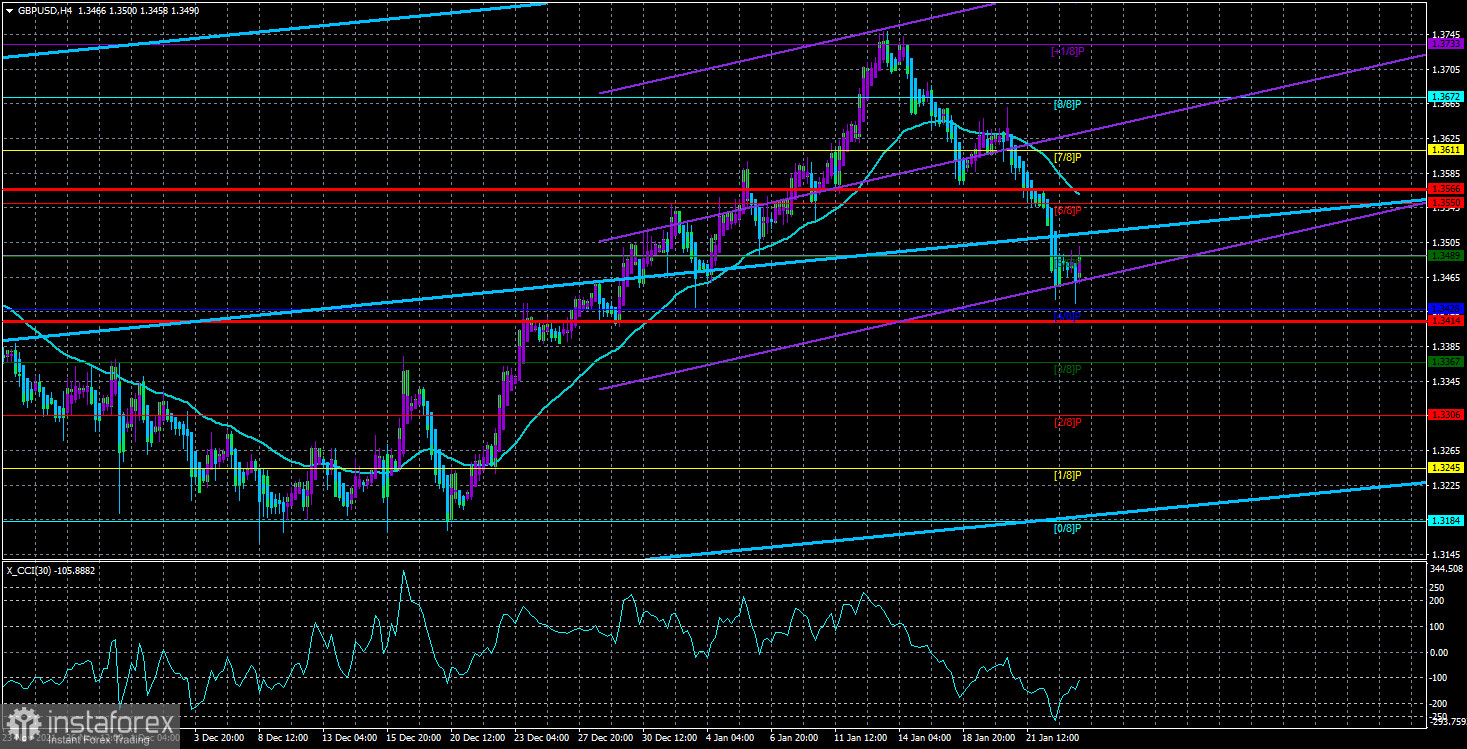

The GBP/USD currency pair collapsed on Monday, but on Tuesday it already refrained from a new strong fall. However, no one doubts the downward trend now. It is noteworthy that both pairs are currently declining, but at the same time, they are doing it at completely different rates. We believe that the strong fall of the British currency on Monday itself speaks volumes. Recall that on this day there were no news or publications that could provoke such a strong fall of the pair. Thus, we believe that at this time the majority of market participants have tuned in to new large-scale sales of the pound. As in the case of the European currency, the main factor in the strengthening of the dollar is now the high probability of repeated tightening of the Fed's monetary policy in 2022. But the prospects for tightening monetary policy in the UK leave a lot of questions. Yes, the Bank of England raised its key rate in December 2021, but what's next? The Fed has made it clear that it will do everything to stop the growth of inflation. And the Bank of England, like the ECB, is still more ranting on this topic. Thus, we believe that in the coming weeks the pair may return to the level of 1.3184, from where it began the last round of the upward movement. Although both linear regression channels are now directed upwards, there are more chances for the British currency to continue falling.

Boris Johnson continues to make resonant statements.

Boris Johnson also made some hilarious statements about the "wine parties" that he has been actively organizing in the last couple of years. It turned out that Boris Johnson was not really to blame for anything. According to him, he was not warned that it is forbidden to hold such parties. It is noteworthy that a little earlier, his former adviser Dominic Cummings, who has already criticized the Prime Minister, said that he warned Johnson about the impossibility of holding such events during quarantine. However, Johnson did not listen to him, and now, according to many experts, he is going to shift responsibility to other officials. Therefore, resignations in the British state apparatus may follow in the near future. British media also report that in the near future Johnson will try to divert public attention from his next incident with the help of the conflict in Eastern Europe and the solution of the "migration issue" in the English Channel. It is reported that London may send naval forces to patrol and completely suppress illegal migration across the English Channel. In addition, Johnson lifted all "coronavirus" restrictions in the country to ease social tension. According to political analysts, Johnson is not going to be responsible for his behavior during quarantine and is not going to leave the post of Prime Minister of the country.

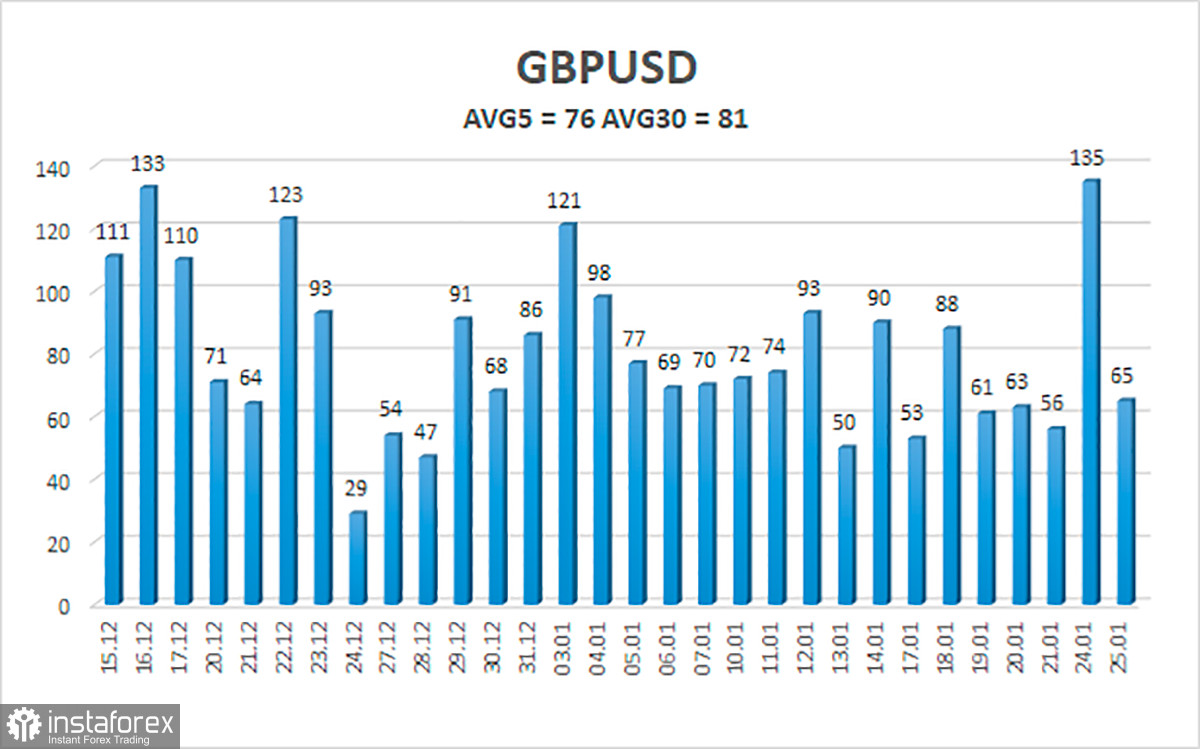

The average volatility of the GBP/USD pair is currently 76 points per day. For the pound/dollar pair, this value is "average". On Wednesday, January 26, thus, we expect movement inside the channel, limited by the levels of 1.3414 and 1.3566. A reversal of the Heiken Ashi indicator upwards will signal a round of corrective movement.

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading recommendations:

The GBP/USD pair continues to be in a downward movement on the 4-hour timeframe. Thus, at this time, it is recommended to stay in short positions with targets of 1.3428 and 1.3367 until the Heiken Ashi indicator turns up. It is recommended to consider long positions if the pair is fixed above the moving average line with targets of 1.3611 and 1.3672, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.