Conditions to open long positions on the euro/dollar pair:

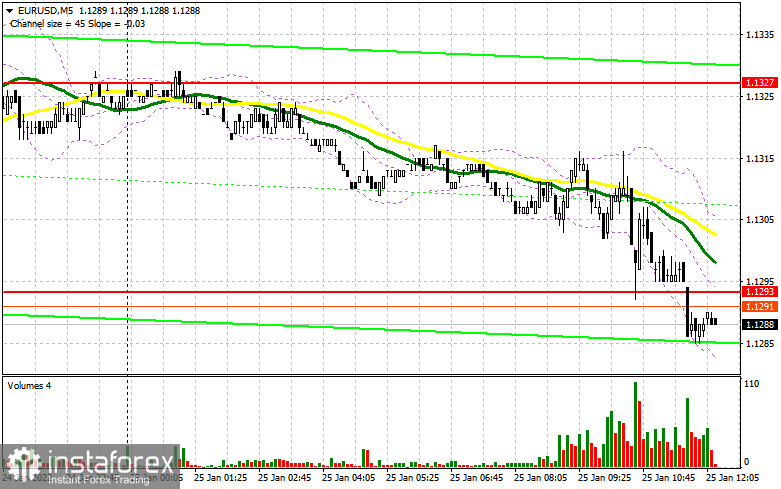

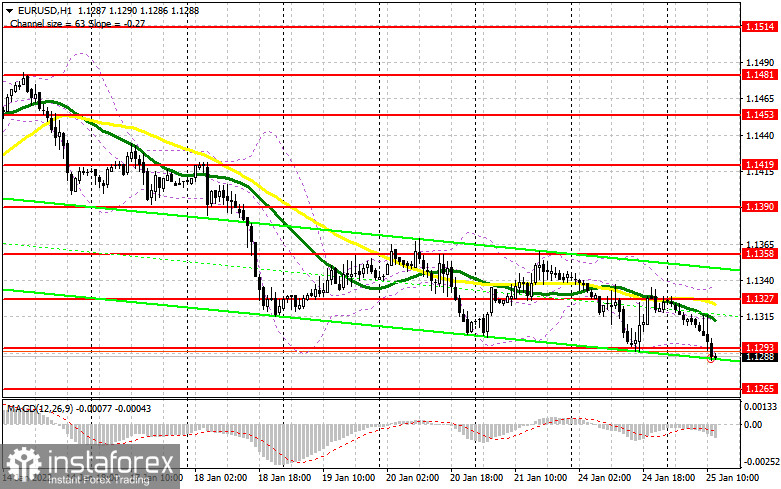

In the forecast I provided earlier, I recommended traders to focus on 1.1293 to make a decision to enter the market. Let us analyze the market situation using the 5-minute chart. Today, Germany disclosed data on such indicators as business climate, current assessment, and expectations. The data turned out to be mixed and failed to support the euro. However, bulls made an attempt to push the price higher near 1.1327. Now, we may only focus on a break of 1.1293. Notably, in the first half of the day, there were no signals to enter the market. Let us take a look at the pound sterling.

In the second half of the day, traders are likely to shift their attention to the reports on the US economy. Bulls should do a lot to regain control over the market. Unless the euro returns to 1.1293, it is likely to go on falling. In this case, buyers will have to protect the next support level of 1.1265. If the price touches this level, it may drop even deeper ahead of the FOMC meeting. Just a false breakout of the level of 1.1265 may provide a buy signal. However, a large upward correction may begin only if the US discloses weak reports on its consumer confidence index and Richmond manufacturing index. The figures will hardly disappoint traders. That is why it is better to remain cautious trading the euro. Buyers should also return the price to 1.1293. Only weak data from the US and the price consolidation above the mentioned level will provide traders with a buy signal, thus allowing the euro to recover to 1.1327. There, we can see moving averages that support sellers. The high of 1.1358 is a farther target, where it is recommended to lock-in profits. If the euro/dollar pair drops during the US trade and bulls fail to show activity at 1.1265, pressure on the euro may jump. In this case, it is better to buy the euro when it touches the low of 1.1248. However, traders should open long positions after a false breakout. It is possible to buy the euro from the levels of 1.12224 and 1.1208 with the upward target of 20-25 pips within one day.

Conditions to open short positions on the euro/dollar pair:

Bears continue controlling the market. In addition, we see no buyers below the bottom of the 13th pattern. This proves that big buyers of risky assets feel concerned ahead of tomorrow's FOMC meeting. Today, bears pushed the price below 1.1293. It means that the price is likely to go on sliding in the short term. Until the pair trades below this level, it may fall to the low of 1.1265.

An upward break of this area and strong data from the US may give additional short signals with the targets of 1.1248 and 1.1224. The level of 1.1208 acts as a farther target, where it is recommended to lock-in profits. However, the pair may touch this level only amid a massive sell-off of risky assets that could be caused by intense discussions of further Fed's actions concerning the key interest rate. If the euro rises, bears will have to protect the resistance level of 1.1293. A false breakout at this level may provide an additional signal to open short positions. It is possible to sell the asset from 1.1327 or even from 1.1358 with a downward target of 15-20 pips.

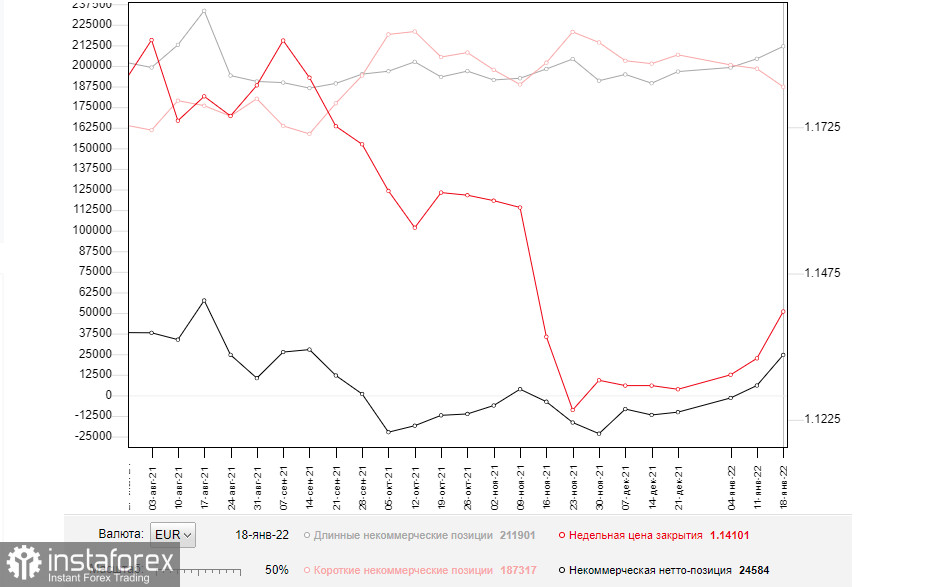

The Commitment of Traders report for January 18 unveiled a rise in the number of long positions and a drop in the number of the short ones. It means that even the expected changes in the Fed's policy cannot curb demand for the euro. The more the pair falls, the bigger demand is. This week, everyone is waiting for the results of the FOMC meeting, during which the regulator will make a decision on its monetary policy. Some traders suppose that the regulator will decide to raise the key interest during the meeting in January instead of March. A lot depends on the rhetoric of Fed Chairman Jerome Powell. If he shows concern about the US inflation, demand for the greenback is likely to rise. Economists foresee that the regulator will raise the benchmark rate four times. Meanwhile, the European Central Bank plans to fully complete its emergency bond purchase program in March this year. However, the regulator is not going to take any other actions aimed at tightening its policy, which limits the upward potential of risky assets. The COT report indicates that the number of long non-profit positions rose from 204,361 to 211,901, while the number of open build up long positions on the euro in the expectation of an uptrend. At the end of the week, the total non-commercial net position remained positive at 24,584 against 6,005. The weekly closing price rose to 1.1410 against 1.1330 a week earlier.

Signals of indicators:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, which indicates that the market remains under the control of sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A rise could be capped by the upper limit of the indicator at 1.1330. A break of the lower limit at 1.1290 may boost pressure on the euro/dollar pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands (Bollinger Bands). The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total long position opened by non-commercial traders.

- Short non-commercial positions is a total short position opened by non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions opened by non-commercial traders.