The Australian dollar strengthened sharply at the beginning of the Asian trading session on Tuesday, having received support from the Australian Bureau of Statistics, which published fresh inflation data. According to the ABS, the consumer price index rose in the 4th quarter by 1.3% (+3.5% in annual terms). The base CPI grew by +1.0%, and its annual growth rate accelerated to 2.6%, the highest since 2014.

"Shortages of building supplies and labor, combined with continued strong demand for new dwellings, contributed to price increases for newly built houses, townhouses and apartments," ABS commented, adding that problems in global supply chains and shortages of some goods, combined with rising transport tariffs and strong demand led to a rise in prices for many goods, including materials for housing construction, cars, furniture, and audio and video equipment.

After the publication of the report by the Australian Bureau of Statistics, the AUD/USD pair rose to an intraday high of 0.7172, but during the Asian trading session it declined, dropping to the local support level of 0.7130.

At the time of writing, AUD/USD is trading near 0.7150, remaining the only major dollar pair with a white intraday candle. The rest of the main competitors of the U.S. dollar are losing to it today, while the DXY dollar index is growing again. At the time of writin, DXY futures were trading near 96.10, 149 pips above the local low of 94.61 reached the week before last.

Then the dollar fell against the backdrop of a strong rise in inflation in the United States. U.S. consumer prices rose 7.0% in December year-on-year, the highest since June 1982, according to released data. Investors are obviously wary of accelerating inflation, fearing that the Fed's tightening of monetary policy may not be enough.

The Fed's meeting on monetary policy begins today. It will end tomorrow with the publication of the interest rate decision at 16:00 UTC. Now market participants are waiting for the Fed to start a cycle of raising interest rates. If all goes according to plan, the Fed's first rate hike could happen as early as spring. In total, 3 increases are expected this year. However, there is a growing market sentiment that this may not be enough, and the Fed will have to resort to more aggressive steps to curb accelerating inflation.

As early as the week before last, St. Louis Fed President James Bullard said it now looks like it will be necessary to raise interest rates four times to curb high inflation. "We want to bring inflation under control in a way that does not disrupt the real economy, but we are also firm in our desire to get inflation to return to 2% over the medium term," Bullard said.

Investors are now assessing high inflation in the U.S. and the likelihood that the Fed will have to raise rates more aggressively this year to contain price increases. Market participants are also set on the fact that the Fed, after raising interest rates, will begin to reduce its asset portfolio (the Fed's balance sheet is now $8.8 trillion).

The current accelerated reduction in asset purchases by the Fed and expectations of the start of a cycle of interest rate hikes in March are already pushing U.S. Treasury yields higher. Last week, the yield on 10-year U.S. bonds exceeded 1.900%. The dollar, as you know, is sensitive to the growth of government bond yields, since this growth has an inverse correlation with the cost of government bonds. Growth in sales of government bonds is accelerating, causing an increase in their yield and, accordingly, demand for the dollar.

Nevertheless, the Fed's interest rate is expected to remain at 0.25% at the January meeting. Market participants will carefully study the comments of the Fed leaders. Thus, during the period of publication of the rate decision, volatility may increase sharply throughout the financial market, primarily in the U.S. stock market and in dollar quotes, especially if the rate decision differs from the forecast or unexpected statements are received from the Fed's management.

As for the AUD and the monetary policy of the RBA, its next meeting will be held next week. Australia's 4th quarter inflation data released today was well above expectations. With the Australian labor market continuing to strengthen, creating the conditions for accelerated wage growth, this allows many economists to predict an earlier start to the tightening of the RBA policy. According to their new forecast, the RBA will raise the key rate in August 2022, and not in the 4th quarter, as previously expected.

If at the meeting next Tuesday the RBA leaders confirm the possibility of such a scenario, then the AUD can get good support. With the Fed and, now the RBA, expected to start tightening their monetary policies this year, we are yet to see the AUD/USD trajectory fluctuate wildly. In the meantime, the downward dynamics of this currency pair is preserved, leaving an advantage for short positions on it.

Technical analysis and trading recommendations

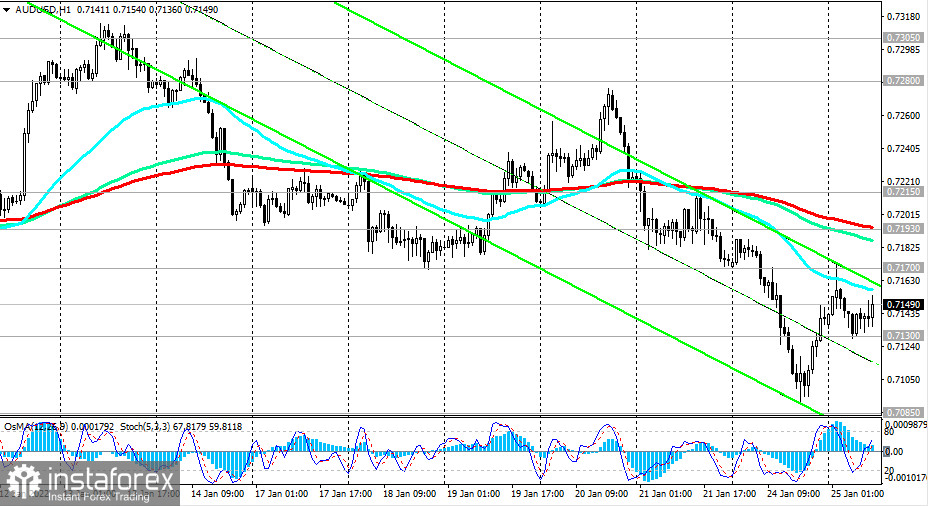

In response to the publication of fresh data on the dynamics of consumer inflation in Australia today, the AUD has strengthened, and the pair AUD/USD has grown, briefly breaking through the local resistance level of 0.7170.

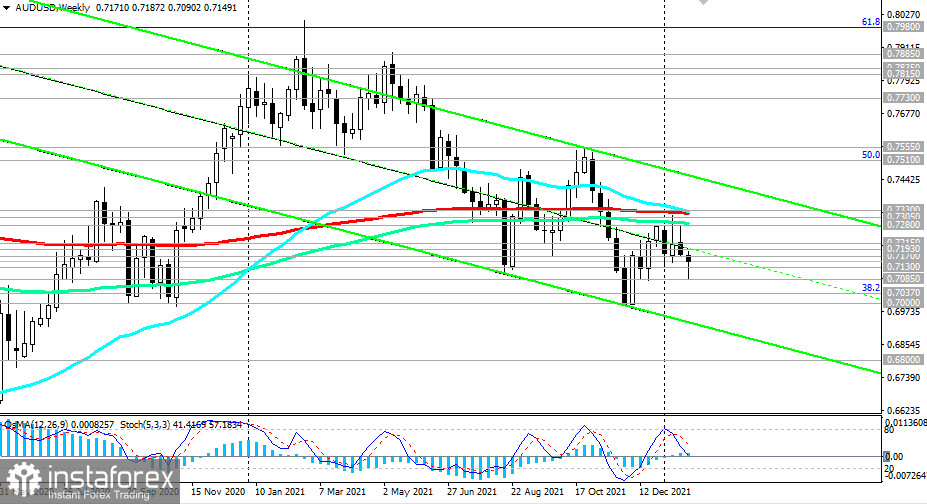

Nevertheless, the pair is in a stable downward trend, below the key resistance level 0.7330 (200 EMA on the daily and weekly charts).

A breakdown of the local support level 0.7130 will be the first signal for resuming sales, and a breakdown of the local support level 0.7085 will be a confirmation.

The nearest decline targets are support levels 0.7037 (38.2% Fibonacci retracement to the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), 0.7000.

In an alternative scenario, an upward correction will resume with targets at the resistance levels of 0.7193 (200 EMA on the 1-hour and 4-hour charts), 0.7215 (50 EMA on the daily chart).

The potential for corrective growth remains until the key resistance levels of 0.7280 (144 EMA on the weekly chart and the upper limit of the downward channel on the daily chart), 0.7305 (144 EMA on the daily chart), 0.7330 (200 EMA on the daily and weekly charts). At the same time, AUD/USD remains in the global bearish trend zone, trading below the key resistance level of 0.7330.

Therefore, it is worth giving preference to short positions.

Support levels: 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Resistance levels: 0.7170, 0.7193, 0.7215, 0.7280, 0.7305, 0.7330

Trading Recommendations for AUD/USD pair:

Sell Stop 0.7125. Stop-Loss 0.7175. Take-Profit 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Buy Stop 0.7175. Stop-Loss 0.7125. Take-Profit 0.7193, 0.7215, 0.7280, 0.7305, 0.7330