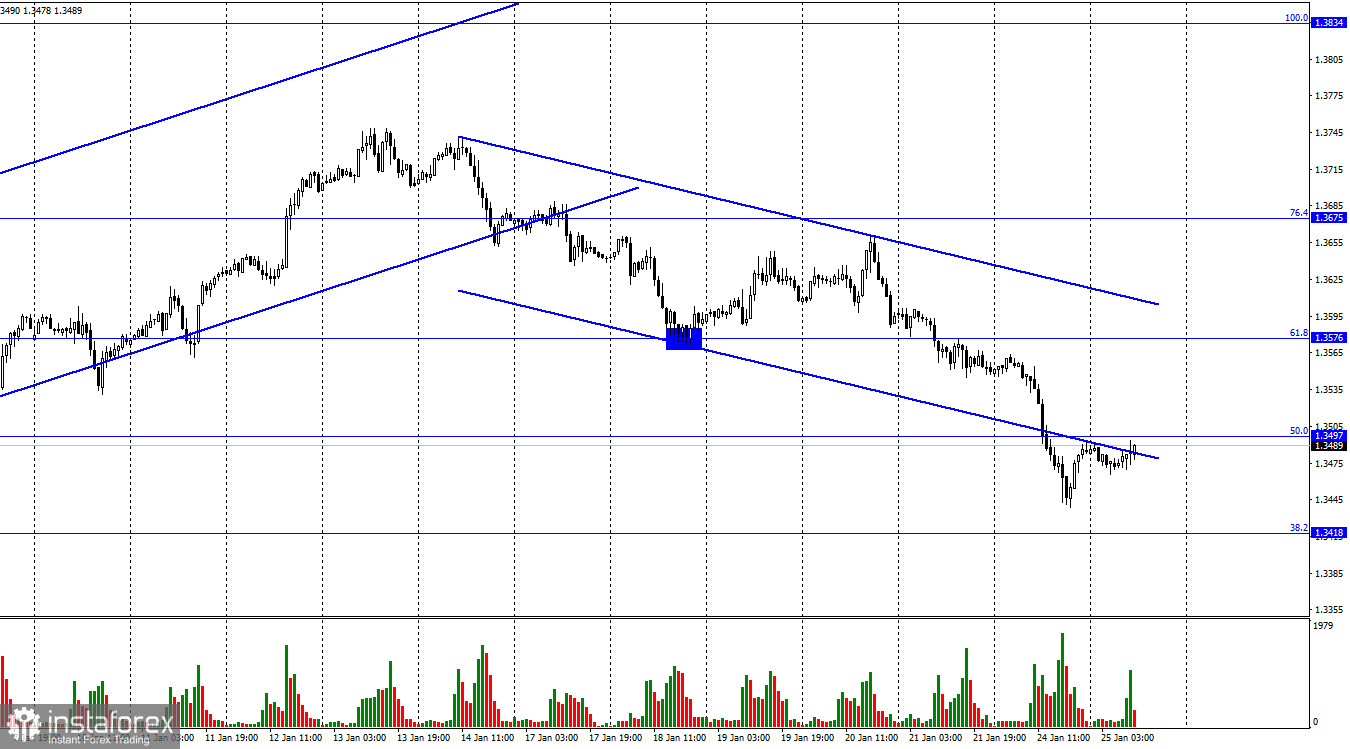

Hello, dear traders! According to the hourly chart, the GBP/USD pair continued to trade downwards on Monday. During the session, the pair closed below 1.3497, the 50.0% Fibonacci level. However, after downbeat statistics on business activity in the US services and manufacturing sectors were released, the pound/dollar pair managed to return to the Fibo level of 50.0%, 1.3497. A rebound in the quotes from this level will allow traders to count on a new decline towards the Fibonacci level of 38.2%, 1.3418. If the price closes above the 50.0% Fibo level, the British pound will have a chance of advancing to the Fibo level of 61.8%, 1.3576. Nevertheless, market sentiment remains bearish, as evidenced by the downtrend channel. Meanwhile, Boris Johnson got embroiled in a crisis over allegations of numerous parties held in Downing Street while the rest of the UK was in lockdown. The growing scandal sparked outrage in the country.

In addition, fresh allegations arose about a lockdown party at the residence of the Prime Minister on the eve of the funeral of Queen Elizabeth II's husband Prince Philip. Boris Johnson offered a "heartfelt" apology for attending drinks during lockdown, adding that it was a work event. He refused to leave his post despite numerous calls. "Nobody told me that what we were doing was against the rules," Johnson stated. In general, everyone understands that Britain's Prime Minister is just trying to avoid the consequences of this story.

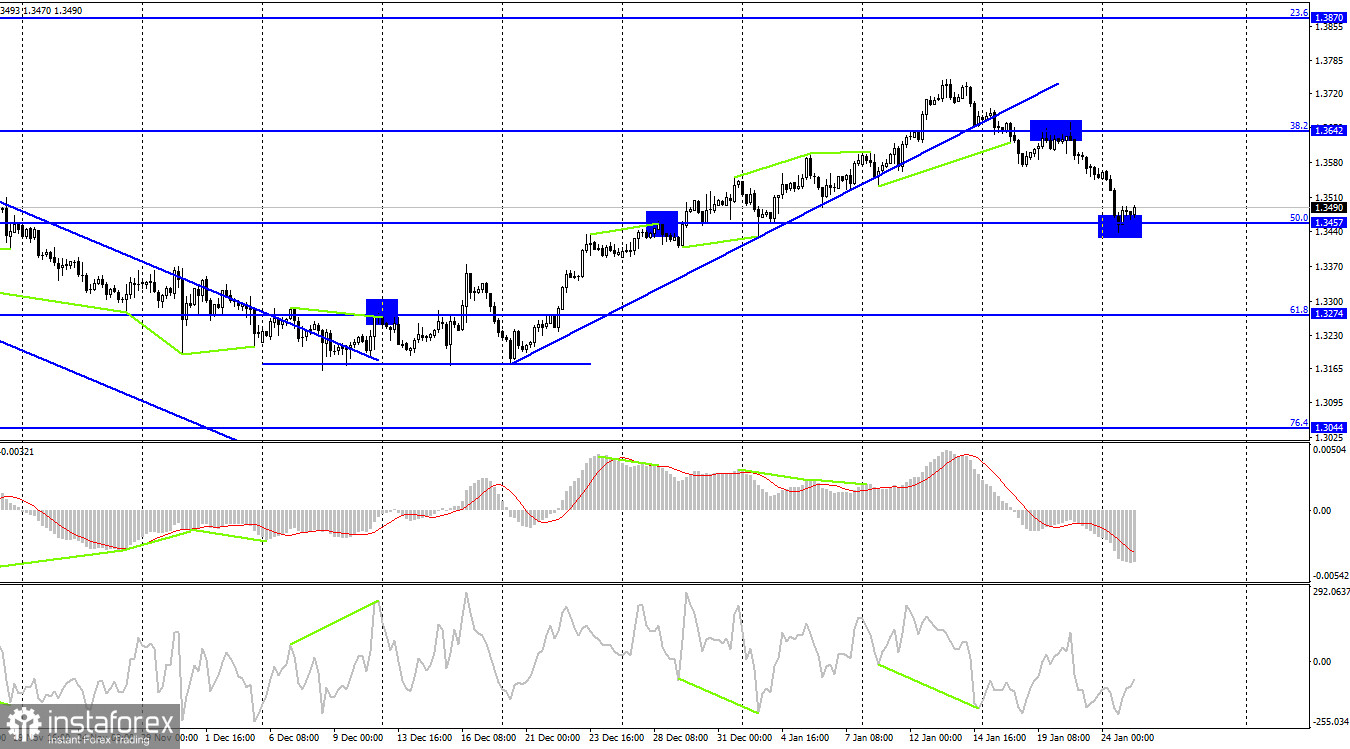

According to the 4-hour chart, the pound/dollar pair fell to the 50.0% Fibonacci retracement, 1.3457. If the price rebounds from this level, the British currency may reverse upwards and head towards the Fibo level of 38.2%, 1.3642. In case the price fixes below the Fibonacci level of 50.0%, the pair will most likely extend weakness, sliding to the next Fibo level of 61.8%, 1.3274. For now, none of the indicators is showing emerging divergences.

News calendar for the US and Britain:

US consumer confidence.

Tuesday's macroeconomic calendar is bereft of any important releases from the UK. The US is set to release data on consumer confidence. I believe that fundamental factors will not have any impact on market sentiment today.

GBP/USD forecast and trading recommendations:

I recommended selling the British pound with a view to reaching the target levels of 1.3497 and 1.3457 if the price rebounded from the level of 1.3642 on the 4-hour chart. As a result, both levels were tested. Now I think it would be a wise decision to open new short positions on the pound sterling amid a rebound from the level of 1.3497 on the hourly chart or in case the price closes below the 1.3457 mark on the 4-hour chart. I do not recommend going long as the pair seems to be at the beginning of a new bearish trend.