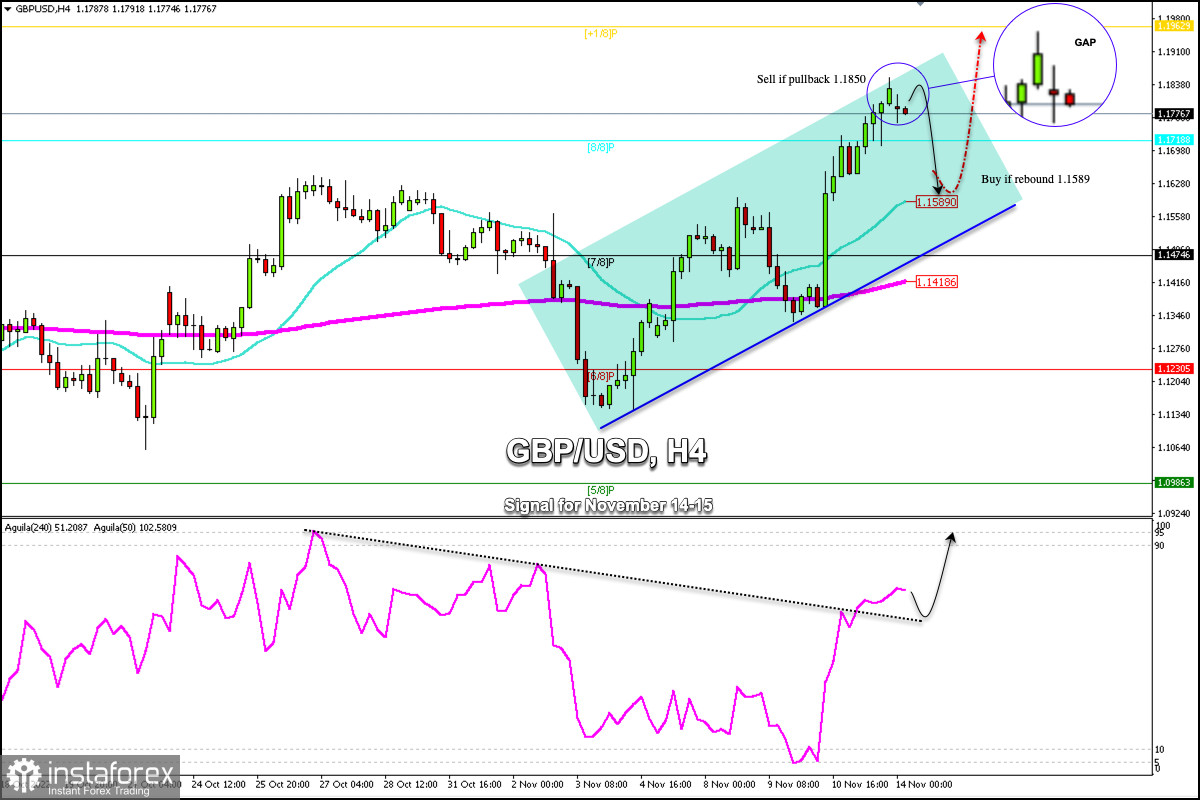

Early in the European, session the British pound is trading at 1.1776, showing some technical correction after reaching a high of 1.1853 last week.

At the opening of trading this week, the British Pound opened with a bearish GAP around 1.1791, some 40 pips from Friday's close.

On the 4-hour chart, we can see that this Gap has not been fully covered yet. Therefore, it is likely that in the next few hours there will be a pullback towards the 1.1850 level and then it could be considered an opportunity to sell.

On Friday GBP/USD broke sharply the resistance of 8/8 Murray which has now become a key support. In case of a technical bounce around 1.1718, there could be an opportunity to buy with targets at -1/8 Murray located at 1.1962. The price could even reach the psychological level of 1.20.

The pound sterling took advantage of the US dollar's weakness as a result of lower-than-expected US inflation data. This positive sentiment in investors assured them to invest in risky assets. Therefore, the pound gained momentum. It is likely to continue its rise this week and could reach the 1.20 level.

Conversely, a return below 1.1718 could signify a major technical correction and the price could hit the 21 SMA located at 1.1589. A strong technical bounce is expected around this zone which could be a signal for the bulls to resume buying and GBP/USD could reach 1.1850 and even 1.19 62 (+1/8 Murray).

The eagle indicator is breaking a key level of resistance and is likely to continue to give a positive signal in the coming days. Its value could reach the 95-point zone which represents an extremely overbought area. Meanwhile, any technical bounce in the GBP/USD pair could be considered an opportunity to buy.

Only a daily close below 1.1580 could be a clear signal for the pound to fall and it could reach the 200 EMA located at 1.1418.